MarketFolly.com puts out quarterly subscription research — Hedge Fund Wisdom newsletter — that follows what the top hedge funds are buying and explains why.

Its worth checking out. Below is a recent version of a portion of the newsletter. You can find out more by emailing marketfolly@gmail.com.

~~~

Reducing Equity Exposure

Dan Loeb’s $4 billion Third Point Offshore Fund has decreased equity exposure three months in a row. At the end of July, Third Point was only 23.3% net long equities, down from 42.6% net long only two months earlier.

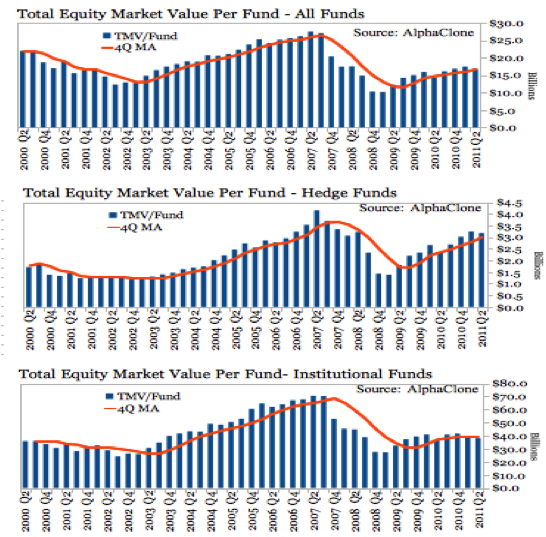

The latest batch of SEC 13F filings depicts a less drastic reduction in equity exposure by hedge funds as a whole, but nonetheless a reduction. Our friends at Alphaclone submitted their findings that “total market value disclosed and attributable to equities” decreased 2% from Q1 to Q2 (see the chart below):

While some funds were more aggressively entering ‘risk off’ mode in Q2, the volatility in August will certainly ensure that more risk has been taken off the table.

Consensus Buys

We track 40+ prominent long/short equity funds, placing emphasis on managers with solid stockpicking performance and longer investment time horizons in an effort to follow true investors, rather than funds more prone to trading. Glancing at their latest portfolios, you can easily single out a few stocks that garnered significant capital.

One of the ‘consensus buys’ among long/short funds in the second quarter was Sensata Technologies (ST). The company was carved out from Texas Instruments in 2006 as part of a leveraged buyout (LBO) consortium led by Bain Capital.

Since then, the company IPO’d in March 2010 and hedge funds have built up stakes in the company. This past quarter, Och-Ziff and Hoplite Capital initiated new positions.

Also, many prominent hedgies added to their pre-existing positions in ST including Scout Capital, Lone Pine Capital, Blue Ridge Capital, and Valinor Management. The brand new issue of our premium newsletter Hedge Fund Wisdom analyzes the potential investment thesis. (You can download a free past issue here.)

Numerous top managers also initiated stakes in Expedia (EXPE), as the online travel-booking company was a consensus buy. In a highly anticipated event, the company announced it will spin-off its TripAdvisor segment as the company looks for appropriate valuation for its fast-growing social media property. This is exactly the type of catalyst-based investment many of the hedge funds we track like to play.

Mosaic (MOS) was also a consensus buy as numerous hedgies took advantage of the secondary offering as the Cargill family unloaded their shares and removed a big overhang on the stock. Southern Union (SUG) was also a name that saw a lot of buying as well.

Buying One Bank, Selling Another?

While the tendency of many hedge funds was to reduce exposure to financials in the second quarter, there was an interesting dichotomy between shares of two of the sector’s titans.

Prominent hedgies such as Paulson & Co (John Paulson) and Appaloosa Management (David Tepper) sold off shares of Bank of America (BAC).

Yet at the same time, some potentially contrarian investors were stepping in to buy shares of rival Citigroup (C) ~ Lee Ainslie’s Maverick Capital and Bill Ackman’s Pershing Square to name a few. These ‘rogue’ funds are somewhat of an outlier, though, as more often than not, hedgies reduced exposure to financials.

Bruce Berkowitz Goes All-In on AIG

And speaking of rogue or contrarian funds, none fits the bill more right now than Bruce Berkowitz’s Fairholme Capital. While he’s a mutual fund manager, Berkowitz certainly acts like a hedge fund manager by taking highly concentrated stakes in companies and getting involved with his investments.

In Q2, he more than doubled down on his already massive stake in American International Group (AIG). This position now accounts for a whopping 23% of his equity portfolio. For what he sees in the company, we extract a bit of analysis from our premium newsletter:

Based on the company’s latest reports, AIG’s core businesses can generate earnings of $2.50+, which would justify the current share price given that the sector trades at ~7x 2012 EPS. Additionally, AIG has a book value of ~ $50 and trades at a little over 40% of that value, which is low compared to peers trading at 60-70%.

Also, AIG has significant deferred tax assets (DTA) from net operating and capital losses. The reversal of the DTA valuation allowance, the successful IPO of its ILFC division, and stronger-than-expected sales due to the recapture of some previously lost distribution channels could unlock AIG’s value.

Conversely, AIG is a highly complex company with opaque financials. The government still owns 77% of the company’s shares and will be selling them in doses over the next couple of years perhaps, which could put a lid on the stock. You can read the bull and bear cases for AIG written by hedge fund analysts in our just released newsletter.

Hedge Funds Buy ‘Growth’ Tech, Sell ‘Value’ Tech

Over the past few years, Wall Street has witnessed a shift in the tech. Customers traded in their Hewlett Packard (HPQ) PC’s running Microsoft (MSFT) Windows for new Apple (AAPL) iMacs. Google (GOOG) replaced Yahoo! (YHOO) as the dominant search engine and itself became a verb (“google it”).

This shift has caused shares of MSFT, HPQ, and YHOO to trade at much lower valuations and all three were actually ‘consensus sells’ among the hedge funds we track in the quarter. Yet in the carnage, there were a few notable value investors who found the valuation of MSFT too tempting to pass up.

Legendary investor Seth Klarman (Baupost Group) purchased a new $312 million stake in MSFT and David Einhorn’s Greenlight Capital boosted its position in MSFT by 63% and owned a $385 million stake at the end of Q2.

While those two widely respected investors took a contrarian stance, many other hedge funds were piling into the ‘growth’ plays instead. Apple (AAPL) and Google (GOOG) were their preferred destinations as they were both consensus buys in the quarter.

And rounding out recent activity takeaways, we’ll close with a bit from Goldman Sachs’ Hedge Fund Trend Monitor. The five most important stocks to hedge funds according to Goldman’s VIP list are: 1. Apple (AAPL), 2. Microsoft (MSFT), 3. Google (GOOG), 4. Citigroup (C), and 5. General Motors (GM).

Source:

MarketFolly.com,

Hedge Fund Wisdom newsletter

What's been said:

Discussions found on the web: