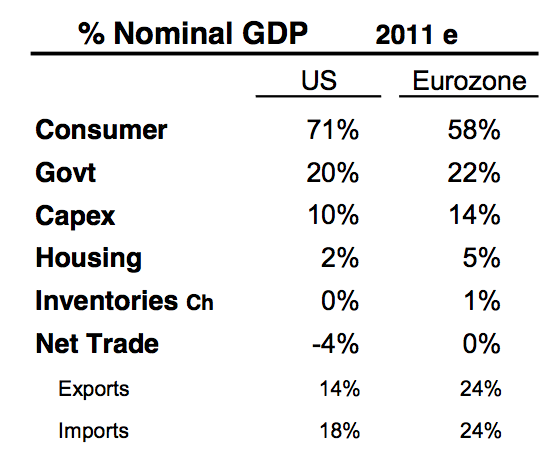

ISI notes the differences between the US and EuroZone in terms of GDP components:

• Housing in the US at just 2% GDP has already collapsed; housing in the Eurozone at 5% has substantial downside risk.

• Capex in the Eurozone at 14% has downside risk.

• Eurozone consumer already is a significantly smaller share of GDP than US.

• Exports & imports = 24% in Eurozone is much more exposed to global slowdown and currency changes.

>