Harm Bandholz is the Chief US Economist for the UniCredit Group in New York. Before coming to the United States, Harm worked as an economist at HypoVereinsbank and as a Research Assistant at the Ifo Institute, both in Munich, Gemany. He holds a PhD in economics from the University of Hamburg and is a CFA Chartholder. Harm is also a member of the American Council on Germany and The Economic Club of New York.

~~~

Philly Fed Index In Recession Territory

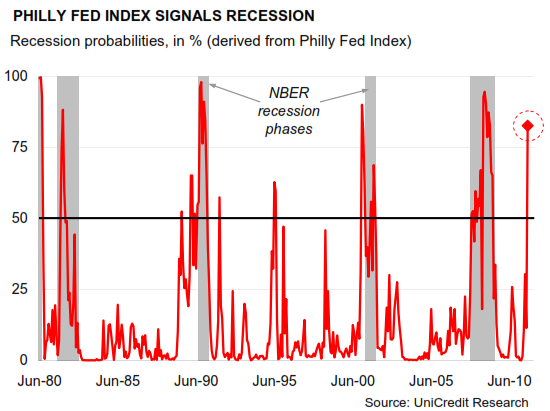

The global economy is weakening. The only question for the coming months seems to be, how quickly growth will slow down and by how much? Yesterday’s Philly Fed Index was undoubtedly grist to the mill of all those, who think that the recession in the US has already begun, or is about to start soon. The index, after all, plummeted to -30.7 in August from 3.2 in July. The monthly decline of 33.9 points was the sharpest drop since October 2008, i.e. the month after the bankruptcy of Lehman Brothers.

According to our calculations, the current index level translates into a recession probability of 82½% (see chart). It is interesting, though, that the Philadelphia Fed itself apparently tried to downplay the weakness of its own index, by emphasizing that “the collection period for this month’s survey ran from August 8-16, overlapping a week of unusually high volatility in both domestic and international financial markets.”1 Along the same lines, Dallas Fed President Richard Fisher told CNBC last night that while the Philly Fed Index is “a wonderful index” the stock market has in his view overreacted to the drop (“I think there’s a bit of an overreaction there.”)2 We agree and think that the move should be taken with a pinch of salt. The latest hard numbers – initial jobless claims or weekly chain store sales – do, after all, not suggest at all that the economic situation between July and August deteriorated as much as between September and October 2008.

Philly Fed Index gave no signals about the economic situation of late …

In general it seems as if the formerly very tight correlation between the Philly Fed Index and measures of economic activity broke down in early 2010. While the Philly Fed Index has fluctuated widely over the last 1½ years, from +20 to -5, back to +40 and now down to -30, growth in manufacturing output was much more stable in this period(see left chart). The correlation with real GDP growth was even negative over the last four quarters (see right chart). Most notable: While the Philly Fed Index averaged a strong 30 points in the first quarter, real GDP eked out only a 0.4% increase.

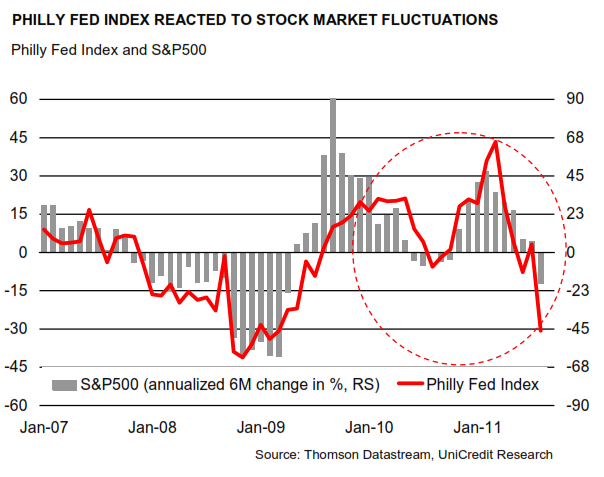

… but reacted to the stock market

But if the Philly Fed Index did not signal swings in economic activity in recent months, what caused the huge fluctuations in the index? The answer is: The stock market! As the chart on the following page reveals, the 6M change in the S&P500 moved from +45% in early 2010 to -7½%, back to +45% and now down to -18%. That means that during the very time that the

correlation between the Philly Fed Index and economic activity broke down, the correlation between the Philly Fed Index and the stock market actually tightened. That it was the Philly Fed Index that initially reacted to the stock market and not the other way round is confirmed by Granger Causality tests or simple cross correlation analysis. Accordingly, the 6M change in the S&P500 is leading the Philly Fed Index by one month; the 3M change in the S&P500 even has a statistical lead over the index of three months. That suggests that the latest plunge in the Philly Fed Index largely/primarily reflects the overall deterioration in the mood of companies due to lower stock prices and not the fact that the economy is falling off a cliff.

Fear of self-fulfilling prophecies

Now, however, the stock market has of course reacted to the bad Philly Fed number as well (there is a certain irony that the stock market reacts to negative “news” that it somehow

created itself). If previous correlation holds, this poses the risk of a negative feedback loop between stock prices, business surveys, and ultimately the overall economy. A particular

concern is the negative impact of both lower stock market valuations and a gloomier mood among companies on capex spending and hiring activity. Empirical findings suggest that

models that incorporate stock prices as explanatory variables “typically generated the most accurate forecasts” for “US business fixed investment spending growth.”3 As the relationship between stock prices and capex spending tends to hold in the medium-term, rather than in the short-term, the current slump in equities will primarily be a drag on investment spending in 2012, and not so much in the second half of this year (where the decisions are already made).

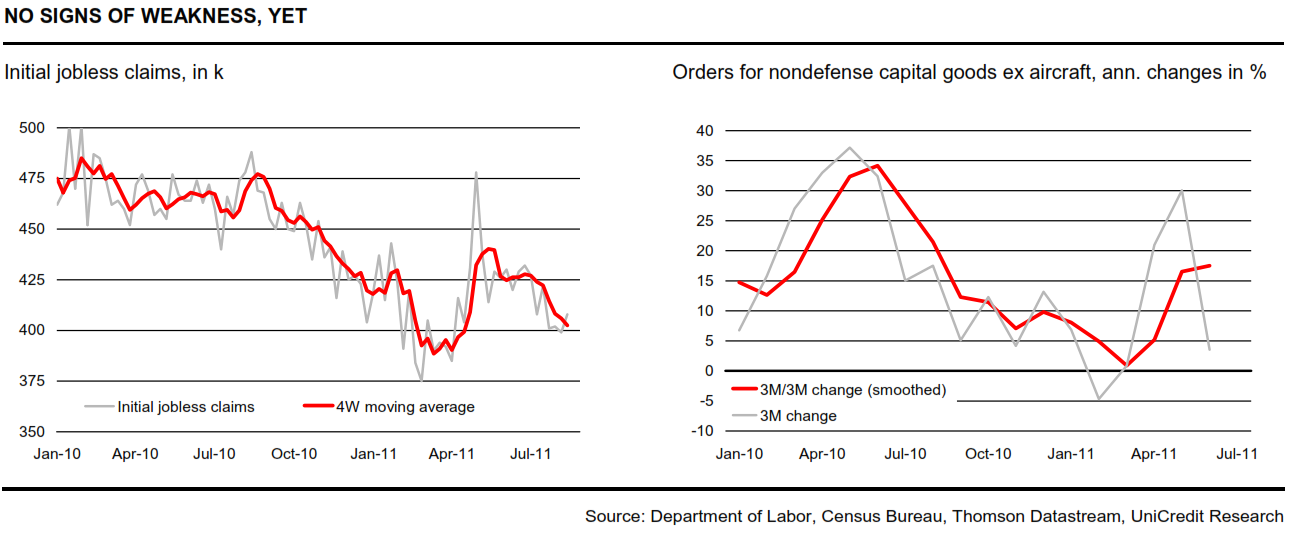

The most timely “hard” indicator to follow is weekly initial jobless claims, which should be among the first to reflect any renewed deterioration on the labor market. So far, they have

continued to improve, after rising sharply in late April due to the earthquake in Japan (layoffs in the car industry), natural disasters in the US and seasonal adjustment issues. The 4W

moving average fell to 403k in mid-August, which is the lowest since mid-April (see left chart on the following page). Orders for nondefense capital goods ex aircraft, the most reliable

leading indicator for capex spending itself, have also continued to rise solidly of late. The less volatile 3M/3M change accelerated to an annualized 17½% in June, the fastest increase since last summer (see right chart). But these numbers have obviously been collected before the market turmoil started. The upcoming numbers for August and September should shed more light on the transmission from weaker sentiment to overall economic activity. A truly devastating signal would be to see a rise in order cancellations. The downside risks for the

economy have in any case increased dramatically.

Should the Fed target stock prices?

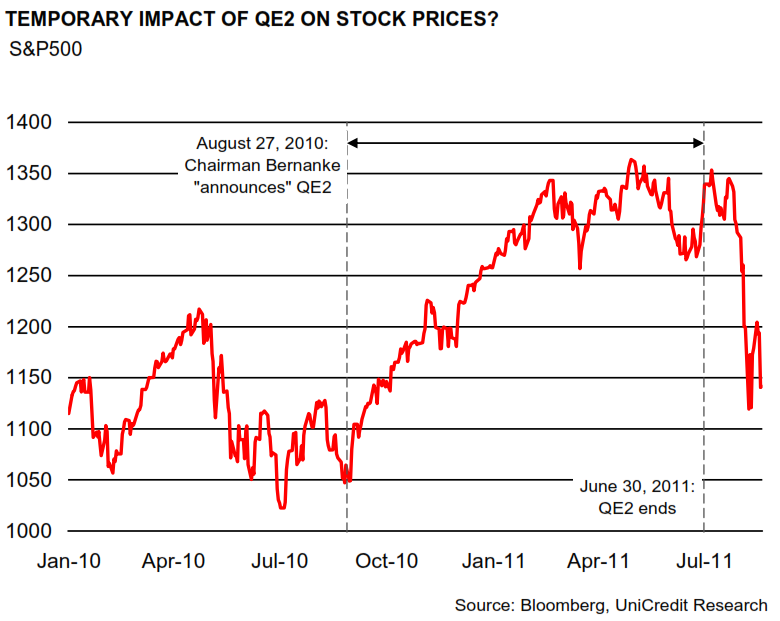

One could, therefore, argue that the Federal Reserve, in order to prevent such a negative feedback loop, should target equity prices. As the Fed is not allow to buy stocks directly, this most likely would have to happen through another large-scale Treasury-purchase program, which, through additional liquidity and lower risk-free rates, would inflate prices of more riskyassets. The experience with the previous purchases program, dubbed QE2, suggests that such a policy might be successful – at least in the short-term. Between late August 2010,

when Chairman Bernanke first held out the prospect of QE2 and the end of the program in June 2011, the S&P500 gained more than 300 points, a plus of 28½% (see chart next page).

But that is only half of the story. If it was the Fed that boosted stock prices by the middle of the year, then it is now probably the lack of additional monetary stimulus that caused, or at

least fostered the latest sell-off in the markets. Moreover, and here the wheel turns full circle, if QE2 had indeed an impact on stock prices – first positive, now negative – it was an

important driver behind the volatility in the Philly Fed index as well. But as we have shown: It was only the mood that temporarily improved, not economic activity. Either way, whether the Fed cannot influence stock prices at all or whether it can only lift valuations through more and more stimulus, we think that the Fed should refrain from targeting stock prices. Or as Richard Fisher said earlier this week: “My long-standing believe is that the Federal Reserve should never enact such asymmetric policies [Bernanke put] to protect stock market traders and investors. I believe my FOMC colleagues share this view.” Let’s hope, he is right.

1 Federal Reserve Bank of Philadelphia, August 2011 Business Outlook Survey.

2 Transcript: CNBC’S Larry Kudlow speaks with Richard Fisher, www.noodls.com

3Rapach, D.E. and M.E. Wohar. Forecasting the recent behavior of US business fixed investment spending: An analysis of competing models, Journal of Forecasting (26), 33-51, January 2007.

4 Fisher, R., Connecting the Dots: Texas Employment Growth; a Dissenting Vote; and the Ugly Truth, speech in Midland, TX, August 17, 2011

Source:

Dr. Harm Bandholz, CFA,

August 19, 2011,

UniCredit Bank

What's been said:

Discussions found on the web: