>

The folks at the St. Louis Fed — about whom I can’t say enough good things — produce a proprietary Financial Stress Index, a full explanation of which can be found here [PDF].

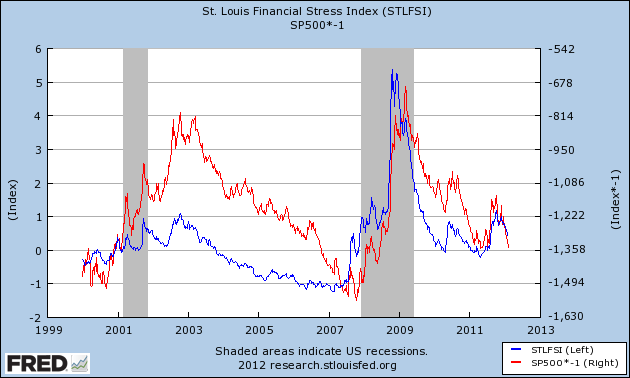

A full deconstruction of the Index is, frankly, a bit above my pay grade. What’s not, though, is exploring the correlation of the Index to the S&P500 and discovering that while it’s generally well-correlated, that correlation has increased dramatically since the recession began at the end of 2007, as can easily be seen in the chart above. (I’ve inverted the S&P500 to better display the correlation.)

The question I need to explore, of course, is whether — or how — this information might be useful in the context of equity exposure.

Note that the Index can dip below zero, and that it is still well off its lows. Should “financial stress” continue to ease — the Index is updated weekly — it would suggest to me more S&P upside. The biggest caveat, of course, is that all correlations work — until they don’t.

>

BR: I would add that peaks in economic activity precede recessions — they start with economic stress rather low. So if we extrapolate from the (very limited data) above, we still have 12-24 months before the real heavy stuff starts coming down.

That said, 2 is not a statistically significant sample

What's been said:

Discussions found on the web: