˜˜˜

Source: Arbor Research

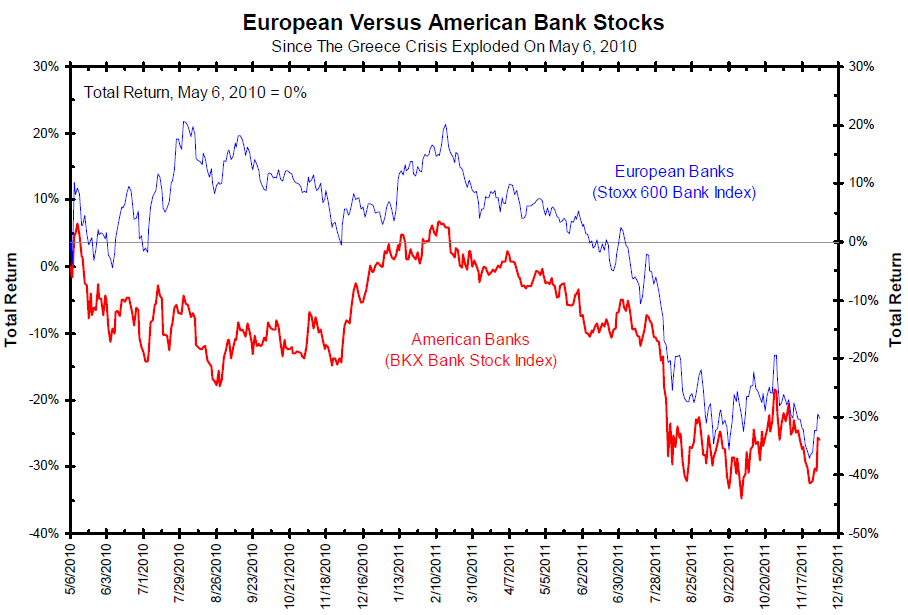

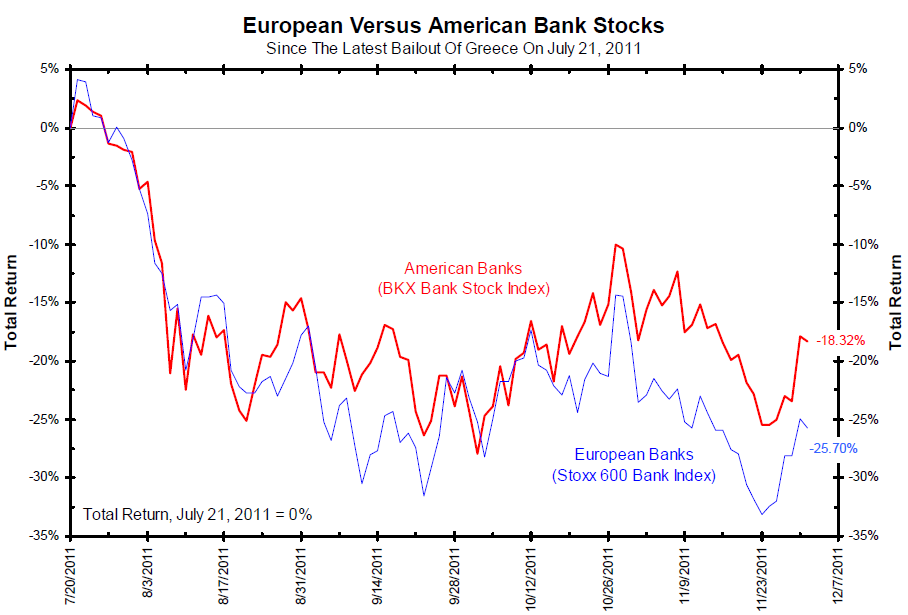

The Economist – Contagion? What contagion? American banks have been strangely immune to Europe’s crisis

THE financial crisis of 2008 mowed down banks in America and Europe with equal abandon. Not so this year’s upheaval. European banks, struggling to fund themselves, are tightening credit. American banks are eager to lend, albeit not to Europe. Their loan growth this quarter will the fastest since mid-2008, reckons Nomura, a bank. This is partly because America’s banks are reasonably healthy. They have significantly bolstered capital since 2008 and now boast core capital of 9% of assets, well above regulatory requirements. While many European banks held dangerous quantities of American mortgages in 2008, American banks today have relatively little exposure to Europe’s troubled sovereigns. For the five biggest, total exposure to Greece, Ireland, Italy, Portugal and Spain (net of hedges) ranges from $16 billion at Citigroup, or 14% of core capital, to $2.5 billion at Goldman Sachs, or less than 5%, according to Peter Nerby of Moody’s, a credit-rating agency. (But if France gets into trouble, that would be a far bigger problem.)

What's been said:

Discussions found on the web: