Source: Realty Bubble Monitor

>

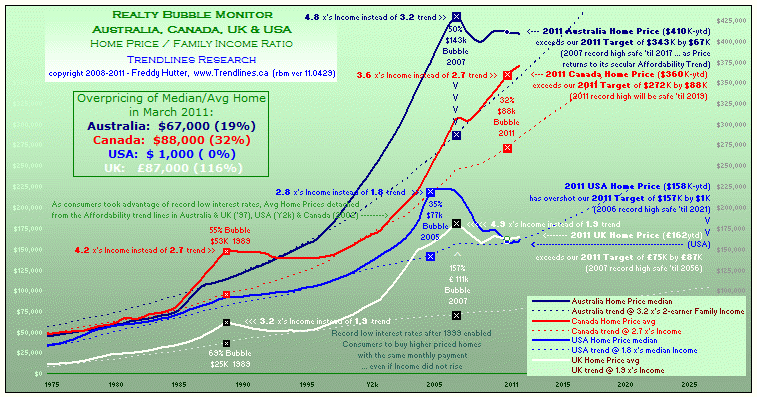

Realty Bubble Monitor looks at the Housing markets in English speaking nations — US, UK, Canada and Australia.

Canada’s Housing is now 32% above trend, just a tad below the 35% mark upon which the USA bubble burst.

Australian median home prices had already detached from the long term Price/Family-Income ratio of 3.2 way back in 1997. The onset of record low interest rates shortly thereafter enabled consumers to buy more expensive Existing Homes w/o increasing their mortgage payments. Subsequent irrational exuberance swept the Price/Family Income ratio to an unsustainable bubble high of 4.8 in 2007.

UK average home price has also detached from its long term Price/Family-Income ratio of 2.0 way back in 1997. The onset of record low interest rates shortly thereafter enabled consumers to buy more expensive Existing Homes w/o increasing their mortgage payments. Subsequent irrational exuberance swept the P/I ratio to an unsustainable bubble high of 4.9 in 2007.

Canadian average home price moved away from long term Price/Family-Income ratio of 2.7 in 2002. P/I ratio hit a bubble high of 3.6 in 2011.

United States had record low interest rates coming out of the 2001 Recession enabled consumers to buy more expensive Existing Homes w/o increasing their mortgage payments. Added to pent-up demand, this caused median price to rise above the long term Price/Income ratio of 1.8 starting in Y2k. As lending standards dissipated, irrational exuberance took the P/I ratio to an unsustainable bubble high of 2.8 in 2005

What's been said:

Discussions found on the web: