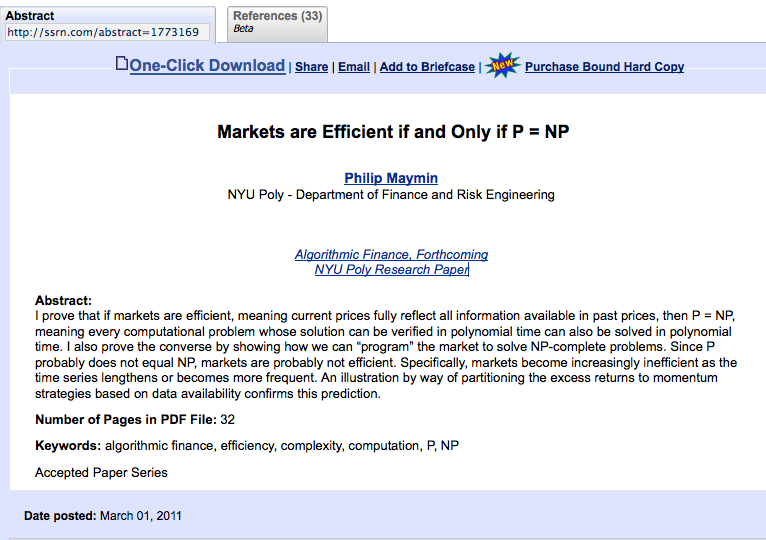

An NYU Poly Department of Finance and Risk Engineering professor has a forthcoming paper in Algorithmic Finance that claims that “Markets are efficient if and only if P = NP.”

Why is this important? Most economists think markets are at least weakly efficient (I disagree).

Computer scientists think that P != NP — that current prices fully reflect all information available in past prices.

This paper claims they both cannot be correct; one must be incorrect. The author’s proof is that they both cannot be correct at the same time, and therefore one must be wrong.

>

Abstract:

I prove that if markets are efficient, meaning current prices fully reflect all information available in past prices, then P = NP, meaning every computational problem whose solution can be verified in polynomial time can also be solved in polynomial time. I also prove the converse by showing how we can “program” the market to solve NP-complete problems. Since P probably does not equal NP, markets are probably not efficient. Specifically, markets become increasingly inefficient as the time series lengthens or becomes more frequent. An illustration by way of partitioning the excess returns to momentum strategies based on data availability confirms this prediction.

What's been said:

Discussions found on the web: