From this weekend’s Barron’s, a look at stocks that do — and don’t — have decent dividends:

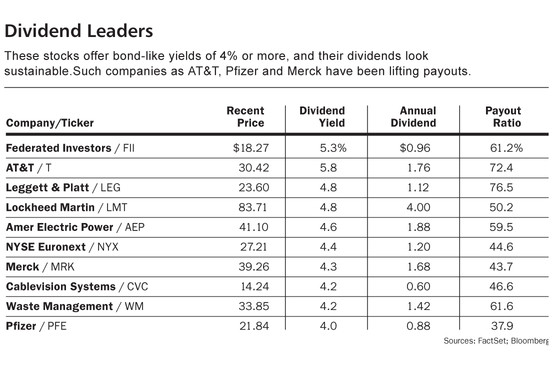

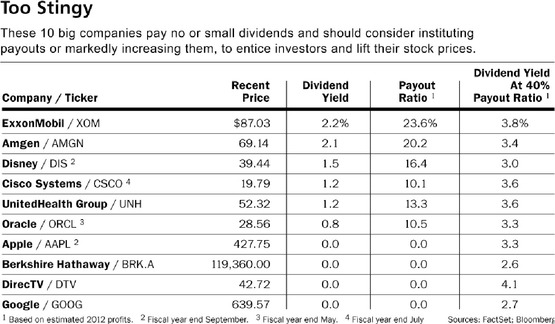

“The benchmark Standard & Poor’s 500 index has a dividend yield of just 2%, one of the lowest of any major global market. European stocks yield an average of nearly 5%, and even the historically low-yielding Japanese stock market pays 2.5%.

American companies have the wherewithal to raise dividends because profits are at record levels and the payout ratio—the percentage of profits paid out in dividends—is near an all-time low at 28%. It has averaged 40% over the past 20 years.” (emphasis added)

That is an astonishing stat . . .

>

~~~

>

Source:

In Search of Yield

ANDREW BARY

Barron’s JANUARY 21, 2012

http://online.barrons.com/article/SB50001424052748704900804577170672872489942.html

What's been said:

Discussions found on the web: