There seems to be an underlying misunderstanding about the US Real Estate market — how it functions, the psychology of buyers, and its current problems. Today, I want to take a long term look at these fundamental issues, and put them into some context.

The cause of these thoughts are a pair of studies: The first from Zillow that looks at home values by community, and finds that “Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.” The second is a similar study from Trulia looking at the rent vs buy question.

The original WSJ web article had a rather surprising headline: Something like “Are Homes Undervalued?” — thats gone now, replaced with the circumspect Linkage in Income, Home Prices Shifts. But the editor who penned the descriptor may be misguided: “Home prices have fallen below “fair value” in one-third of nearly 130 housing markets examined in a study by real-estate firm Zillow, raising concerns that some housing markets have over-corrected.”

There are several reasons to be concerned about housing at present: First, any economic deterioration, especially a recession accompanied by further job losses, will start another leg down in Housing and an accompanying set of bank balance sheet problems. Second, many asset classes recovering from a Boom & Bust cycle do not simple revert to fair value but often careen wildly past it towards a deeply undervalued state. Third, following a debt crisis, consumers spend a decade or more deleveraging, and tend to downgrade purchases that involve taking on more credit — like a mortgage. Last, any former investor favorite that suffers a collapse can take a long time to recover investor confidence. Its been more than a decade since the dotcom bubble popped, and the Nasdaq at ~2,500 is still off its bubble highs by 50%.

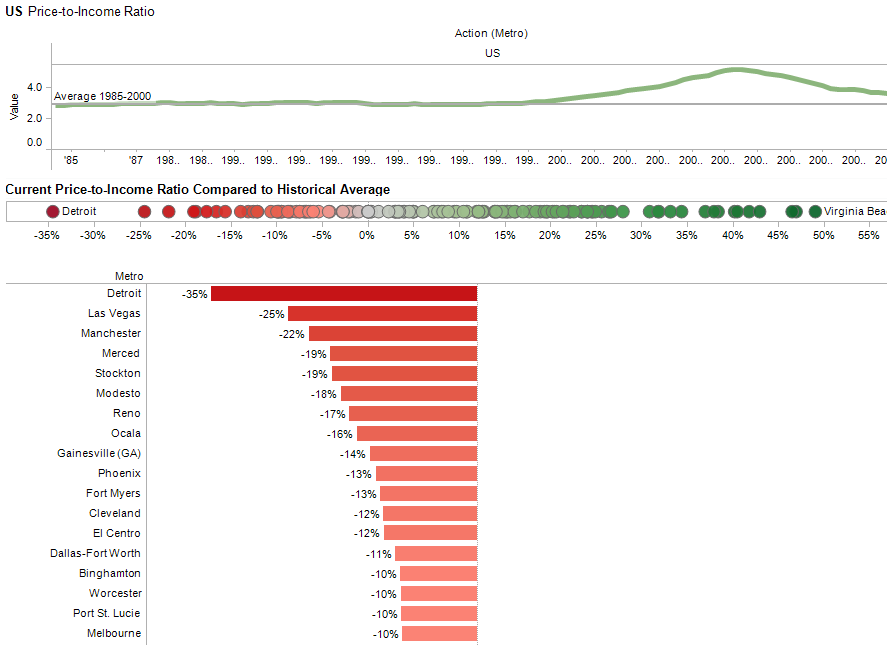

Recall our three favorite metrics for valuing homes:

1) Median Income versus Median Home Price

2) Valuation of Housing Equity as Percentage of GDP

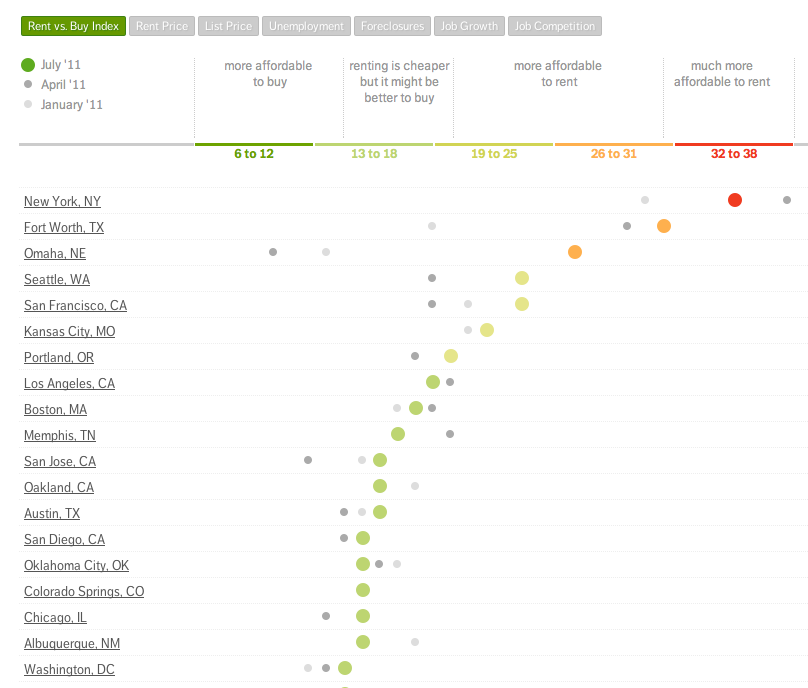

3) Cost of Owning versus Cost of Renting

The first two show that nationally, home prices remain elevated — Zillow pegs Prices at 3.3X Income — about 14% above trend. It varies dramatically by region, with broad differences in median income, economy, and home values. Only the Rent vs Buy metric shows homes cheap, and there are specific reasons not to trust that measure:

• Appropriately Tightened Lending Standards have removed millions of potential buyers from the market.

• Desire for Mobility (or a fear of the lack thereof) may be keeping buyers as renters; Flexibility of tenting allows employees who may need to relocate to obtain better jobs. The fear is getting stuck with an underwater home that is potentially worth less than its mortgage and prevents a job seeker from relocating.

• Deflating Asset: There remains a fear of owning an asset that is falling in price.

• Down Payment Requirements — having the cash to put down on a home purchase is beyond many families abilities. Consider that a mere 20% of $200k homes is $40,000 in cash –far beyond what most families have sitting in their bank accounts.This is beyond the tightening credit qualifications.

Consider the WSJ’s take:

“For the U.S. as a whole, home prices were around 2.9 times incomes from 1985 to 2000. But during the housing boom, values increased at a much faster rate than incomes. The price-to-income ratio peaked at around 5.1 in 2005. Home prices have since fallen so that on average, nationally, prices are around 3.3 times incomes, or about 14% above the historical trend.

Of course, prices have fallen much faster in certain markets. In Las Vegas, home prices are now 25% below their historic price-to-income trend of 2.7. During the housing bubble, that ratio more than doubled to 5.6. Home prices have been falling for the past five years, and by March, prices were just 2.1 times household incomes.

Home prices are undervalued by 35% in Detroit; by 18% in Modesto, Calif.; and 13% in Fort Myers, Fla.”

Detroit is a perfect example of why valuation cannot be considered without understanding the broader context: The Motor city has become The-No-Mojo city, with an exodus of jobs and people leaving the state. The valuation metric based on historical data provides little insight as to the prospects for a real estate recovery anytime soon.

Its the Macro economy, stupid.

The bottom line: The time to be generally optimistic about housing is not yet here . . .

>

Trulia: The 2011 Great Debate — Rent vs. Buy

>

WSJ Interactive: Price-to-Income by Metro Area

>

Sources:

The 2011 Great Debate — Rent vs. Buy http://insights.truliablog.com/vis/rent-vs-buy-q3/

Linkage in Income, Home Prices Shifts

NICK TIMIRAOS

WSJ, AUGUST 17, 2011

http://online.wsj.com/article/SB10001424053111904253204576512532609819142.html

What's been said:

Discussions found on the web: