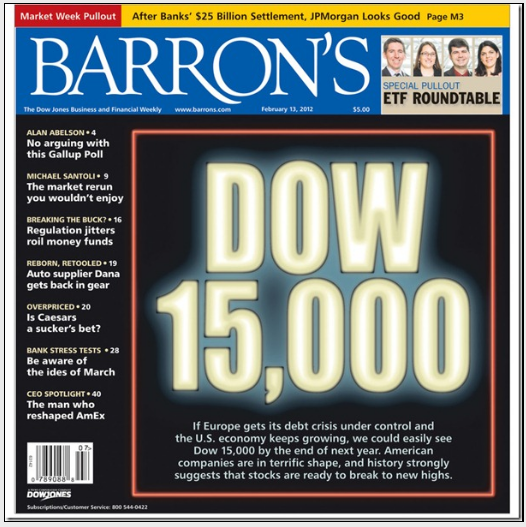

Barron’s – Cover Story: Enter the Bull

Even by conservative measures, the Dow Jones Industrials could top 15,000 in two years. Dow 17,000 is a 50-50 bet

tarting at the close of each calendar year, the returns assume all publicly traded stocks are purchased on a capitalization-weighted basis, with all dividends reinvested. Yearly percentage returns are equal to the average annual compound rate. Total returns over recent years have not benefited as much from reinvested dividends. While payouts have picked up since the cut in the dividend tax in 2003, the yield on the S&P 500 is still well below its average in the post-World War II years. As recently as the period from 1990-95, the yield was rapidly declining, but still averaged 3%, compared with a little over 2% today. In the 1980s, the dividend yield averaged 4.2%; in the ’50s, 4.9%. But there has been an offsetting factor. As Jeremy Schwartz points out, “Firms have been substituting share buybacks for dividends at a greater rate over the last 20 years than through much of history.” Stock buybacks contribute to total returns by putting upward pressure on stock prices. With cash that might otherwise go to dividends spent instead on buying back stock, the long-term effect on returns from cash infusions might be even over time.

Comment

Barron’s doesn’t promote numbers much on their covers, and with good reason. These types of specific forecasts often come back to embarrass them.

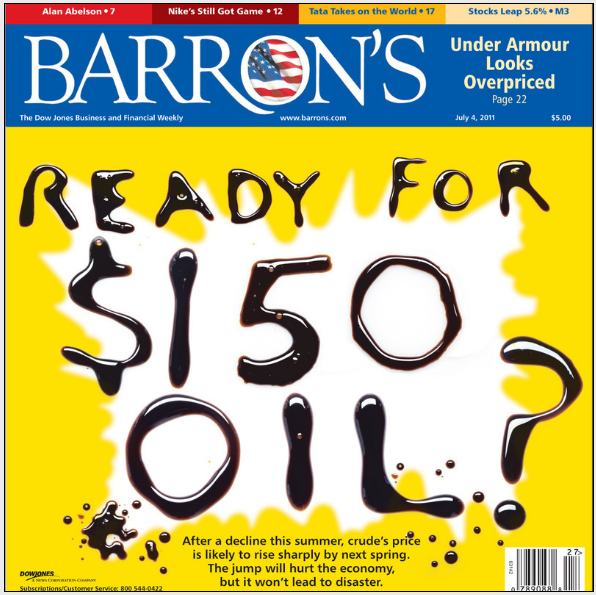

Recall the last time they promoted a number on a cover last summer. The story was even written by the same author as this week’s cover story.

So how did that cover work out?

A few weeks after the last Barron’s cover with a number, prices violently moved in the other direction. This is not an isolated incident for this author, as the blog the Big Picture detailed last year.

The Financial Times – The bulls return, but for how long?

It is almost as if the past year has just been a bad dream. Global equities this week re-entered a bull market, having risen 20 per cent since their October lows. The gains mean that many share indices are within touching distance of their highs from 2011, or above them. The Nasdaq index of predominantly technology stocks is at its highest level since the end of 2000. Justifications for the sharp rally are well rehearsed. Better economic data, particularly in the US but also in Europe and China, has, for now, dimmed the prospects of a global double-dip recession. And fears of a break-up of the eurozone have receded due to action from the European Central Bank. But the question all investors are asking is: just how sustainable is the rise in equities?

Source: Bianco Research

What's been said:

Discussions found on the web: