>

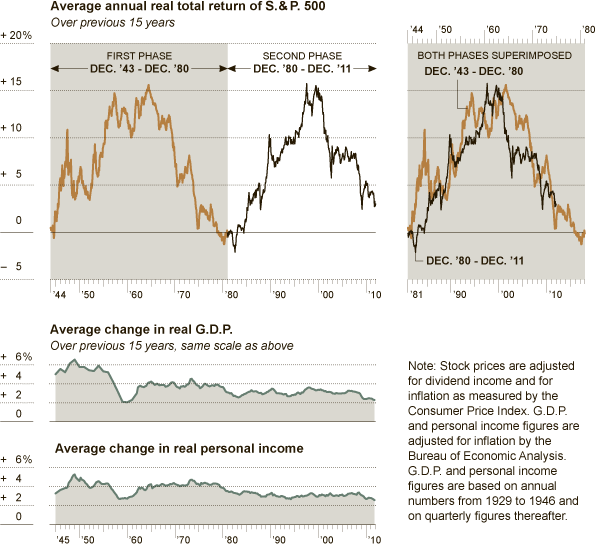

Floyd Norris points out the cyclical nature of stock markets over 15-year periods:

“Compound annual total real return of the Standard & Poor’s 500-stock index peaked at more than 15 percent in 1999, and has since fallen to just 3 percent. That peak was similar to the earlier peak, reached in 1964. After that 1964 peak, the stock market lost momentum and then entered a bear market. By 1979, the market had failed to keep up with inflation over the previous 15 years.”

>

Source:

A Historical Cycle Bodes Ill for the Markets

FLOYD NORRIS

NYT, January 6, 2012

http://www.nytimes.com/2012/01/07/business/economy/a-historical-cycle-bodes-ill-for-the-markets.html

What's been said:

Discussions found on the web: