Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve.

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve.

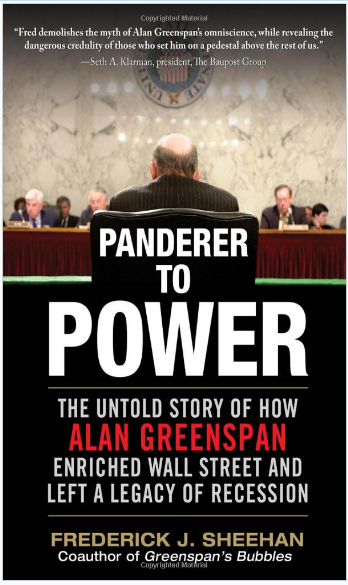

His new book, Panderer for Power: The True Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession, was published by McGraw-Hill in November 2009. He was Director of Asset Allocation Services at John Hancock Financial Services in Boston. In this capacity, he set investment policy and asset allocation for institutional pension plans.

˜˜˜

The Rotten Heart of Europe

To Americans, European problems may seem as remote as they did in 1939. There is a good chance, though, that the crumbling financial structure will not be “contained” or “ring-fenced”: the latter being the common description of how Europe had isolated itself from Italy’s difficulties. That lasted a week or so. We may soon discover the extent of American exposure to European financial insolvency.

The catalyst for this coming weekend’s European Union meeting is the failure of Europe’s daisy-chain finance. On Monday, December 5, 2011, Bill King (The King Report) wrote of the latest: “European solons are proposing another Daisy Chain Bailout scheme – bankrupt and near-bankrupt European nations will inject money that they must borrow from the IMF so they can in turn borrow the money that they borrowed and then lend to themselves.” Wendy’s toes are curled around the end of Captain Hook’s gangplank.

The creditworthiness of the fractured institutions is not trusted: the commercial banks, the national central banks, the ECB, the EFSF, and most importantly, the Bundesbank. On November 23, 2011, the Bundesbank attempted to auction €6 billion of 10-year German government bonds. It received bids for €3.8, or 61% of the total. Neil Jones at Mizuho Corporate Bank Ltd. in London told Bloomberg: “If investors do not wish to buy bunds, they do not wish to buy Europe.” Right-ho.

The purpose of this dispatch is to dispel rumors that current front-page treaty talks have any economic meaning. The European and U.S. stock markets react with a 3% or 4% gain after vague announcements, but we are getting closer to a day when the false prophets are stripped bare.

The euro cannot survive in its current form. To understand this, we will return to its introduction. Some dates: The 1992 Maastricht Treaty formally established the intent of a single currency. The euro acquired electronic legitimacy on January 1, 1999. For instance, it was henceforth used in electronic bank transfers. The national currencies were locked at a specific rate to the euro on that date. On January 1, 2002, euro coins and bills became legal tender.

The euro was introduced after the finances of 10 (or 11, we’ll skip over this) countries had “converged,” meeting such criteria as national budget deficits less than 3% of GDP and a debt ratio less than 60% of GDP. It is now the currency of 17 European countries. Most, if not all, played games to meet these requirements. This was not a secret.

The preferred method of cheating has been to fabricate or ignore. On June 5, 2000, when Greece was admitted into the not very exclusive euro club, Austrian Finance Minister Karl-Heinz Grasser told reporters: “Greece will become a member for sure. It meets all the requirements for membership.” A leading requirement was to not tell reporters the truth. French Finance Minster Laurent Fabius offered a more discreet assessment, as would be expected from a graduate of the École Nationale d’Administration (the training ground for advanced French bureaucrats): “Greece has made a huge improvement.”

The euro, and more generally, the European Union, has been a bureaucratic racket from the beginning. Brussels protects its own interests first. It does not weigh the success of its ventures by how the masses subject to its mandates fare. The euro had its flaws, but the paper pushers never answer for mistakes. Like the Federal Reserve or the Gang of Four, they are unaccountable. (The latter offers some hope.) Human tissue is Play-Doh in their hands to be molded into what Superior Persons call their “European Project.”

When trouble loomed, the Eurocrats looked the other way: “Except for being told by the EU and ECB to get its financial house in order, Greece was not punished for cheating. In 2005, Germany and France helped loosen the rules when they forced through the relaxation of the anti-debt “stability pact,” despite knowing that Greece had been above the 3% threshold for the previous three years.” (Gold Alert, May 27, 2011)

The great flaw was already evident: countries could spend and tax as they wished (or didn’t wish) while issuing bonds as if they were as creditworthy as the Bundesbank. It is only natural that Italy shoveled out bonds, borrowing and spending, until its debt grew to be the third largest sovereign bond market in the world, without a chance now of repayment at par.

Former European Central Bank Chief Economist Otmar Issing was quoted by Bloomberg on May 26, 2011: “Greece cheated to get in, and it’s difficult to know how we should deal with cheaters.” In fact, this is a matter of character, not law: “The grand plan outlined by France and Germany on Monday for European Treaty change breaks no new ground in terms of ideas – all the proposals already exist in various legal acts, the only problem is they have never been observed in practice.” (Reuters – December 5, 2011)

The Eurocrats are meeting this weekend to discuss a treaty that will – do nothing, even in today’s frantic quest to sign a scrap of paper that will satisfy potential bond buyers. A carrot was dangled, but quickly withdrawn. From Ambrose Evan-Pritchard in the Daily Telegraph: “[German Chancellor Angela] Merkel seems to have backed off on demands that budget breaches will be justifiable before the European court, so the Treaty chatter is mostly Quatsch, betises, and eyewash.”

By the way, the effectiveness or necessity of rules is not discussed nearly as much as whether they are breached. The rules seem to be an end in themselves. The real problem, of divergent national economies operating in a single financial system, while countries spend and tax with very different priorities, has not changed. It remains – just talk.

Recall that the catalyst is disintegrating finance. Aside from the Bundesbank auction, an unknown number of banks cannot borrow from each other, so are drawing on the European Central Bank, which, itself, is highly leveraged, is holding Greek and Italian bonds at par, and is cheating on its constitutional restriction that it cannot bail out nations. Europe has begged around the globe for capital investment, to no avail. Portugal carried its tin cup to Angola, a former colony. The Angolans responded “nyet.” Thwarted by its African sidekick, Lisbon officials validated Angola’s wariness by confiscating €5.6 billion from Portuguese pension funds to fill its budget gap. Isn’t technology wonderful? Tanks and troops slogging across continents warned of such heists in the past. Americans beware.

Of importance: the financial woes are REAL; the advertised solution is pretense. There is no financial “solution” as the loungers and idlers at European Union cocktail parties would define solution. They want a “fix” under the assumption the European Project could not possibly suffer from a design flaw. They designed it.

The Belgian bureaucrats expect the ECB to deploy enormous monetary firepower (€2 to €5 trillion) to relieve them of all this financial talk. To do so would break the law, not a consideration eurocrats or eurocratic periodicals mention. Bernard Connolly, in The Rotten Heart of Europe: The Dirty War for Europe’s Money (1995), wrote that monetary union “is not only inefficient but undemocratic. A danger not only to our wealth but also our freedoms, and ultimately, our peace. The villains of the story… are bureaucrats and self-aggrandizing politicians.” Monetary union “is a mechanism for subordinating the economic welfare, democratic rights, and national freedom of the European countries to the political and bureaucratic elites whose power-lust, cynicism, and delusions underlie the actions of the vast majority of those who now strive to create a European superstate.”

Connolly is now an economic consultant (Connolly Insight) who wrote this book after his eye-opening experience inside the Eurocracy. There is a single copy available on Abebooks, for $1443.52.

It was 97 years ago when German Chancellor von Bethmann-Hollweg asked the British ambassador in Berlin, Sir Edward Goschen, why England would defend Belgium’s neutrality. His Majesty’s Government had signed a treaty to do so, in 1839. Bethmann-Hollweg replied this was a “scrap of paper.”

It has been a deplorable century for the law, agreements, and treaties since that confrontation in 1914, the same year the International Gold Standard unraveled. Now, the stellar leadership mentioned above and in the United States are worming their way to a poetic conclusion. Currencies will not be worth the money they are printed on.

What's been said:

Discussions found on the web: