From John Siliva and the Economic team at Wells Fargo.

~~~

Introduction: Income Inequality versus Economic Mobility

It is undeniable that there is a growing income gap between the ultra-rich and the rest of America. Indeed, a recent report from the Congressional Budget Office (CBO) makes it clear that from 1979 to 2007, the income gap between top income earners and everybody else grew ever more lopsided.1 This disparity in the American economic experience over the past generation is among the primary catalysts for the various “Occupy” movements across the country. While opinions about the protests themselves are mixed, there seems to be some consensus about Americans’ distaste for the growing share of the pie going to the richest percentile of our population. A recent poll suggests that six out of ten Americans support policy to address income equality.2 The survey is short on specifics about what such policy would look like, and we suspect that a punitive “eat the rich” tax policy would meet significant political barriers. Still, in our view, this issue of income inequality will likely be at the forefront of the political discourse throughout the upcoming presidential election year. So what other factors should policymakers consider in the context of making sure that the United States remains a place where everybody gets an equal opportunity even with unequal outcomes?

In this paper, in addition to discussing income inequality, we are shining a light on the concept of economic mobility, a facet of the debate that does not get as much attention, but one that is just as critical from the perspective of keeping the American Dream alive. Economic mobility refers to the capacity of an individual or a family to improve their financial standing, specifically as it relates to income and wealth. Or put more simply, it is the proverbial “picking yourself up by your bootstraps” or “rags to riches” story. It is a narrative that is threaded into the fabric of the American experience from the archetypical protagonist in the writings of Horatio Alger to the actual experiences of presidents like Abraham Lincoln (born in a one-room log cabin) and visionaries like Steve Jobs (the adopted son of middle-class parents). However, some would argue that just a small number of unusually capable and lucky people are actually able to live the American Dream, and that the publicity given to these aberrational cases is exaggerated in a deliberate strategy to keep the working class and the poor “in their place,” thus preventing them from agitating for a broader change. In this paper, we examine statistics on economic mobility in America. Our findings are somewhat surprising and may cause some of the more thoughtful protesters among the 99 percent to reconsider the best ways in which to address income inequality. More than anything else, the message of our findings to policymakers is that, rather than a redistribution of wealth, what is really needed is broader access to affordable education, better essential nutrition, more stable early childhood development experiences and basic financial literacy training for all income groups.

We Have Heard “We Are The 99%,” But Is There More to the Story?

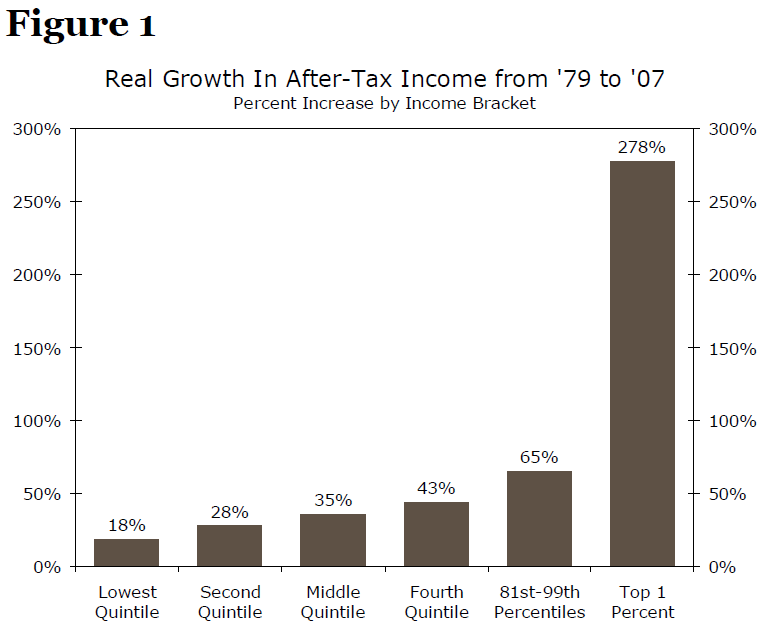

According to the previously mentioned report from the CBO, the share of income earned by the top 1 percent of households soared 278 percent between 1979 and 2007, while income growth for the bottom 20 percent of households was limited to just 18 percent during the same period (Figure 1). The study essentially divides the population into quintiles and adds a sixth category by carving the top 1 percent out of the top quintile. Every quintile experienced growth in income, but the higher the income group, the greater the income growth experienced. In other words, since 1979, the rich have kept getting richer.

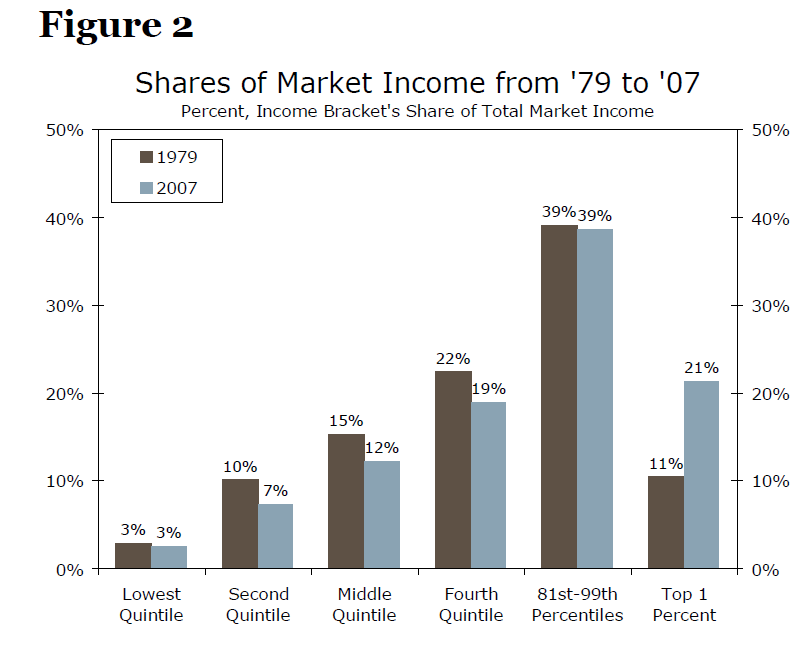

When looked at as share of market income, the data clearly indicate that the income growth experienced at the top percentile has come at the expense of the other groups’ income share. In 1979, the top 1 percent claimed 11 percent of the total market income. By 2007, the piece of pie going to the top 1 percent nearly doubled to 21 percent. Consequently, the share earned by each of the other five income groups was smaller in 2007 than what it had once been in 1979 (Figure 2).

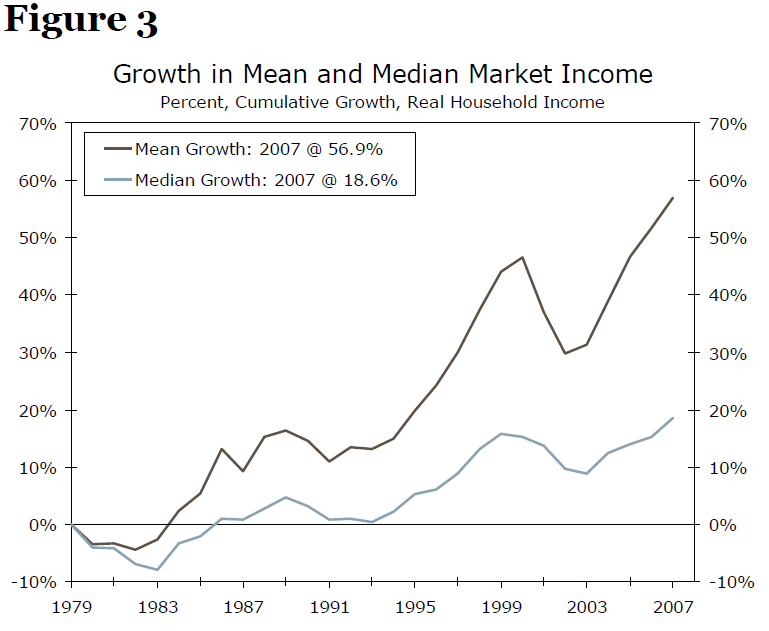

We are all doing better on average, the study tells us, with inflation-adjusted mean household market income up 57 percent since 1979. But this is one of those times when the difference between mean (average) and median (the data point in the middle) really stands out. The extreme growth at the top skews the mean higher. In this case, the change in median income really tells the story; inflation-adjusted household income growth here was just 19 percent from 1979 to 2007 (Figure 3).

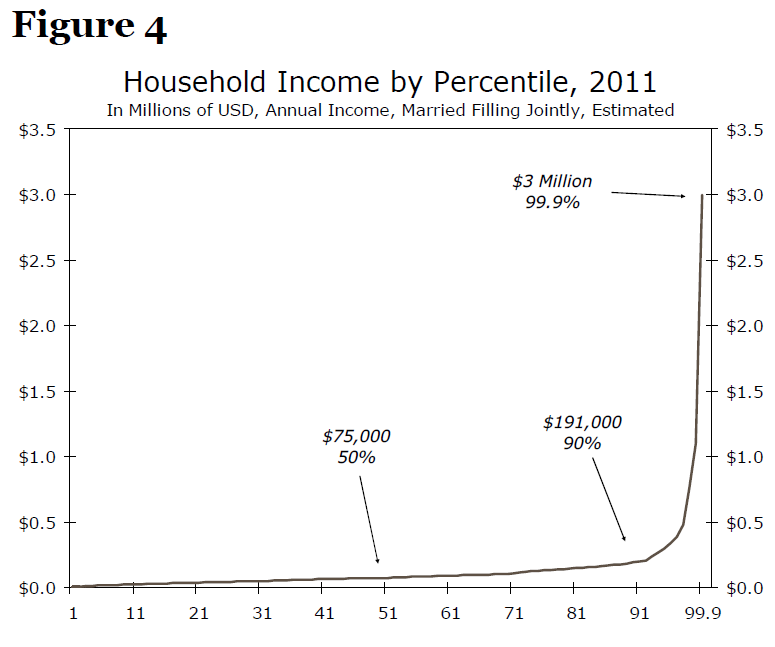

To get a sense of a more contemporary assessment of income disparity, we also looked at data from the Internal Revenue Service and the Tax Policy Center, a nonpartisan joint venture between the Urban Institute and the Brookings Institution. This is a time when a picture (or a chart, see Figure 4 on the previous page) is worth a thousand words.

Working together, these groups have preliminary results for 2011 household income, and the data are consistent with the income inequality seen in the CBO report. Median annual income for married couples filing jointly comes in at approximately $75,000. Roughly one third of households will make six figures in 2011, but less than 2 percent of households at the top will make more than $500,000. The income distribution then goes parabolic: incomes north of $1 million are reserved for the top 1 percent, and incomes north of $3 million are reserved for the top 0.1 percent.

Joneses versus the Jeffersons: Different Types of Economic Mobility

Rising income inequality, while alarming at first glance, is not necessarily problematic for economic growth and social stability if rising income inequality is accompanied by high economic mobility. That is, as long as workers are constantly shifting into and out of the very highest income brackets, a large and growing gap between income brackets is less consequential; because, in this scenario, every worker has a fair shot at one day entering into a higher income bracket. Simply knowing that this fair shot exists therefore fosters greater competition in the labor market and increased worker productivity.

It is important to point out, though, that there are different types of economic mobility. The type of economic mobility that we have illustrated thus far is called relative intra-generational mobility, which will be the primary focus of our data analysis in the next section. Relative intra-generational mobility is concerned with the ease with which workers are able to move into higher income brackets relative to their income peer group and specific to only one generation of workers. This relates to a phenomenon known both informally and to economists as “Keeping Up With The Joneses,” which is the basic idea that workers tend to measure their economic success against the success of their peers. (Or against the success of the Joneses, who represent each worker’s artificial, wealthy next-door neighbor.) In mobility terms, we are simply asking the question, “How easy is it for workers to earn the same annual income as do the Joneses?”

Relative inter-generational mobility, on the other hand, relates to the relative mobility between two separate (usually adjacent) generations. For illustration, if someone asks you the question, “Do you have a better shot at becoming rich than did your parents?” that person is actually asking you a question about relative inter-generational mobility. The populace is typically less concerned about inter-generational mobility as, again, workers tend to measure their economic success against the success of their peers and not against that of their parents or grandparents.

As opposed to relative mobility, there also exists a concept called absolute mobility. Absolute mobility does not treat economic mobility as a zero-sum game. Instead, absolute mobility is concerned with how a worker’s overall earnings change through time, without respect to changes in the earnings of peer workers. For example, while a “No” answer to the previous question, “Do you have a better shot at becoming rich than did your parents?” would indicate low relative mobility, absolute mobility need not also be low. Indeed, despite answering “No” to this question, if one’s income is higher than the income of his or her parents in absolute terms, it would be a sign of high absolute inter-generational mobility. So it is actually possible for absolute mobility to be high at a time when relative mobility is low.

What Happened to “Movin’ on Up?”

Rather than debate the merits of these varied types of economic mobility, our analysis is concerned only with changes in relative intra-generational mobility, which, in a utility-maximizing sense, matters most to workers. The best way to measure relative intra-generational mobility is to observe trends in panel data. Panel data contain observations of different economic variables through time for the same set of workers or firms—as opposed to time-series data, which observe the same economic variables through time, but for different workers or firms. Panel data therefore allow us to observe how a certain worker’s income changes through time to get a sense of how easy it is for that worker to move into a higher income bracket. This would not be possible with time-series data, because each observation of time-series data is for a different worker, meaning that changes in earnings in the economy tell us nothing about who specifically is benefiting the most from those changes.

We consider data from the Panel Study of Income Dynamics (PSID), which is a panel survey directed by faculty at the University of Michigan that began in 1968 with nearly 5,000 U.S. families. While the PSID tracks many different economic and social variables, including automobile purchases and even alcohol consumption, we consider only trends in total household income, which we define from the PSID data as the combined annual taxable income earned by the head of a household and that head’s spouse. Moreover, we consider only the families that reported their total household income for each PSID measurement year from 1968 to 2009. This narrows our sample size down to roughly 500 families.

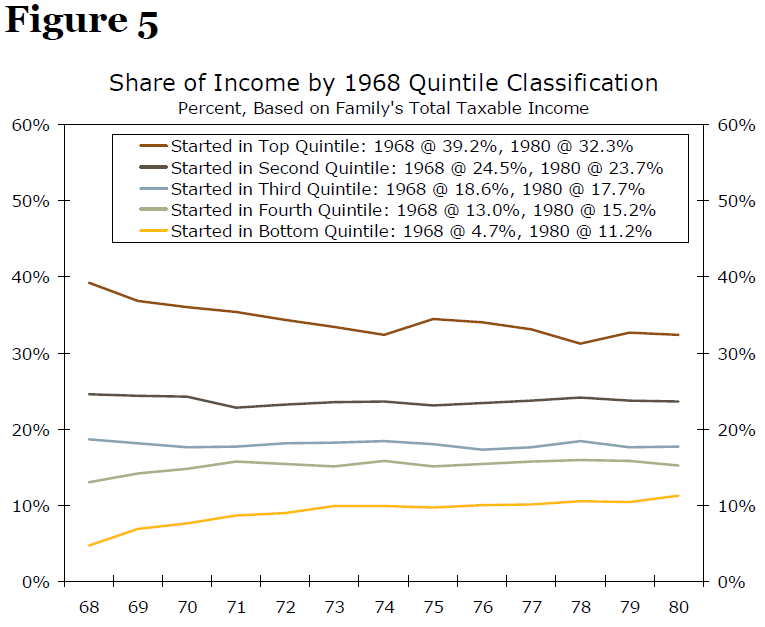

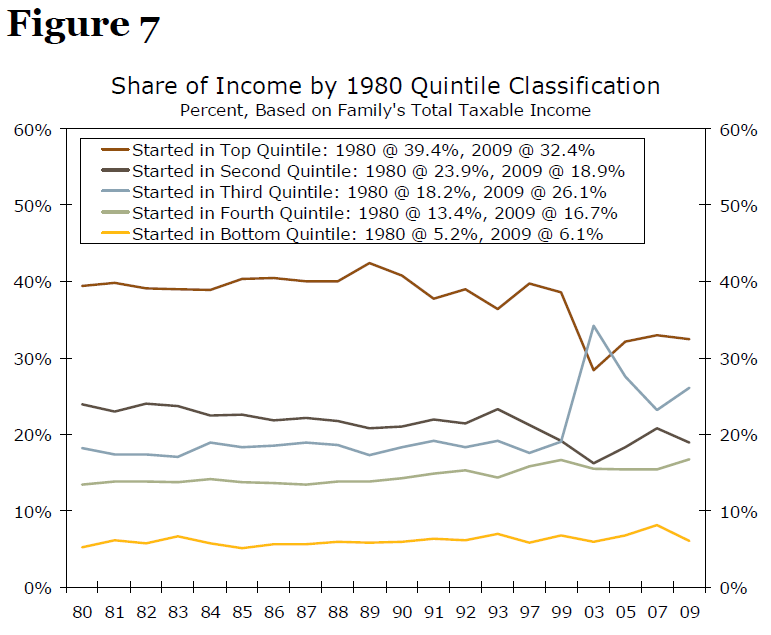

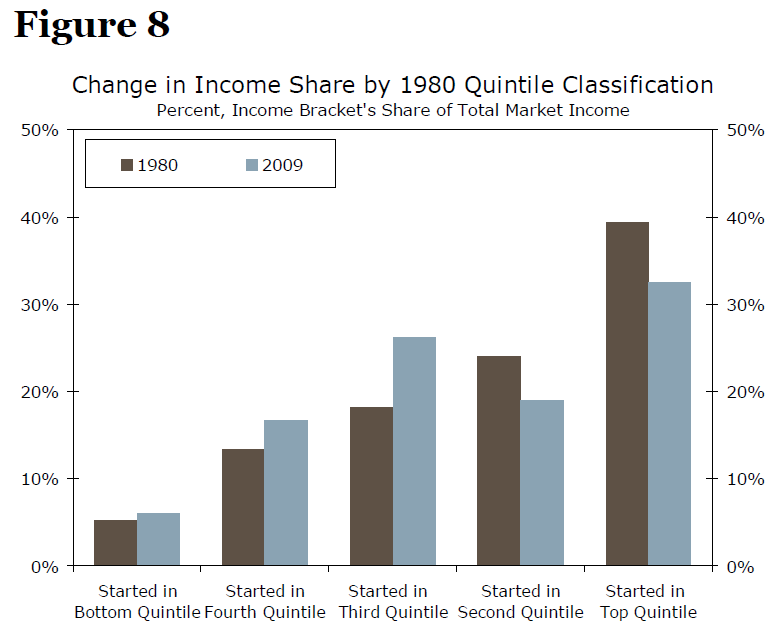

We then split our analysis into two periods: from 1968 to 1980 and from 1980 to 2009. From hereafter, we will denote the 1968 to 1980 period as “period one” and the 1980 to 2009 period as “period two.” For each of these two periods, we then separated the considered families into five quintiles, based on the total income earned by each family in year one.3 Next, we observed how each quintile’s share of the total income earned by all families changed through time for each respective measurement period. The results of this two-period analysis are shown in the following four charts:

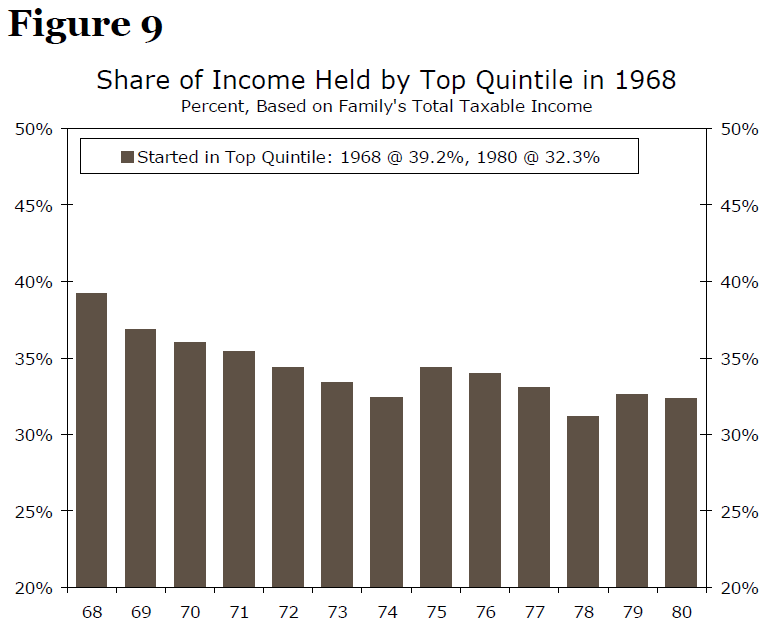

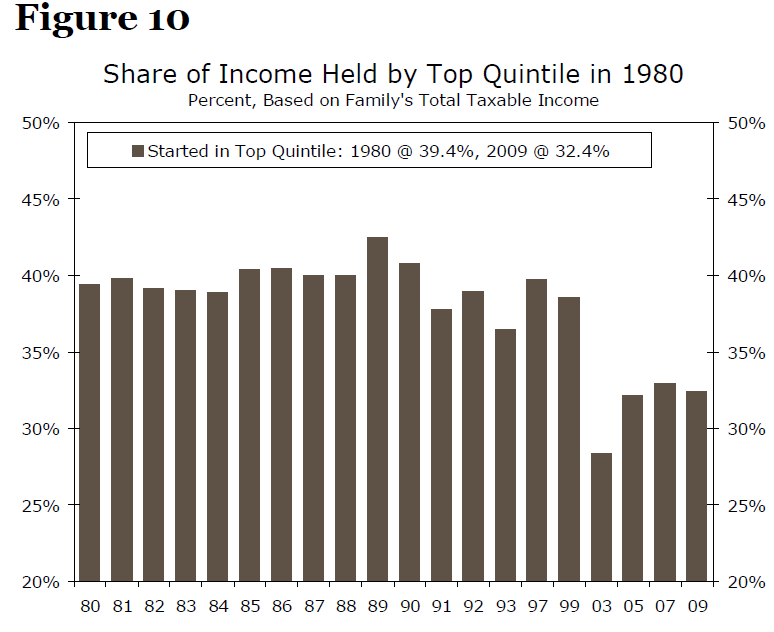

In both period one and period two, those families that started off in the top quintile lost a considerable share of the total income earned among all families. Specifically, the share of income earned by the top quintile in period one declined from 39.2 percent in 1968 to 32.3 percent in 1980. In period two, the share of income earned by the top quintile declined from 39.4 percent in 1980 to 32.4 percent in 2009. However, the share of income earned by the top quintile steadily declined throughout most of period one, compared to a share that stagnated through most of the 1980s and 1990s and did not start to decline until the early 2000s. It can therefore be inferred that economic mobility, at least at the high end of the income distribution, was much lower in the 1980s and 1990s relative to what was the case in period one (Figure 9 and Figure 10).

More recently, however, economic mobility at the upper end of the income distribution has picked up, with the share of total income earned by those families in the top quintile (by 1980 classification) declining from 38.6 percent in 1999 to 32.4 percent in 2009. In other words, these data suggest that the large gains witnessed at the upper end of the income distribution over the past decade may not have necessarily gone to the same individuals year in and year out. It might be an overstatement to suggest that economic mobility is alive and well, but it is not dead either.

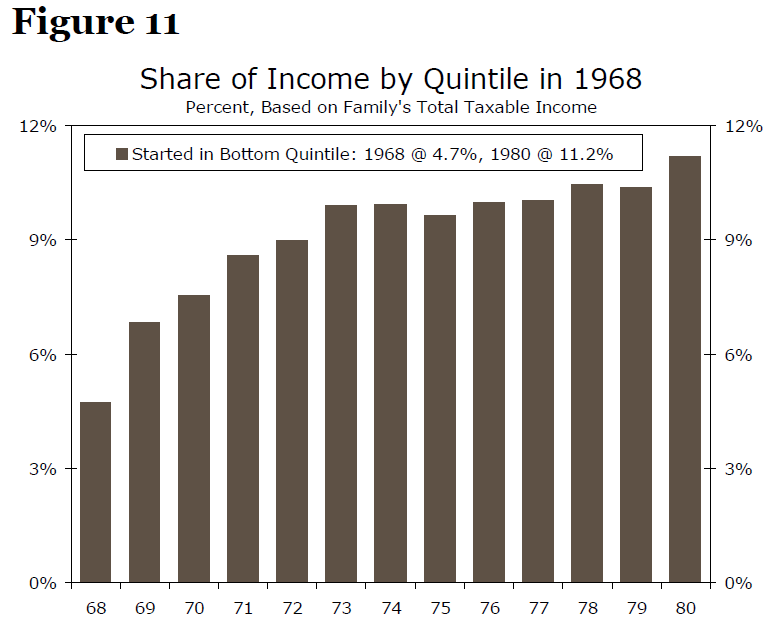

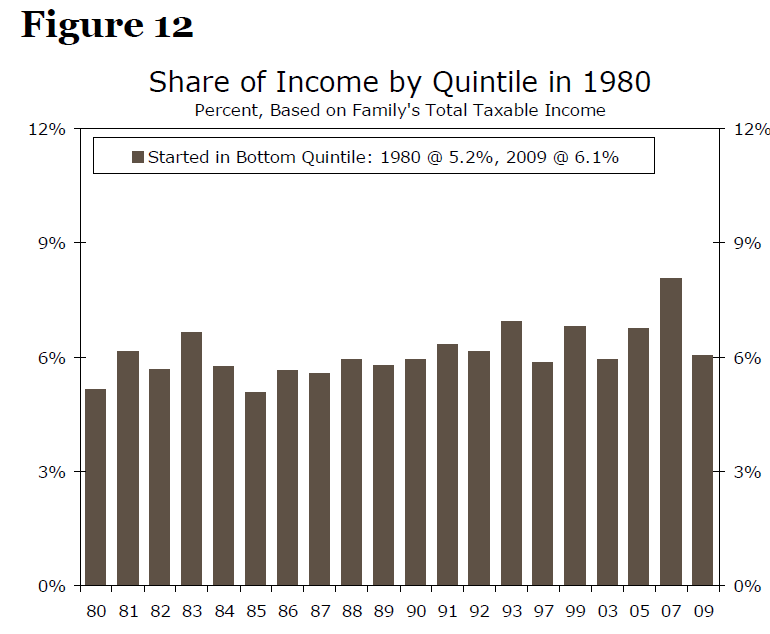

But if the share of total income earned by those families that started out in the top quintile is declining, which income groups are gaining share? Observations at the lower end of the income distribution tell the story. For those families in the bottom quintile, economic mobility was much higher in period one than what was the case in period two. The share of income earned by the bottom quintile in period one more than doubled from 4.7 percent in 1968 to 11.2 percent in 1980 (Figure 11). In period two, the share of income earned by the bottom quintile increased only modestly, from 5.2 percent in 1980 to 6.1 percent in 2009 (Figure 12). This suggests that the likelihood of a worker starting out in poverty and then moving into a higher income bracket or perhaps even becoming wealthy was much greater in the 1968 to 1980 period than in the 1980 to 2009 period. Or, put differently, a rags-to-riches story was more likely to happen in period one versus period two.

There are a number of different reasons for the change in relative economic mobility at the lower end of the income distribution. Among the most important factors driving this outcome, however, are the shifts in labor supply and demand brought on by globalization, which started to really gain steam in the 1980s. An increase in labor demand for highly skilled and college-educated workers (driven by technological and computing innovations) coupled with an increase in labor supply of lower-skilled workers (driven by the liberalization of labor markets in Asia) served to depress wages and opportunities for lower-skilled workers and to enhance wages and opportunities for highly skilled workers. The end result of these supply and demand shifts was a larger competition pool for lower-skilled workers in period two relative to period one, as U.S. workers in period two had to compete with a flood of low-wage laborers in emerging-market economies. This larger competition pool, in turn, placed downward pressure on economic mobility for those lower-skilled U.S. workers at the bottom end of the income distribution during period two.4

Economic mobility trends at the middle of the income distribution are also revealing. For those families in the fourth quintile, mobility remained roughly unchanged and somewhat strong throughout the entire 1968 to 2009 period. In period one, the share of income earned by the fourth quintile increased 2.2 percentage points to 15.2 percent. In period two, the share of income earned by the fourth quintile increased 3.3 percentage points to 16.7 percent. For families in the third quintile (the middle income bracket), mobility also remained roughly unchanged but weak during period one and through most of period two. Then, in 1999, mobility strengthened, as the share of income earned by the third quintile increased an impressive 7.9 percentage points to 26.1 percent in 2009. Much of the drop in income share observed at the upper end of the income distribution from 1999 to 2009 was therefore attributed to families in the middle of the income distribution gaining share.5 So while it is less likely for one to rise from rags to riches anymore, this trend suggests that there is still enough economic mobility in the United States for one to go from an urban apartment to a suburban mansion; that is, with enough hard work, education and good fortune.

Why Has Economic Mobility for Lower-Income Workers Declined?

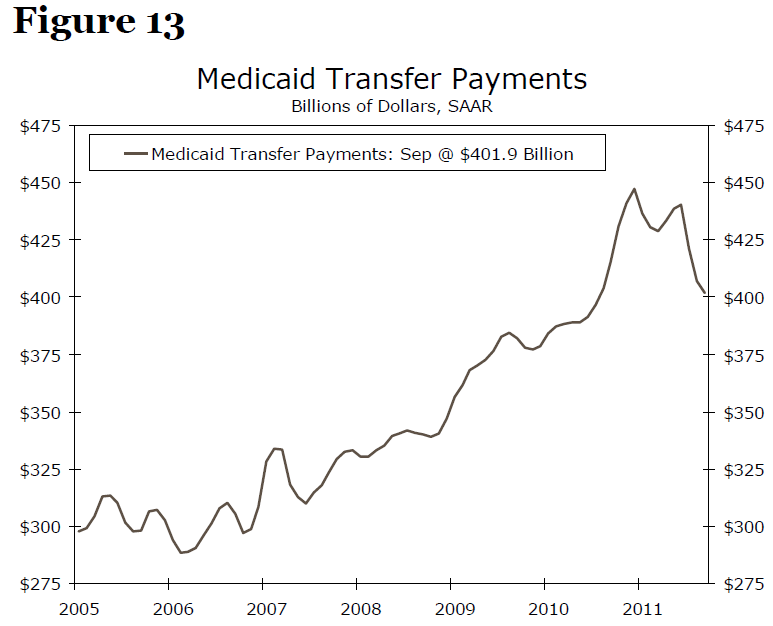

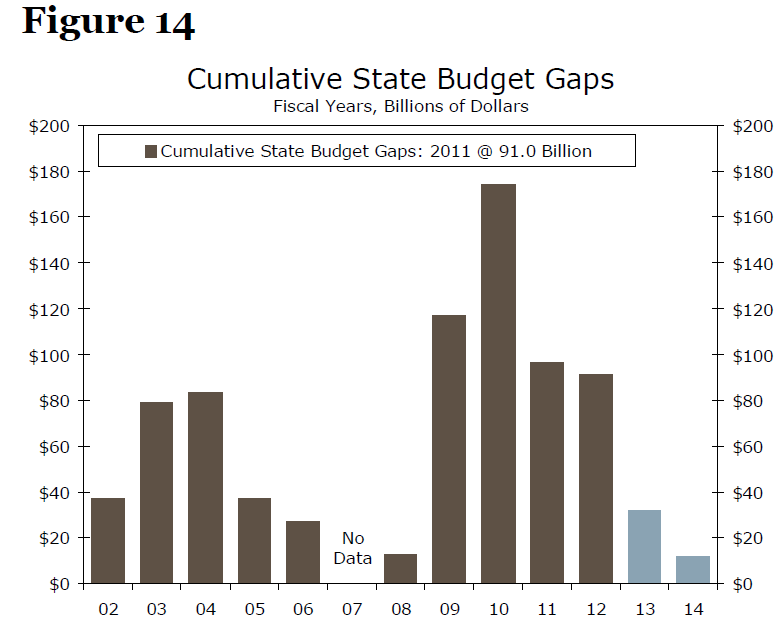

Declining economic mobility at the lower end of the income distribution is particularly alarming, especially considering the outlook for federal spending targeted toward the poor. Medicaid transfer payments have already started to decline in recent months (Figure 13), as states have been forced to shoulder a greater cost burden for health care due the drying up of federal stimulus funds. In addition, the pace of growth for food stamp rolls has begun to moderate in recent quarters. We expect these trends to continue, as governments at the state level work to bring spending more in line with revenues in the coming years (Figure 14) and as the federal government grapples with its own longer-term budget problems. So those at the lower end of the income distribution are currently stuck between a rock and a hard place: they do not have the economic mobility to improve their finances in the labor market and government assistance helping them get by is now drying up.

Either increasing transfer payments to lower-income workers or increasing economic mobility at the lower end of the income distribution could, in theory, be a socially optimal fix to that rock-and-a-hard-place situation. However, increasing economic mobility at the lower end of the income distribution would be the more economically optimal outcome, because increasing mobility fosters greater competition in the labor market and thus increases long-run productivity growth.

“I am for doing good to the poor, but I differ in opinion of the means.

I think the best way of doing good to the poor, is not making them easy in poverty,

but leading or driving them out of it.”

— Benjamin Franklin, November 1766

Two questions then arise: (1) why has economic mobility slowed for lower-income workers and (2) what policies could potentially increase economic mobility for these workers? As previously mentioned, educational differences between lower-income workers and higher-income workers are a primary cause for strong mobility at the middle and upper end of the income distribution and weak mobility at the lower end. Therefore, promoting greater education opportunities for workers born into lower-income families is a sensible solution to increase economic mobility for lower-income workers.6

According to the National Center for Education Statistics, only 43 percent of first-generation college students earn a bachelor’s degree compared with 68 percent of students whose parents earned a four-year degree.7 That statistic alone illustrates the challenges that workers born into lower-skilled families face. More federal grant money for education targeted at students in poor neighborhoods could certainly help increase economic mobility for first-generation college students, but many of the challenges these students face occur much earlier than during the college application process. Poor childhood nutrition and the lack of guidance from parents,tutors and guidance counselors remain key impediments restraining academic performance for students raised in low-income neighborhoods. Thus, many targeted early education and health initiatives for developing countries, including FRESH (Focus Resources on Effective School Health), which was launched jointly in 2000 by the World Health Organization, UNESCO, UNICEF and the World Bank, could also benefit many U.S. inner-city primary and secondary education systems, in which many lower-income students reside and study.8

Economic mobility challenges for those at the lower end of the income distribution also have roots in experiences that occur well before primary school. Rectifying early childhood development challenges, including undernourishment, dangerous and stressful household environments and the preclusion of many children from interactive preschool and quality child care, are therefore critically important for improving economic mobility for those raised in poverty. Most of these challenges occur very early on, when children are between the ages of zero to six. Numerous studies have shown that the returns to investing in human capital and social stability are the highest during these years, as children with healthy, safe and interactive early childhood development experiences tend to reap lifetime labor-market benefits, including higher educational attainment and greater earnings power.9

Finally, financial illiteracy also plays a role in restraining economic mobility at the lower end of the income spectrum. The tax burden on long-term capital gains and qualified dividends for taxpayers at the bottom of the income distribution is negligible. And yet, most lower-income taxpayers do not earn any income in the form of capital income. In fact, those taking advantage of lower tax rates on capital income are almost entirely wealthy taxpayers in the highest marginal income tax bracket, with extremely wealthy taxpayers—those earning more than $1 million per year—receiving nearly 60 percent of all capital gains and dividends in the United States.10

The current tax code is indeed progressive enough in law, but in practice, the tax code is less progressive, primarily because wealthy taxpayers take more advantage of tax breaks, even though such breaks are also available to lower-income taxpayers. So more education about tax advantages, and personal finance in general, could improve economic mobility for lower-income workers. It is, however, understandable that not everyone has the capacity to become a tax policy expert, or hire one, so more simplicity in the current tax code would also be beneficial for economic mobility.

Conclusion

In summary, while income inequality has increased dramatically in the United States over the past three decades, the trends in economic mobility are mixed. The relentless forces of globalization that began in the 1980s have put downward pressure on economic mobility for those U.S. workers at the bottom of the income distribution. U.S. workers at the middle of the income distribution, however, remain fairly mobile. The trends in economic mobility at the top of the income distribution suggest that the large gains witnessed at the upper end of the income distribution may not have necessarily gone to the same individuals year in and year out over the past decade.

Rather than redistribute income, the more economically optimal solution to address declining economic mobility for lower-income workers should comprise reforms to education, better essential nutrition for children born into poverty, more interactive preschool and child care experiences and improved financial literacy for all income groups.

————

1 (2011). Trends in the Distribution of Household Income Between 1979 and 2007. Congressional Budget Office. Publication No. 4031.

2 ABC News/Washington Post poll conducted by Langer Research Associates by telephone (Oct. 31-Nov. 3, 2011), among a random national sample of 1,004 adults, including landline and cell-phone-only respondents. Results have a margin of sampling error of 3.5 points for the full sample.

3 For period one, year one is 1968. For period two, year one is 1980.

4 While we do not have panel data to prove it, our hunch is that this downward pressure on economic mobility for lower-income U.S. workers probably coincided with upward pressure on economic mobility for lower-income Asian workers during the 1980 to 2009 period.

5 The likely explanation for this outcome is that many high-income investors lost a considerable amount of wealth and capital income after the dot-com bubble burst in 2000, which was then followed by a general rise in wealth and income related to housing and construction for middle-class income earners during last decade’s housing bubble.

6 See The Kids Are Alright (August 22, 2011), available at: https://www.wellsfargo.com/economics.

7 Chen, Xianglei and Carroll, Dennis C. (2005). First Generation Students in Postsecondary Education. National Center for Education Statistics. U.S. Department of Education.

8 (2000). Focus Resources on Effective School Health: a FRESH Start to Enhancing the Quality and Equity of Education. World Education Forum. The World Bank.

9 Sachs, Jeffrey. (2011). The Price of Civilization: Reawakening American Virtue and Prosperity. New York: Random Housing Publishing Group. (pp. 196 – 99).

10 Hungerford, Thomas. (2011). An Analysis of the “Buffett Rule.” Congressional Research Service. U.S. Congress.

———–

Source:

Economics Group, Wells Fargo

Special Commentary

November 15, 2011

What's been said:

Discussions found on the web: