Over the past few years, I watched bemusedly, as analyst after analyst upgraded ole Mister Softee. First the value guys loved it, then the dividend buyers, next the growth-at-a-reasonable-price (GARP) crew. It got added to lots of “conviction lists.” The company is cheap, they are a cash cow, it has a great dividend, they are a turnaround story, blah blah blah. The only guy I don’t recall hearing from was the analyst from Nostalgia Capital Management.

History informs us that leaders from prior bull markets do not lead in the next bull — and MSFT was a leader two bull markets ago. I doubt they will be pulling the Nasdaq Qs Train up the hill back towards 5100 anytime soon.

Investors should be aware of a few other things when it comes to companies like Maytag Microsoft. You may have memories of the company as a fast growing, fearsome monopoly competitor dominating the technology landscape during the 1980s and ’90s. First DOS, then Windows, Office, SQL, gaming, and the massive potential of the internet.

But that was then, and they are no longer that firm. The Anti-Trust case slowed them down just enough to allow competition to explode in techland. Enterprise has been built to the point where it is replacement cycles, not innovation driving their profits. Consumers are migrating from desktop to mobile to handheld — none of which plays into their strengths. Besides, their genius was the original contract which paid them regardless of whether their operating system was in the PC; not delighted consumers with magical new products.

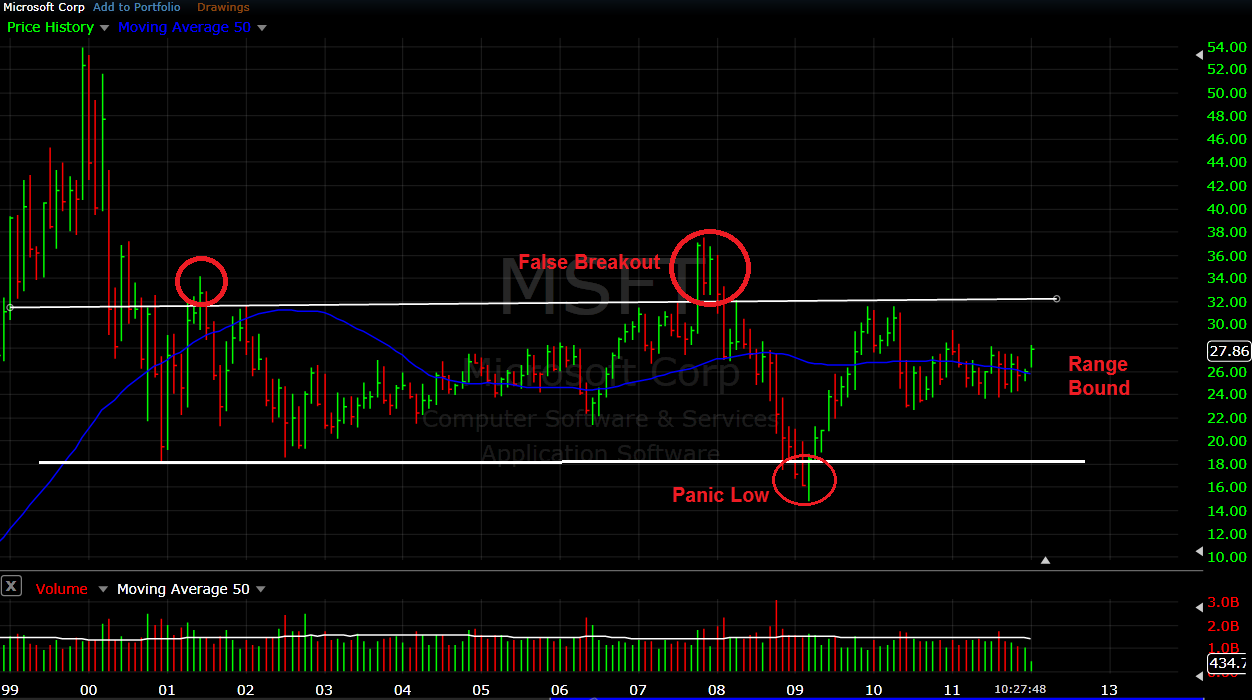

During the past decade, MSFT has returned exactly zero to investors, including dividends. They are a bloated, bureaucracy run by bloated, bureaucrat. The paradigm has shifted repeatedly, and they have failed to make the turn. They missed literally every major new technology, every innovation, every great idea from search to social to handhelds to tablets over that period.

The Kinnect is certainly a hit, but it is not the sort of product that moves the needle for a $234 billion company. X Box is also a consumer winner, but the firm spent billions to grab the franchise from Sony — with far less ROI than such a massive investment would should ever warrant. Everything else from Online to Search to Social to MP3 players to even their well reviewed but 5 years too late cell phone — has been a bust. Their bread and butter franchises — Office, Windows and SQL — are under assault from completely new product categories to which they have no response.

If you want to trade Mister Softee, go right ahead. You covered call writers and swing traders, have your fun. But this is no Widows & Orphans stock, no Buy & Hold long term investment. At least, not any longer. Its Apple or Oracle or Google that threatens the franchise, but a million entrepreneurs moving the ball forward, taking us into the future. They are in the process of turning into Maytag, a boring producer of appliances, with a modest dividend and not a whole lot of growth ahead of them.

Steam engines, leather belts, copper wires, bloatware all had their day in the sun. It happens to nearly every company eventually, Apple, Facebook & Google included.

The thing is, it has already happened to Microsoft . . . No one seems to have bothered to tell them this yet.

>

Microsoft (MSFT) 2000-2012

What's been said:

Discussions found on the web: