I am please to report that calling out the Big Lie has now gone fully mainstream.

Recall last month, I had two Big Lie columns in the Washington Post:

• What caused the financial crisis? The Big Lie goes viral.

• Examining the big lie: How the facts of the economic crisis stack up

The first column was the most popular article on WashingtonPost.com for a full week. It generated nearly 1845 comments.

Since then, both Bloomberg.com and Reuters each have picked up the Big Lie theme. (Columbia Journalism Review as well). In today’s NYT, Joe Nocera does too, once again calling out those who are pushing the false narrative for political or ideological reasons in a column simply called “The Big Lie“.

Nocera details exactly how its done:

“So this is how the Big Lie works.

You begin with a hypothesis that has a certain surface plausibility. You find an ally whose background suggests that he’s an “expert”; out of thin air, he devises “data.” You write articles in sympathetic publications, repeating the data endlessly; in time, some of these publications make your cause their own. Like-minded congressmen pick up your mantra and invite you to testify at hearings.

You’re chosen for an investigative panel related to your topic. When other panel members, after inspecting your evidence, reject your thesis, you claim that they did so for ideological reasons. This, too, is repeated by your allies. Soon, the echo chamber you created drowns out dissenting views; even presidential candidates begin repeating the Big Lie.

Thus has Peter Wallison, a resident scholar at the American Enterprise Institute, and a former member of the Financial Crisis Inquiry Commission, almost single-handedly created the myth that Fannie Mae and Freddie Mac caused the financial crisis. His partner in crime is another A.E.I. scholar, Edward Pinto, who a very long time ago was Fannie’s chief credit officer.”

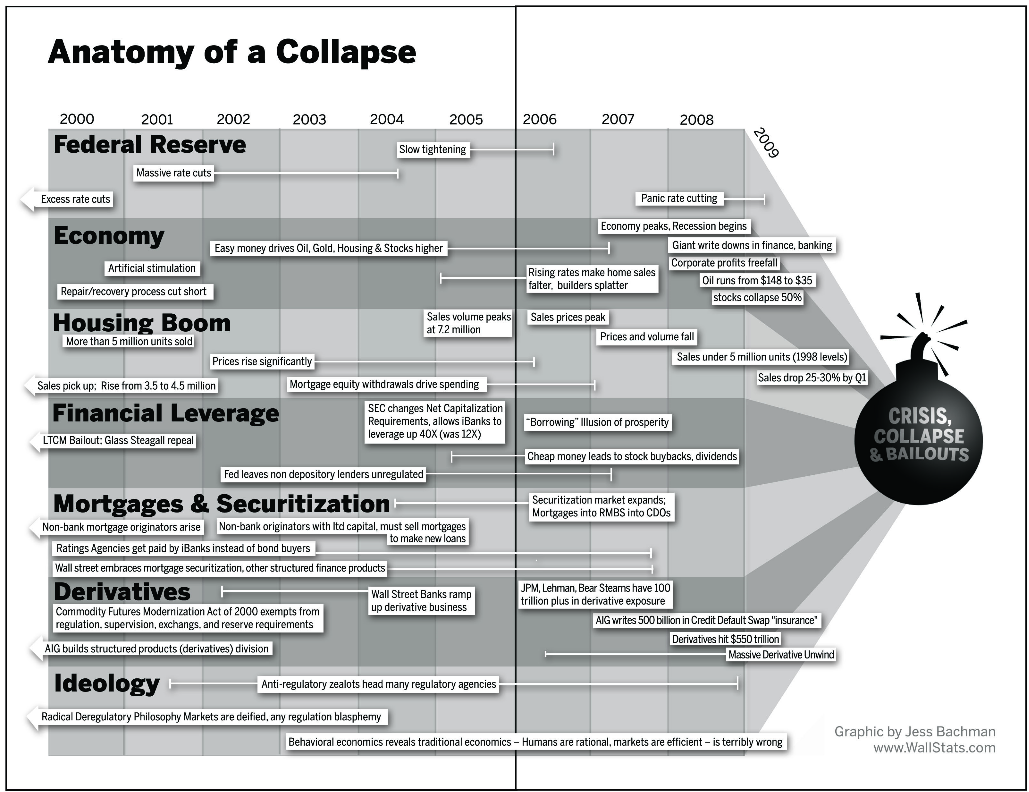

Longstanding readers of TBP may recall the genesis of my interest in this: When I was writing Bailout Nation, I did lots and lots of research into exactly what it was that led to the housing boom and bust, the stock market crash, and the Great Recession.

The answer was “its complicated.” There were many many factors, lots of bad ideas, plenty of poor judgement all around.

I summarized these into 7 broad categories. The incomparable Jess Bachman (of Wall Stats) created this fantastic graphic that is the centerfold of the book:

>

>

The perpetrators of the big lie all have something to hide. Whether they voted for more deregulation or passed the ridiculous the CFMA or supported the repeal of Glass Steagall or cheered Alan Greenspan’s monetary policy, the Big Lie supporters all bear some resposibility.

In the case of Peter Wallison, he was the Co-director of AEI’s financial market deregulation project. That was scrubbed from his AEI bio.

Ed Pinto has taken a different approach to trying to deflect the blame from the blameworthy. He has continually thrown shit against the barn wall to see what will stick. Originally, it was the fault of the CRA. When that argument failed, he blamed Acorn. And now its the GSEs. Wallison and Pinto have had their greatest success with this — its now a talking point amongst many of the GOP contenders for the Republican niomination for President.

~~~

With this post, we move Peter Wallison an Edward Edward Pinto into the UnGuru category, where they can join the likes of Ben Stein, Elaine Garzerelli and Meredith Whitney as “Ungurus.” All posts that prominently mention these people include the category Unguru.

>

Source:

The Big Lie

Joe Nocera

NYT, December 23, 2011

http://www.nytimes.com/2011/12/24/opinion/nocera-the-big-lie.html

What's been said:

Discussions found on the web: