Invictus writes:

I could not help but be struck by the different positions — both articulated on Friday — on federal spending taken by two economists for whom I have the utmost respect — Paul Krugman and David Rosenberg. In his daily missive Friday, Rosie went off on federal spending:

Government spending, in the United States, is simply out of control.

Over the past decade, federal expenditures rose at an average annual rate of 6% while the growth rate in the number of households has risen at a 0.8% annual rate. At around 25% of GDP, spending is higher now than at any other time since 1946. That is an outlier. Admittedly, revenues at 15% of GDP are abnormally low as well, and while a partial by-product of the recession and sluggish recovery, loopholes galore and endless tax gimmicks are also at play — in the 1991 economic downturn that ratio was around 18% and in the severe economic decline in the early 1980s, it was 19%. Revenues have to go up and there’s a cool trillion sittin’ right there in loopholes — oh, sorry, deductions and “tax expenditures,” we don’t want to offend anybody — that could be eliminated without sacrificing growth while reducing the ridiculous complexity of the tax code. […]

But to think that the U.S. government cannot manage to deliver effective and essential services with a $2.5 trillion revenue base is absurd. […] Isn’t 21 grand per household of government benefits enough?

You get the gist.

Krugman sees it otherwise:

Whenever someone like me or Bruce Bartlett points out how little Obama resembles the right’s portrait of a raging leftist, someone is sure to come back with the assertion that Obama has presided over a vast expansion of federal spending. Even people who really should know better, like John Taylor, do it.

So what’s the truth? I’ve written about this before, but here’s another take.

The fact is that federal spending rose from 19.6% of GDP in fiscal 2007 to 23.8% of GDP in fiscal 2010. So isn’t that a huge spending spree? Well, no.

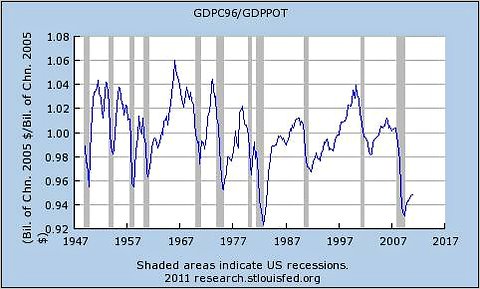

First of all, the size of a ratio depends on the denominator as well as the numerator. GDP has fallen sharply relative to the economy’s potential; here’s the ratio of real GDP to the CBO’s estimate of potential GDP:

A 6 percent fall in GDP relative to trend, all by itself, would have raised the ratio of spending to GDP from 19.6 to 20.8, or about 30 percent of the actual rise.

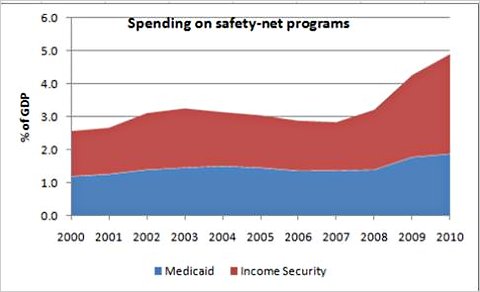

That still leaves a rise in spending; but most of that is safety-net programs, which spend more in hard times because more people are in distress. The CBO breaks out “income security” (Table E-10 in Historical Budget Tables), which is unemployment insurance, food stamps, etc., and also gives us numbers on Medicaid; here’s what they look like as percentages of GDP:

That’s another 2 points of GDP, or about half the rise.

So we’re still left with a bit, around 1 point of GDP. That’s the stimulus, more or less. And there are two things you need to know about it. First, it’s temporary, and already fading out fast. Second, a large part of the stimulus “spending” was actually aid to state and local governments, intended not to expand spending but to avert a fall — that is, it was about maintaining government, not expanding it.

Now, pointing out the Obama spending binge is a myth generally produces rage: people know that it happened, because Rush Limbaugh and the Wall Street Journal say so. But that doesn’t make it true.

What I find most fascinating is that back in the period leading up to the recession, both Krugman and Rosenberg were spot-on in their assessments of what was unfolding. Far from calling it in real time, they were way ahead of the curve and their peers (see here for Rosie’s prescient piece on the housing market; it’s just one of dozens). They both brilliantly foretold of the coming crisis and the effects it would have on the economy, jobs, joblessness, liquidity, monetary policy, interest rates, etc. Where they are diametrically opposed is on how to solve a problem they both so astutely saw coming. That two people could so precisely diagnose a problem, yet differ so totally on the solution, intrigues me greatly. Would love to see the two of them side-by-side on a panel discussion.

See also:

Mokito Rich, NY Times, The Role of Government Spending, July 29, 2011

What's been said:

Discussions found on the web: