From Jesse’s Café Américain:

~~~

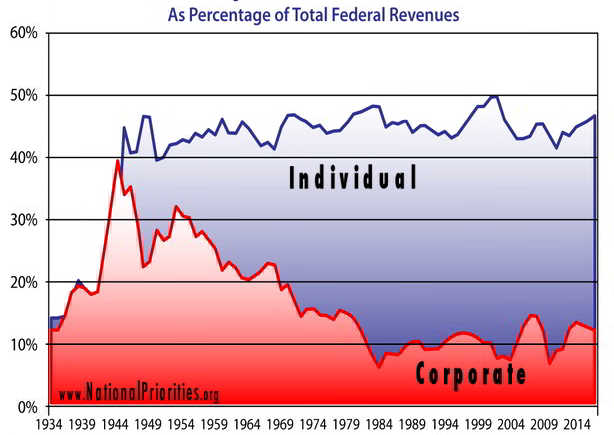

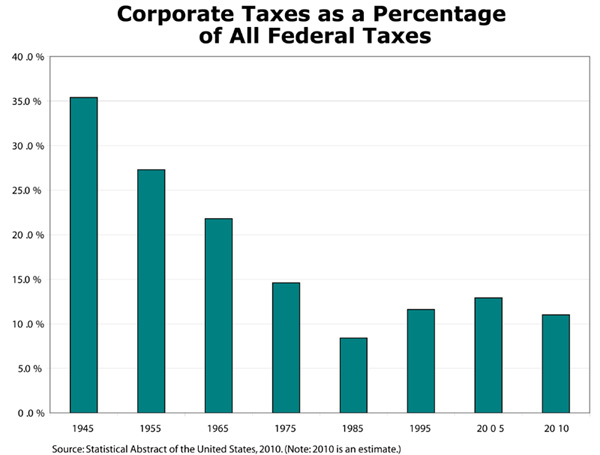

Although the nominal US corporate tax rate of 35% seems high, and especially so given all the corporate funded propaganda promoting more tax cuts and givebacks, in fact the realized corporate rates are relatively low both in terms of historical experience and other countries. This is because of the many loopholes, subsidies, and accounting gimmicks available to its corporate citizens from the corporate friendly government.

One could make the case that the tax burden is falling disproportionately on smaller businesses and individuals that do not have the infrastructure and latitude to take advantage of the loopholes available to the bigger business lobby companies.

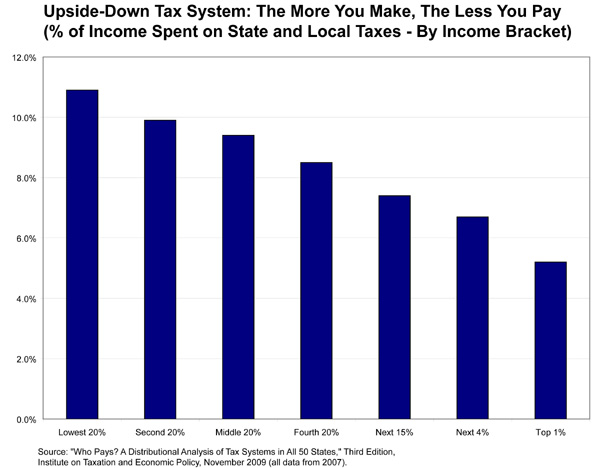

State and local taxes appear to be regressive. The top echelons of corporations and private individuals seem to be doing rather well for themselves.

What's been said:

Discussions found on the web: