One of the smartest hedge fund managers we know spends most of his day locked away in his office analyzing how the market consensus could be wrong. He hangs with au contraire crowd, breaking bread with contrarians and demands you check your cheerleader pom-poms at the door when visiting his office. Not that he takes action or trades on all or any of this, but his rigorous discipline of stress testing his perspectives, positions, and the conventional wisdom of the market is a lesson for all of us.

Our hope is the policymakers, especially the Fed, do the same. The world is experiencing the adverse consequences of negative real interest rates and yet the monetary policy prescription of choice is for more negative real interest rates.

In his September 6th FT piece, Bill Gross writes,

…monetary policy at the zero interest rate bound introduces a new dynamic that may conflict or even reverse standard logic that lower interest rates across the sovereign yield curve are everywhere and always stimulative to economic growth.

This potential paradox arises not just from observation of the Japanese experience over nearly two decades, but from an analysis of our modern-day financial system and its potential inadequacies. Fractional reserve banking, where only a portion of bank deposits are backed by hard cash, as well as unreserved collateral-based lending on overnight repo have allowed for an expansion of credit beyond the bounds of a central banker’s imagination.

Mr. Gross concludes the Fed’s pancaking of the yield curve through Operation Twist will destroy the banking system’s incentive to create credit by reducing the opportunity for banks to leverage a positively sloped yield curve

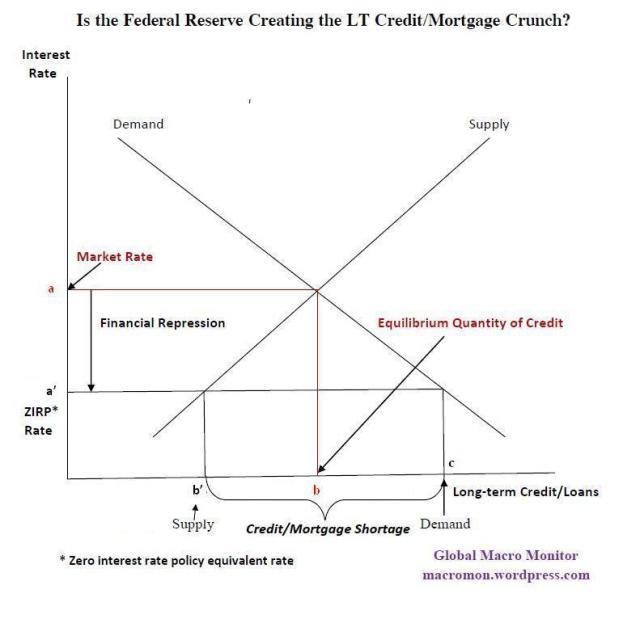

We add our two cents to the Bond King’s skepticism of current policy using the basic supply and demand curves of microeconomics, or what graduate students call “price theory.’ Recall how we were taught as freshman that rent control creates a shortage of rental apartments and housing when government policy distorts or represses market prices.

Take a look at the chart below, which should look familiar as it is simple adaption of the rent control analysis. The vertical axis shows the interest rate with the horizontal the quantity of loans/credit/mortgages.

It is also important to note demand and supply curves are not observable in the real world. What we see are prices and quantity. But like any economic model, supply and demand curves help us understand the underlying dynamics and the factors that determine the prices and quantity/volume which we observe.

The graph shows that points a and b are the equilibrium market clearing interest rate and quantity of long-term credit/loans/mortgages. The implementation of zero interest rate policy (ZIRP) and Operation Twist represses the rate to point a’. This reduces the supply of credit/loans/mortgages from point b to b’.

After all, who in the private sector will lend long-term money at such repressed and non-economical interest rates? Fannie and Freddie? Yes. Bill Gross and PIMCO? We suspect it’s possible for a trade. Asian investors? NFW!

Furthermore, demand increases to point c at the repressed interest rate forcing either public sector lenders to expand their balance sheets or the market to ration credit through a tightening of credit standards, higher down payments, or by other means. This analysis doesn’t even consider the reduced income on savings and the crowding out effect of the federal deficit. There’s no doubt, in least in our mind, the government is going to get funded first even if the FED has do it alone.

It’s our sense, and we could be wrong, this simple model reflects current reality and one can easily conclude that zero interest rate monetary policy may be what ails the economy and not the prescription that is going to cure it. We throw it out there to help Mr. Bernanke, at least, consider a contrarian perspective, which, like our friend, will make him a better hedge fund manager. Maybe he already has. He’s a smart guy and a professor.

(click here if the graph is not observable)

(click here if the graph is not observable)

What's been said:

Discussions found on the web: