click for larger graphic

Recalculated with base of 100.

>

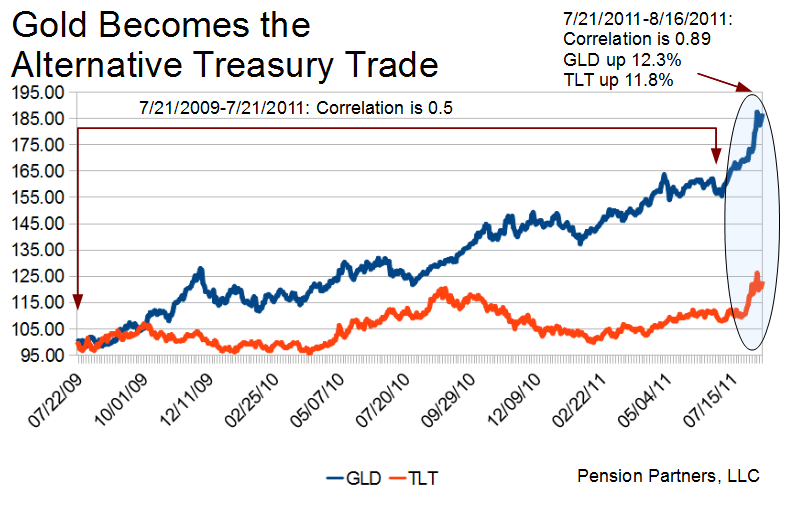

Gold! Are a new class of investors treating it like Treasuries?

The evidence: A stunningly high correlation of Gold to 20+ Year Treasuries (Symbol: TLT) from July 21 through August 16 is 0.89. Over that period, Gold is up 12.3%, while Treasuries up 11.8% (not counting today’s spasm).

Contrast this to a correlation of 0.5 over the periods July 21, 2009 – July 21, 2011 and it appears Gold and Treasuries are now behaving as one and the same, moving in lockstep fashion. Of course, Treasuries are a much broader and deeper market, and a move in Bonds represents trillions of dollars of activity, versus Gold, which is orders of magnitude smaller.

Perhaps investors who might otherwise flock to Treasuries during risk-off modes are now flocking to Gold? After all, S&P cannot downgrade a metal…

Source:

Michael A. Gayed, CFA

Chief Investment Strategist

Pension Partners, LLC

Michael A. Gayed, CFA is Chief Investment Strategist at Pension Partners, where he structures portfolios. Prior to this role, Michael served as a Portfolio Manager for a large international investment group, trading long/short investment ideas in an effort to capture excess returns. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies. Michael earned his B.S. from New York University, and is a CFA Charterholder.

What's been said:

Discussions found on the web: