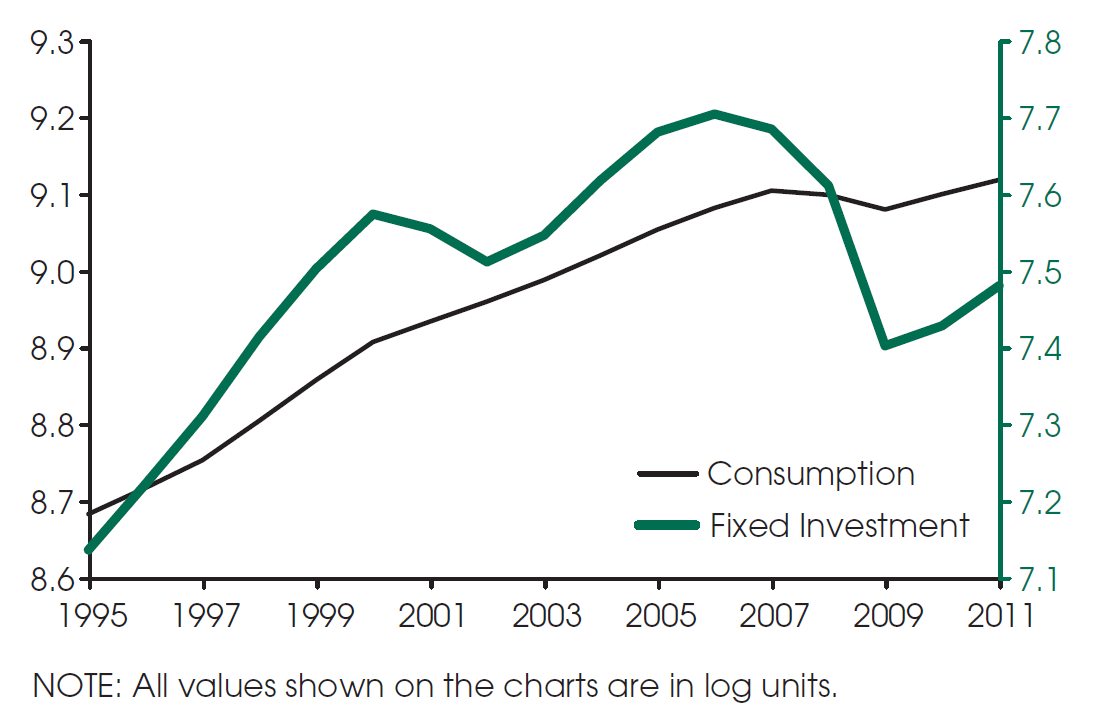

Private sector investment is the main culprit in the weak U.S. recovery following the Great Recession of 2007-09. The left chart below displays the trends in private investment and consumption since 1995 after adjusting for the effects of inflation. Consumption expenditures have actually surpassed their previous peak levels

of 2007 and are therefore higher than ever. Government expenditure and net exports (not shown) display similar trends. Investment is the only component of gross domestic product (GDP) that has not yet recovered. Currently, it stands 20 percent below its peak level of 2006. This means investment is contributing negatively to GDP growth by 3.2 percentage points (the investment component represents about 16 percent of total GDP).

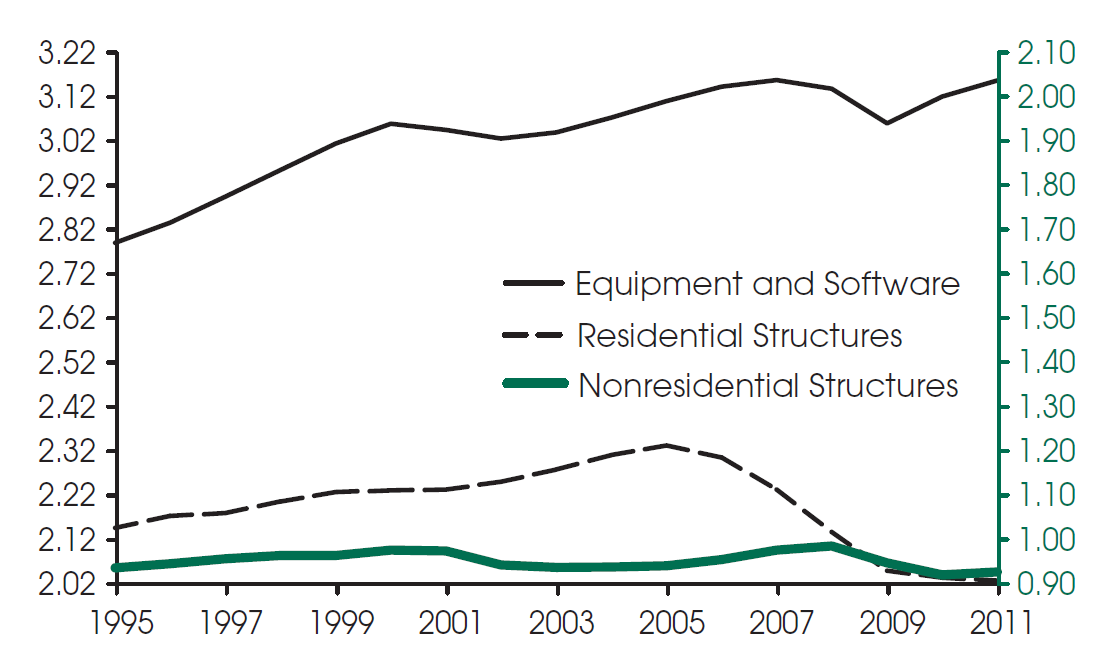

The right chart focuses on the individual components of private investment. According to the data, the low levels of investment are accounted for by a continuous decline in investment in structures (residential and nonresidential). The only other component of investment—equipment and software—is already above its previous peak level.

What economic factors explain the depressed behavior of residential structure investment? Many commentators have suggested that real estate prices during 2000-06 were driven by unreasonably low risk premia or too-optimistic expectations. Asset prices during this period, including the market valuations of existing and newly constructed houses, plus many nonresidential structures, might have been too high. Namely, there was a bubble in real estate prices. Events such as the failure of Lehman Brothers, caused by a bet on further increases in the already “high” prices of commercial real estate that did not materialize, led to revised expectations. House prices started to fall and some existing homeowners were forced (perhaps because of illness or job loss) to sell or move into foreclosure. A self-fulfilling burst in home values materialized.

As the real estate bubble burst, the U.S. economy found itself with a stock of residential and nonresidential structures higher than desired. Under these conditions, economic theory predicts investment in structures should collapse (just as observed in the data) and stay low until the desired level is attained (either by natural depreciation or by actively restructuring the housing stock to more desirable uses). Moreover, this adjustment process is expected to be slow, given the relatively low rate of depreciation of residential and nonresidential structures.

The current slow economic recovery may therefore be, at least in part, the natural result of the burst of the real estate bubble. Further research is required to determine what role monetary policy can play under these circumstances.

Source:

Real Estate Bubbles and Weak Recoveries by Adrian Peralta-Alva

Monetary Trends, December 2011

What's been said:

Discussions found on the web: