November 27, 2011:

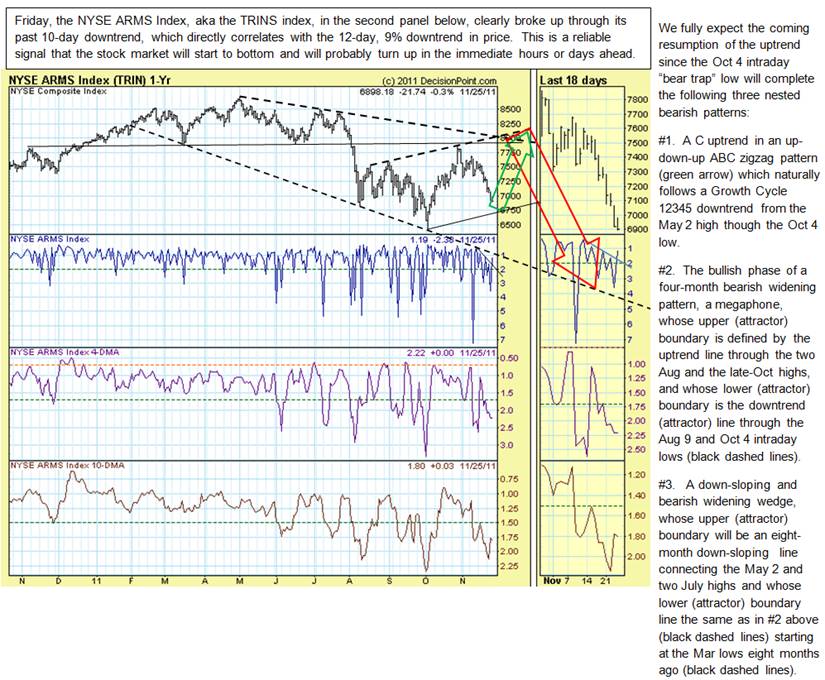

The short term (weeks) bullish setup of several technical patterns, which are annotated in the first chart below is consistent with:

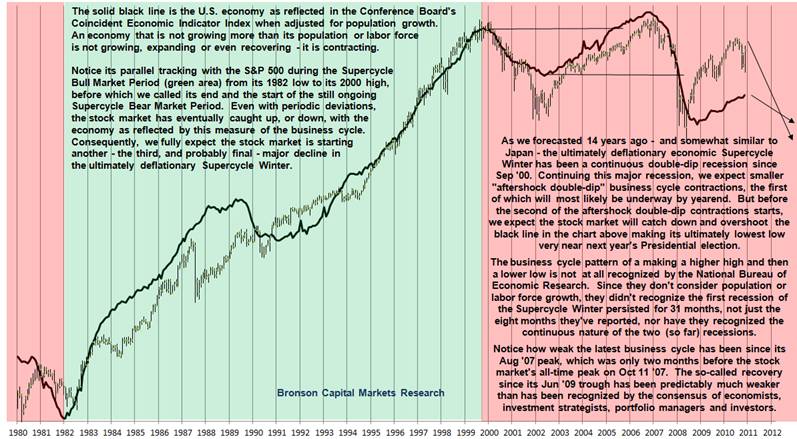

(a) the labor market leading the reacceleration in the U.S. economic recovery (see the charts and table of unemployment claims further below) as measured by the U.S. core business cycle, using quarterly GDP data, and by the monthly business cycle coincident indicator data from the Conference Board (CB), both adjusted for population growth, as demonstrated in charts further below; and

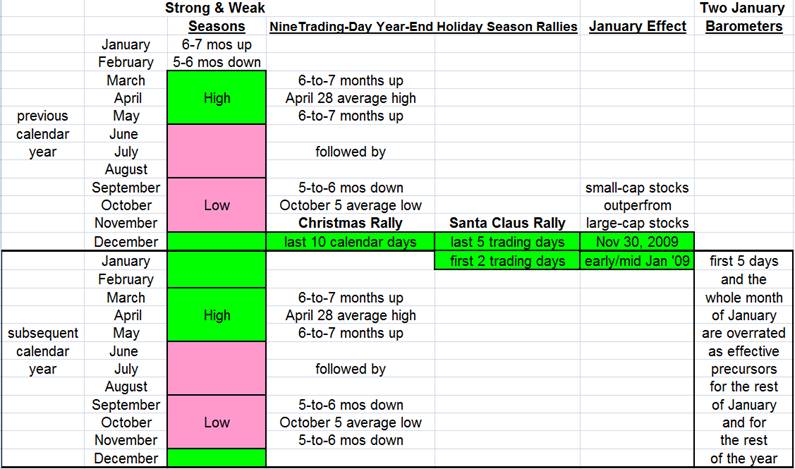

(b) the ongoing Strong Season of the annual stock market cycle from its bear-trap Oct 4 low, including the upcoming bullish yearend holiday season with its Christmas, Santa Claus, and the combination of month-end, quarter-end and yearend rallies, summarized in the schematic even further below.

Combined, we fully expect these chart patterns, fundamentals and seasonal conditions to lead to a significant short term stock market bounce, completely reversing its current oversold condition just as the Q4 pre-earnings reporting season gets underway in January.

Even more important to this occurring will be negatively correlated moves from both the bond market, which started topping out Friday, and the U.S. dollar doing the same this coming week, in spite of the constant barrage of (supposedly) negative news on the Eurozone debt crisis.

As a result of over-touted Economic Cycle Research Institute (ECRI) and many others being too early in their U.S. recession calls over several months, we expect that by yearend, all-important permabull institutional investors will join in a herding consensus that the U.S. economy is both decoupling from Europe, which is back into recession again, this time driven by austerity fiscal policies, and from the incipient slowdown in the investment-bubble driven Chinese economy.

All of this will support the NDX long position in our double-profit potential, countertrend hedge recommendation, which has virtually eliminated all portfolio volatility for the past almost four months. Profits were taken months ago in our long-standing long positions in gold and bonds and short positions in the U.S. dollar. Of course, we expect to re-establish these positions in our recommended model portfolio later next year.

We believe the coming popular assessment of a decoupled, reaccelerating U.S. economic recovery will then have been only correct on an intermediate term (months) basis, since longer term we still expect an after-shock, double-double dip global recession, following the financial crisis and Great Recession in the U.S.

We still fully expect the global economy will later enter into a vicious cycle, or downward spiral, with negative feedback loops, as the major international trading blocs have rolling recessions that will progressively interlock. This will result in our long-standing call for a China/commodity bust and a follow-on major currency crisis continuing the forex de facto devaluation of the U.S. dollar since 1985 as the trading blocs clash trying to solve their sovereign deficit/growth problems in a major win-lose foreign trade battle that will last for several years. The U.S. will likely ultimately win with a formal devaluation of the dollar.

If you are a Wall Street Journal subscriber, here’s a dozen-years late realization of the investor mass mood that we expect will become widely prevalent at the end of the equity Supercycle Bear Market late next year and persist for several years thereafter: Very slow growth 2012 then long bear to 2020

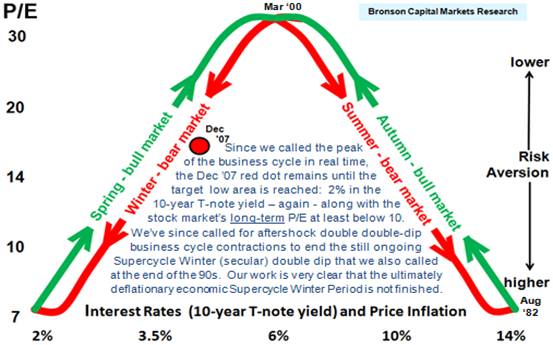

But please don’t confuse this with thinking we are perpetual doom and gloomers. We fully expect all of this, as we forecasted more than a dozen years ago with our SMECT model A Forecasting Model That Integrates

Multiple Business and Stock-Market Cycles to end the still-ongoing, ultimately debt and asset deflationary U.S. Supercycle Cycle Winter (see our summary quant table at the bottom here), and that it will be naturally followed by a reflationary economic Supercycle Spring, which will probably bring the Dow 30 ultimately to between 50,000 and 100,000 by 2030.

More specifically, our long-standing working model is that we expect the U.S. stock market will probably triple every eight years, if not double every five years, during the next equity Supercycle Bull Market. And following the incipient equity Supercycle Bear that started 6.7-months ago on May 2, that Supercycle Bull Market will naturally follow a very volatile technical basing period during the two years between the coming Presidential election and the following midterm Congressional election in 2014.

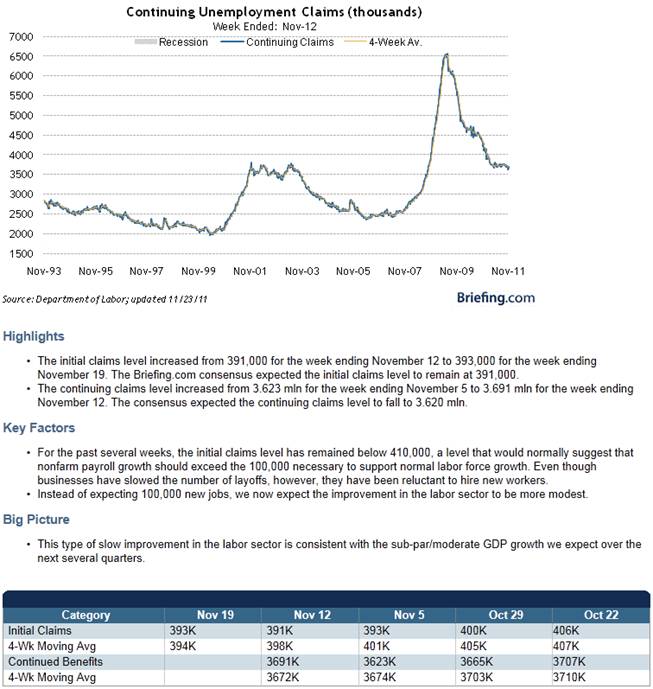

Note in the first two charts below that initial unemployment claims, one of ten components of the CB’s (LEI), have declined to their lows seven months ago (especially on a four-week smoothed basis), which is bullish for the U.S. stock market. The stock market is another one of the LEI components, so the two time series are coincident to each other with a high inverse correlation, especially over several months. And continuing claims, in the third chart, have even broken to new lows, which is equivalent to new highs in the stock market.

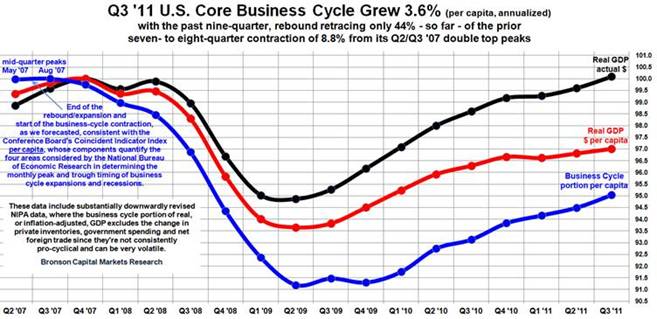

Because of a huge decline in private inventories, the headline figure of 2.0% GDP hid a much stronger 3.6% growth in the more important U.S. Core Business Cycle per capita (explained in the chart’s legend), which is not generally understood, and thus is not reported, by the financial media or discussed by talking heads on CNBC.

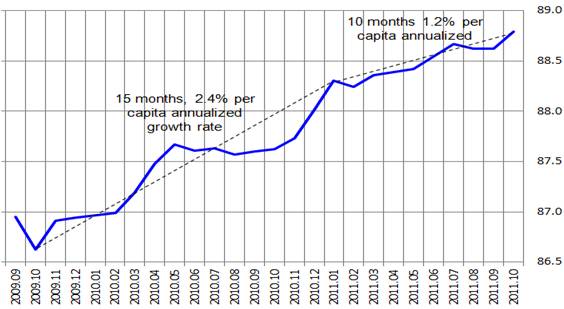

Q4 will undoubtedly show a larger headline GDP (Goldman Sachs expects 3.5%), but smaller growth in the all-important core business cycle per capita as inventories are rebuilt. Of course, we place much more weight on the more timely and more directly relevant CB monthly CEI adjusted for population growth. See the four charts below, updated through Oct, demonstrating these points in the context of the history of U.S. economic recoveries from the last four to five recessions.

Despite ECRI’s premature call on Sept 30 that the U.S. economy was already in recession (probably trying to make up for their previous two recession calls that were each five months late with gross underestimates of their severity – much deeper and much longer), and the fact that Europe has already started its predictable austerity-led recession and that China’s investment-bubble led economy is definitely slowing, others, in addition to Goldman Sachs, expect higher U.S. Q4 GDP.

1. Over many years we’ve documented our discussions with others who have used the terms K-Cycle, Kwave, Kondratieff (Kondratiev) Wave or longwave with Season(s), and the like. Our decades-long publishing record clearly establishes that we were the first to use these terms with Season(s), as well as the first to quantify them economically and otherwise fundamentally (Kondratieff and Schumpeter did not) and even technically. Most importantly, we were also the first to forecast their applicability to the secular period dating variously from the late 1990’s through March 2000, depending on the metric under consideration – see As Forecasted – A 12-Year Retrospective ; We more than welcome further inquires.

2. The Supercycle Summer and, especially, the Supercycle Winter have only a fraction of the economic growth of the Supercycle Spring and Autumn due to the increased severity (magnitude times duration) of recessions, or more accurately, business-cycle contractions during Summer and Winter.

3. The terms “more“ and “less” refers to the combination of cyclical frequency and severity (duration times magnitude) – see SMECT: A Forecasting Model That Integrates Multiple Business and Stock Market Cycles Since 1896

4. The terms ““bull” and “bear” refer to the over- and under-performance in Supercycle (secular) trends of excess total return compared to the risk-free return and other asset classes.

5. P/E includes quantification of investor mood (animal spirits) – see our earnings-capitalization stock-market valuation model: Quantifying and Forecasting an Equity Risk Factor

6. See our severity (magnitude and duration) quantification of the 33 most severe bear markets since 1895: Exhibit E in #3 above.

7. Here’s a link to our report Sell Commodity Indices Sell Commodity Indices, which demonstrates that commodity price indexes, like the CRB, are much more inversely correlated to the trend rather than the absolute level in real (inflation-adjusted) short term interest rates. Precious metals, especially gold, are more responsive to trends in the U.S. dollar, and the most economically important commodity, oil, which is still primarily priced in the U.S. dollar, is also very reactive to global political events.

What's been said:

Discussions found on the web: