Click to enlarge:

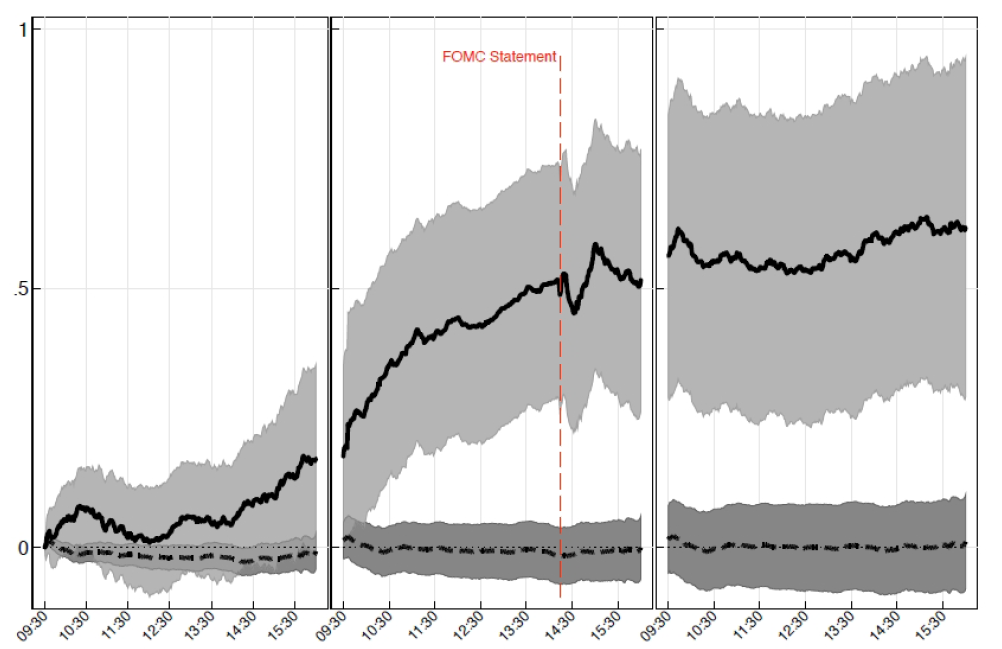

Average Cumulative One-Minute Return on the S&P 500 Index The figure shows that stock prices rise significantly in the 24 hours preceding FOMC announcements but are fairly flat after FOMC statements are released. Stock returns are also flat in periods without an FOMC announcement.

~~~

Why are equity returns so strong on FOMC announcement days? The answer is not clear: factors such as risk, volatility, and liquidity cannot explain the market’s reaction. Similar patterns do not emerge around other scheduled macroeconomic announcements or across other asset classes such as fixed income and currencies. Regardless of the source, however, these findings suggest that equity investors should be circling FOMC announcement dates in their calendars.

A recent paper entitled “The Pre-FOMC Announcement Drift,” David Lucca and Emanuel Moench of the Federal Reserve Bank of New York find that U.S. stock prices rise significantly in the 24 hours prior to FOMC announcements but do not rise or fall significantly after FOMC decisions are released to the public. In fact, the authors find that 80% of the equity premium of the S&P 500 index over treasuries from 1994 to 2011 was earned solely on FOMC announcement days, meaning that all other trading days combined accounted for only 20% of the equity premium during this period. The authors also found similar patterns in numerous international equity markets such as France, Germany, Spain, and the United Kingdom.

Source:

Stocks Drift Higher Ahead of Federal Reserve Policy Announcements

Guggenheim, by Andrew Metrick, PhD

What's been said:

Discussions found on the web: