There is a detailed article in today’s WSJ about ways to pay for financial advice. This has been an ongoing discussion topic amongst me and a small group of colleagues for years now.

I do have a few thoughts about your choice of fee structures; they range as follows:

• 2% & 20%

• Commission

• Percentage

• Flat rate

• Do it yourself

These each have advantages and disadvantages, along with some specific peculiarities. Decisions investors make should be a function of their understanding of what is involved in agreeing to pay for finance advice.

A quick review of each shows their strengths and weaknesses.

2% & 20% is primarily used by hedge funds. You pay a hefty premium plus one fifth of your profits for the privilege (many funds have an extended lock up period as well). Unfortunately, performance at funds has been lacking.

Bottom line: Top managers earn their fees, but the rest, not so much. If your manager(s) are making you outsized profits and avoiding the crackups, stay with them. Otherwise, rethink the fees you pay for under-performance

Commission driven is my least favorite of all the structures. Fees tend towards 4 or 5%, as brokers must constantly spin assets to generate revenue.

Bottomline: I simply do not understand how this business continues to exist . . .

Percentage basis is my preference how to conduct fin planning (and how I do my asset management work); Adviser is on the same side of the table as the client — no commissions, no compromised payments, no legal kickbacks from 3rd parties. If I am doing my job, I am helping clients plan for the future, avoid major drawdowns where possible, and capture upside.

Bottomline: Work with someone you are comfortable with to develop a plan for you; you should be able to tap someone for advice on a wide range of finance related issues. Your job is to manage someone else who does the day to day work.

Flat rate is a business model that I believe warrants further exploration. It has typically been used for accounts sized under $500k; Numerous firms offer this; they all seem bedeviled by under-performance and de minimus customer service. I believe this is an area that has potential for huge growth if someone can figure out a way to radically improve the performance problem.

Bottomline: One day . . .

Do it yourself is something I have long advocated for, but with some caveats: Dollar cost averaging into a handful of broad indices on a monthly basis is how you start; overlay a risk management approach (like the 10 month moving average) and you are onto something very doable. The downside is your own cognitive biases, the tendency to be overwhelmed by the daily noise, and a lack of discipline in following through on your own plan.

Bottomline: Very doable if you know who you are and have the ability to follow through.

There are numerous ways to get good financial planning advice at a variety of fee levels. Figure out what works best for your personal circumstances before committing to any one fee structure.

>

Source:

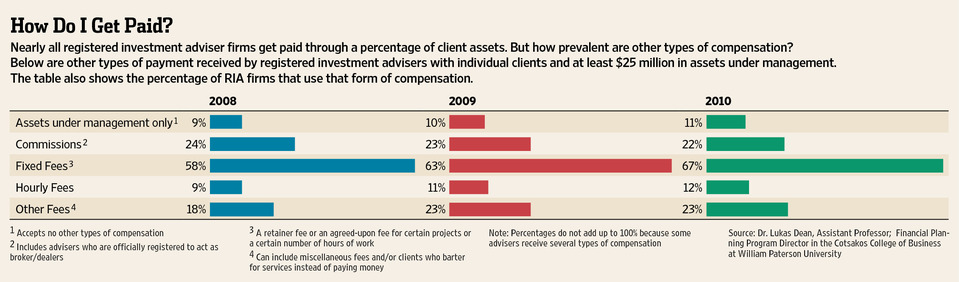

How to Pay Your Financial Adviser

DAISY MAXEY

WSJ Special Report DECEMBER 12, 2011

http://online.wsj.com/article/SB10001424052970204554204577024152103830414.html

What's been said:

Discussions found on the web: