>

Michael Gayed observes:

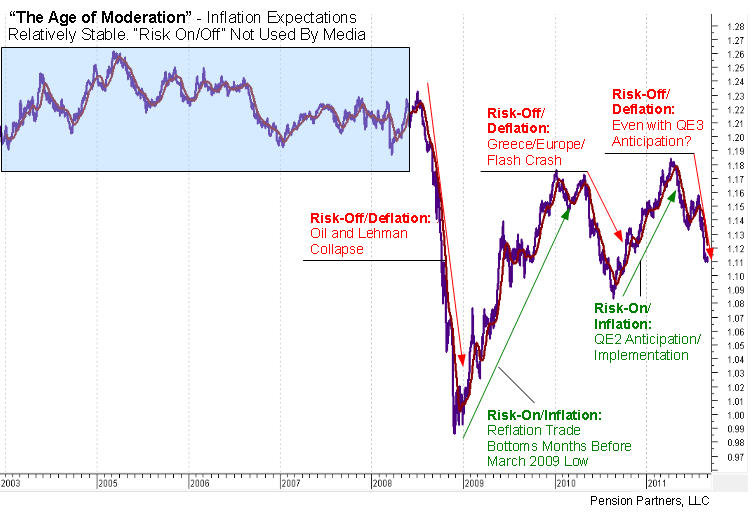

“When the TIP/IEF price ratio (Inflation-Protection/Nominal-No-Inflation-Protection) trends higher, it means bond market is swinging towards increased inflation expectations. When the ratio is trending down, bond market is favoring deflation through outperformance of Nominal bonds.

Inflation hedge tends to be equities: risk-on. Deflation hedge tends to be nominal bonds: risk-off. In nearly all cases, the ratio moved ahead of the stock market (mid-2008 downtrend before Lehman Crash, November 2008 ratio low before March 2009, Europe Problems April 2010 before Flash Crash/Correction, August 2010 QE2 inflation bets and stock market rally, decline for most of 2011 before August Summer Plunge). Curious to see that the trend now still appears lower even with QE3 on the horizon, no? May be suggesting bond market doesn’t believe QE3 will cause inflation and ultimately work.

If that’s the case, the stock market may be in for a rude awakening…”

>

~~~

Michael A. Gayed, CFA is Chief Investment Strategist at Pension Partners, where he structures portfolios. Prior to this role, Michael served as a Portfolio Manager for a large international investment group, trading long/short investment ideas in an effort to capture excess returns. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies. Michael earned his B.S. from New York University, and is a CFA Charterholder.

What's been said:

Discussions found on the web: