Herewith a potpourri of unrelated items I’ve found on my never-ending voyage through the internet. Grab a cup of coffee and pull up a chair.

Seen This Movie Before

First up, an excerpt from a speech given by Teddy Roosevelt in December 1906. I was taken by the opening line and the third paragraph. Indeed, his opening line could probably have been used countless times since he spoke it, most recently six or seven years ago:

As a nation we still continue to enjoy a literally unprecedented prosperity; and it is probable that only reckless speculation and disregard of legitimate business methods on the part of the business world can materially mar this prosperity.

But the third paragraph was really the jaw-dropper for me:

I again recommend a law prohibiting all corporations from contributing to the campaign expenses of any party. Such a bill has already past one House of Congress. Let individuals contribute as they desire; but let us prohibit in effective fashion all corporations from making contributions for any political purpose, directly or indirectly.

I’m always fascinated by how little we seem to learn and how likely we are to simply ignore history’s lessons. I wish I had more time to study our country’s history via the infinite documents and archives that have made their way on to the internet. So much to learn, so little time.

Maybe We’re Not So Lazy After All

I took Senator Jon Kyl to task here (March 2010) for an offensive comments about lazy Americans who would prefer to remain on unemployment benefits than be gainfully employed (“In fact, if anything, continuing to pay people unemployment compensation is a disincentive for them to seek new work.”). It’s worth re-running the chart I used at the time:

We now see, in a newly issued report, via the Wall St. Journal that:

“Any negative effects of the recent unemployment insurance extensions on job search are clearly quite small, too small to outweigh the benefits of transfers to people who have been out of work for over a year in conditions where job-finding prospects are bleak,” according to the report. […]

There’s a chance extended benefits actually increase the number of Americans who find new jobs, according to the study. By one calculation, unemployment insurance extensions increased the share of workers who became reemployed by about 1.3 percentage points in January 2011 by reducing the fraction who excited [sic] the labor force.

Industrial Production and Private Sector Jobs

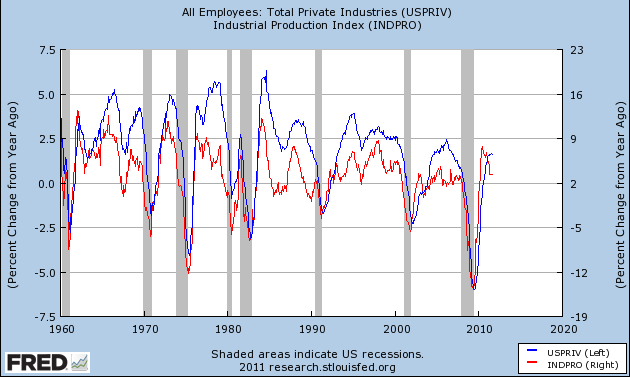

The change in year-over-year Industrial Production (INDPRO) and Private Sector Jobs (USPRIV) have a correlation of 0.83 over the past 50 years. Industrial Production seems to have put in a peak and, if my eyes don’t deceive me, I see payrolls just starting to rollover:

Buy-Side: Not Much Better Than Sell-Side

I posted here back in early August about Street-wide year-end S&P500 forecasts. I will say that I’ve breathed a sigh of relief as it’s become clear over the last six weeks that those forecasts were too optimistic and have been chopped across the board. I then posted here about one month ago when the first batch of 2012 S&P earnings estimates were published (Median: $104). I suspect it’s only a matter of time before those start getting pared, if they haven’t already.

I decided to take a look through the Barron’s archives to see what the seers were saying year-end 2010, and found the following graphic. What really jumped out at was the extent to which the consensus was looking for the 10-year in the range (generally) of 3.50 – 4.00% at YE 2011. Of course, it is only September, but I’d say that call’s as shaky as S&P1400. I also noted that the buy-side doesn’t look much better than the oft-maligned sell-side.

Fed Flow of Funds

The Fed released its Z.1 Flow of Funds report which, although always a bit stale, is a treasure trove of data. I never tire of finding ways to look at the data presented in the report.

Here, from Table B.100, are Household Real Estate (Line 4) and Corporate Equities (Line 24) as a percent of Total Household Assets (Line 1)

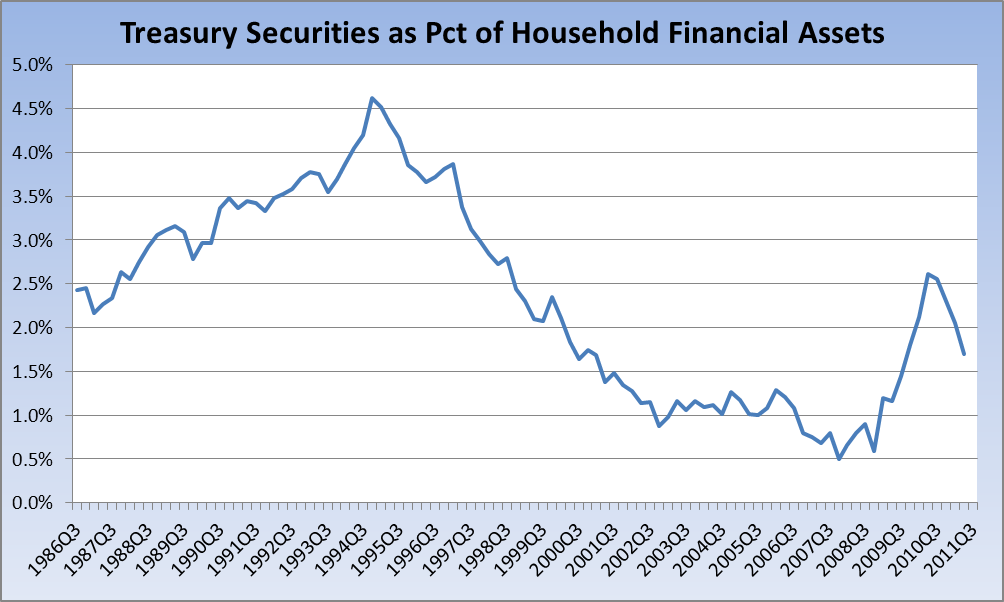

Here are Treasury Securities as a still-insignificant part of the American household’s financial assets (not total assets, just financial assets):

In terms of dollar holdings, Treasuries are now $835 billion on the household balance sheet versus financial assets of $49 trillion and total assets of $72.3 trillion. Liabilities stand at $13.9 trillion. Household real estate stands at $16.2 trillion, down some $6.6 trillion from the 2006Q4 high of $22.8 trillion.

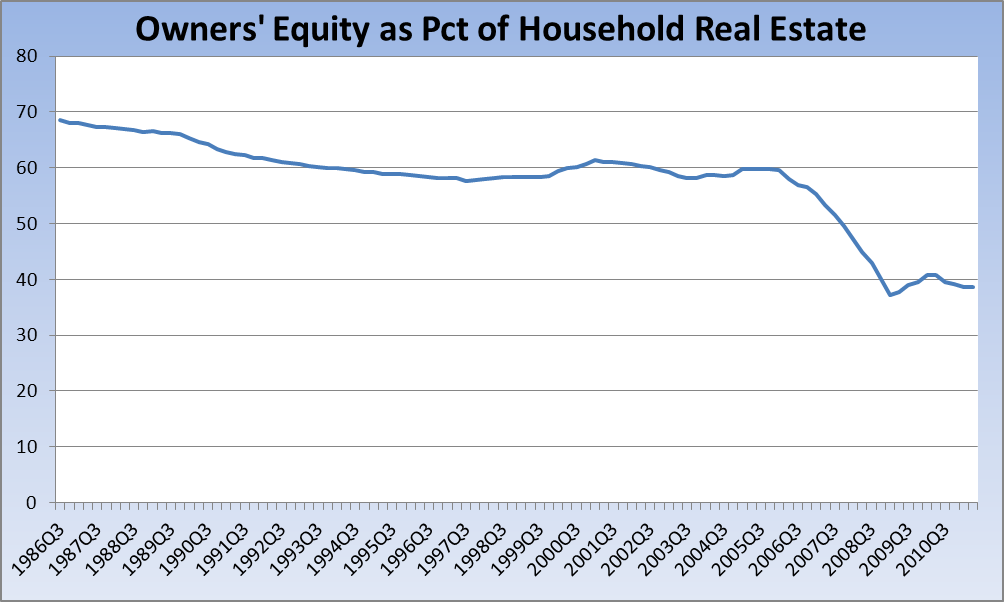

Here’s Owners’ Equity as a Percentage of Household Real Estate:

On the chart above, we have made no progress since since the fourth quarter of 2008, when we sat at 40.1 (we’re now at 38.6 for two quarters running). This decline in homeowners’ equity speaks to the credit expansions that allowed Americans to live beyond their means while incomes — as we saw when the Census released its report last week — have been stagnating.

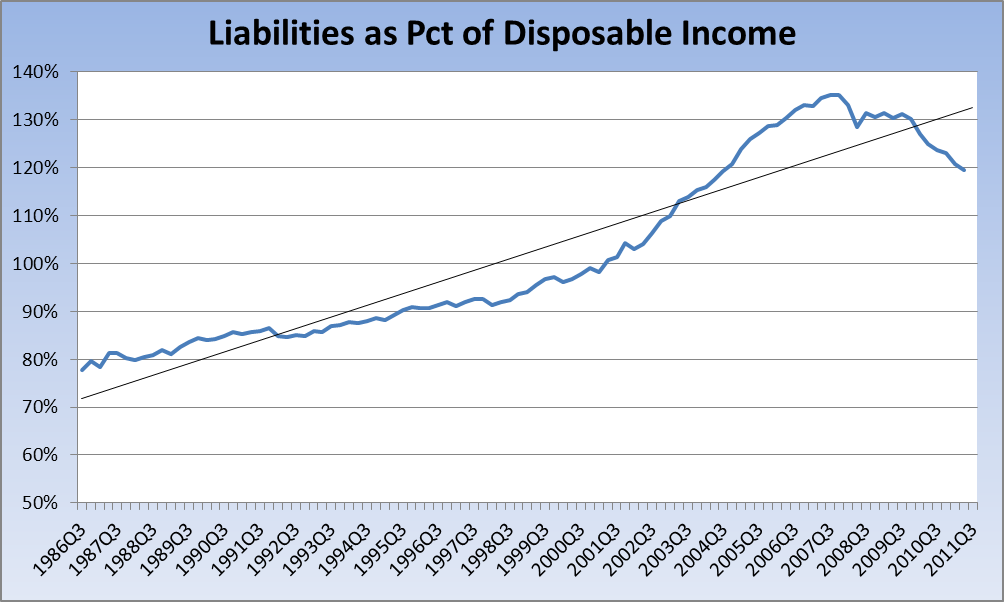

Last but not least, here’s Liabilities as a Pct of Disposable Income:

Though we’re below the upward sloping trendline on this file, the average over the period shown is 102%, which is a further shedding of about $2.25 trillion in liabilities (or similar gain in income, which we plainly know is simply not happening).

Are We Beyond Civil Discourse?

As has been noted in several places, it appears we have moved as a country toward something that I find unrecognizable:

- Rick Perry’s inappropriate claim that Ben Bernanke’s actions as Fed chair could be “treasonous” and that he’d be treated “pretty ugly” in Texas drew approvals.

- The mention that Perry has presided over more state-run executions than any other governor in modern times drew rousing (and to me, shocking) applause.

- Wolf Blitzer’s question to Ron Paul as to whether a hypothetical comatose citizen without insurance should be left to die were met with audience hoots of “Yeah!”

- Noise was made about offsetting the cost of emergency relief in the wake of Hurricane Irene.

Via Mediaite:

Jon Seidl at The Blaze tries to get the Tea Party audience some room to wiggle out of this ghoulish display, theorizing, alternately, that it was a delayed reaction to something Paul said earlier (not unless those folks were watching on their portable DVRs), or that the hoots were from liberals, cheering on Blitzer’s “Gotcha!” (which would make them the quietest bunch of liberals in the world for the rest of the debate)

The reactions of three or four audience members at a debate isn’t all that meaningful on its own, but this outburst follows last week’s Death Penalty Ovation at the Reagan Library debate, and another ugly moment at the Tea Party debate in which the crowd cheered for fed chairman Ben Bernanke to be tried for treason, a capital crime.

I’m still trying to figure out exactly what’s going on here. While Perry’s presiding over 234 state-run executions during his terms as governor may speak to our adherence to the rule of law (much as I may wish we had no such law), should we really be applauding the fact that our government puts people to death? Similarly, should the uninsured — specifically those who can afford but choose not to buy insurance — be left to die should something happen to them? And how far have we drifted from our moral moorings that we have a president (Obama, not Bush) who unilaterally orders the extra-judicial execution of American citizens? These developments are all deeply troubling, and speak to a society that has lost its way. It’s almost as though we can no longer distinguish between “reality TV” and reality.

~~~

I found myself in complete agreement with Phil Angelides in this interview with Bloomberg’s Lisa Murphy.

~~~

Catch up with me on Twitter: @TBPInvictus

What's been said:

Discussions found on the web: