The Fed’s EXPLICIT Goal Is to Devalue the Dollar by 33% … and NEGATIVE Yield Bonds Are Coming

The Federal Reserve’s explicit goal is to devalue the dollar by 33%.

As Forbes’ Charles Kadlec notes:

The Federal Reserve Open Market Committee (FOMC) has made it official: After its latest two day meeting, it announced its goal to devalue the dollar by 33% over the next 20 years. The debauch of the dollar will be even greater if the Fed exceeds its goal of a 2 percent per year increase in the price level.

***

The Fed has announced a course of action that will steal — there is no better word for it — nearly 10 percent of the value of American’s hard earned savings over the next 4 years.

While that is stunning, it is actually par for the course for the Fed:

Here’s a chart of the trade weighted US Dollar from 1973-2009.

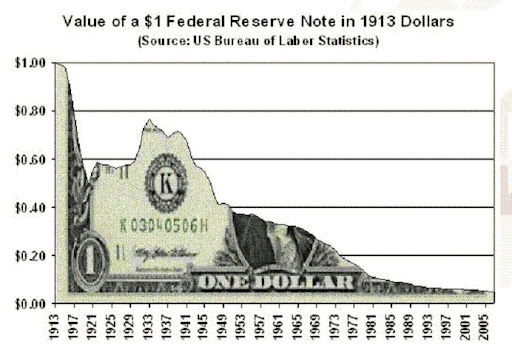

And here’s a bonus chart showing the decline in the dollar’s purchasing power from 1913 to 2005:

The giant banks – through their treasury borrowing committee headed by JP Morgan and Goldman Sachs – are also demanding the issuance of negative yield bonds.

In other words, the too big to fail banks want Americans to pay to have the luxury of holding their money in bonds.

American savers – and especially those living on fixed incomes and pensions – are going to get creamed.

What's been said:

Discussions found on the web: