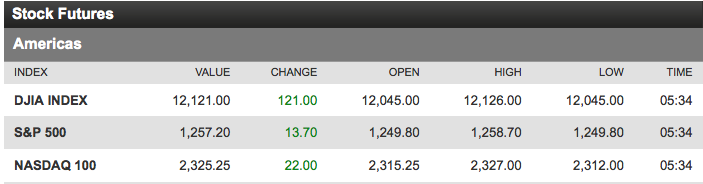

click for updated equity futures

>

Good Monday morning.

We wake up to Futures appreciably higher, following last week’s 800 point blast off in the Dow, and higher bourses in Asia and Europe.

As we head into the last 4 weeks of the year, markets are flat since January 1st. Hedge funds are having a terrible time of it (See Breakeven is the new black).

Volatility for Q3 and Q4 has more than doubled versus Q1 and Q2.

The crosscurrents continue — it is a difficult environment to maintain any short positions in, as “the Interventionists” can goose the animal spirit, however temporarily the results are, at a moment’s notice. Traders are frustrated, investors are unhappy, the politics of the moment redefine the term rancor.

What was surely horrific news last week — a bank the approximate size of a Soc Gen — was on the ropes and about to take the long dirt nap. As the interventionists, well, intervened, that somehow became the basis of a massive rally. To prevent another collapse (the de rigeur phrase is “Lehman-like Event“) 6 central banks (plus China) agreed to a Coordinated Central Bank Intervention to provide liquidity and Dollar swaps facilities.

Its all part of the ongoing program Cash for Clunkers program begun under Bush and Paulson, continued by Obama and Geithner. The clunkers in this instance being zombie banks. We would all be better off in the long run if these mismanaged credit facilities were allowed to suffer the same ignominious fate of all poorly run enterprises in the Darwinian competition we call the economy: Reorganization and/or failure. Alas, that is a story for another time.

Today, we have a backdrop of improving retail sales (3-4%), modestly improving employment picture, and an uptick in consumer sentiment. Institutional investors so not have enough equity, are are desperate to move the needle higher before December 31st, a typically strong month for stocks. Offsetting that are earnings at a cyclical peak, negative income numbers, weak volume on rallies, a dysfunctional government, and an ongoing global deleveraging.

We must also make the near impossible probability calculation of when the next major banking disaster hits; it seems that we are a mere fat thumb or errant algo away from utter financial breakdown.

Hence, some caution is warranted. Last week, my client accounts were at 60-65% equity exposure. But on December 1, the tactical component of our portfolios flipped from 100% equity to 100% bonds. It might be bit early to become to defensive, as the year end rally shows no signs of letting up just yet. However, in secular bear markets, capital preservation and risk management should be every investors first priority.

Hence, Investors are advised to watch the quality of this rally — the volume, the market internals, the reaction to news events — and position themselves accordingly.

What's been said:

Discussions found on the web: