Jonathan Miller of Matrix RE released a rental study of Manhattan real estate:

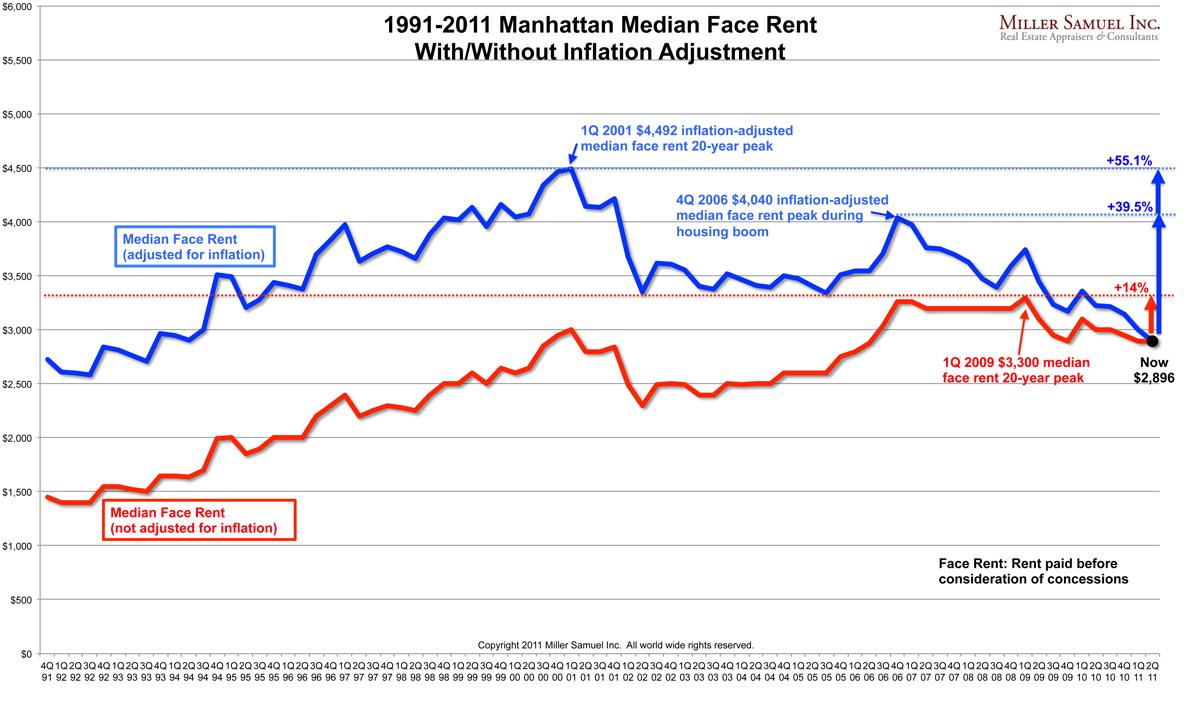

Last week we released our rental study and the consensus was that the rental market was strong, better than the sales market (and expensive). So I thought I’d present the past 20 years and look at some of the peaks. When adjusted for inflation, the perspective of when peak was actually changes quite a bit.

Curbed has argued Manhattan rents are rising, but as Jonathan points out, that is before you account for inflation. Back out CPI price increases, and you end up with a different view of NYC rental prices. As Jonathan notes, “adjusted for inflation – we have a long we to go before we see actual peak numbers.”

>

click for larger graphic

What's been said:

Discussions found on the web: