This week officials from the Obama administration, the banking regulators, and state Attorney Generals announced a settlement of claims stemming from the financial crisis. The nominal amount put forward as the cost of the settlement is $26 billion, and in return the banks will be released from civil claims on origination of mortgages and the falsification of documents in the foreclosure process, or “robosigning”. This caps off a month of political noise on the housing situation which started at the State of the Union, when the president announced a task force on financial fraud headed by officials from his administration as well as New York Attorney General Eric Schneiderman.

An investigation, and a multi-billion dollar settlement. That sounds like a lot, until you put it into perspective. Here are the numbers. Roughly half of homeowners with mortgages are underwater, which means they owe more than they own, to the tune of $1 trillion or so. And housing values are still declining so far in this “recovery”, throwing more homes underwater. In terms of an investigation, the Savings and Loan crisis used roughly 1000 FBI investigators to uncover fraud — this task force taking on a crisis forty times more severe will employ 10 FBI agents.

There’s a reason this is so inadequate to the problem at hand. For the last three years, the policy has been to impose a political solution to a math problem. It hasn’t worked. America simply has too much mortgage debt to pay back. Serious economic thinkers across the spectrum, from Democrat Alan Blinder to Republican Martin Feldstein to New York Fed President William Dudley, believe that there is only one solution — writing down the enormous creaking mound of debt. This solution is currently off the table, because writing down these unsustainable debts could cost our fragile banks enormous sums of money and possibly lead to a restructuring of one or more of our major banks. Avoiding this clear policy choice has resulted in our economy falling into a Japan-style “zombie bank” torpor, with debts carried on the books at full value which everyone knows will not be paid back at par.

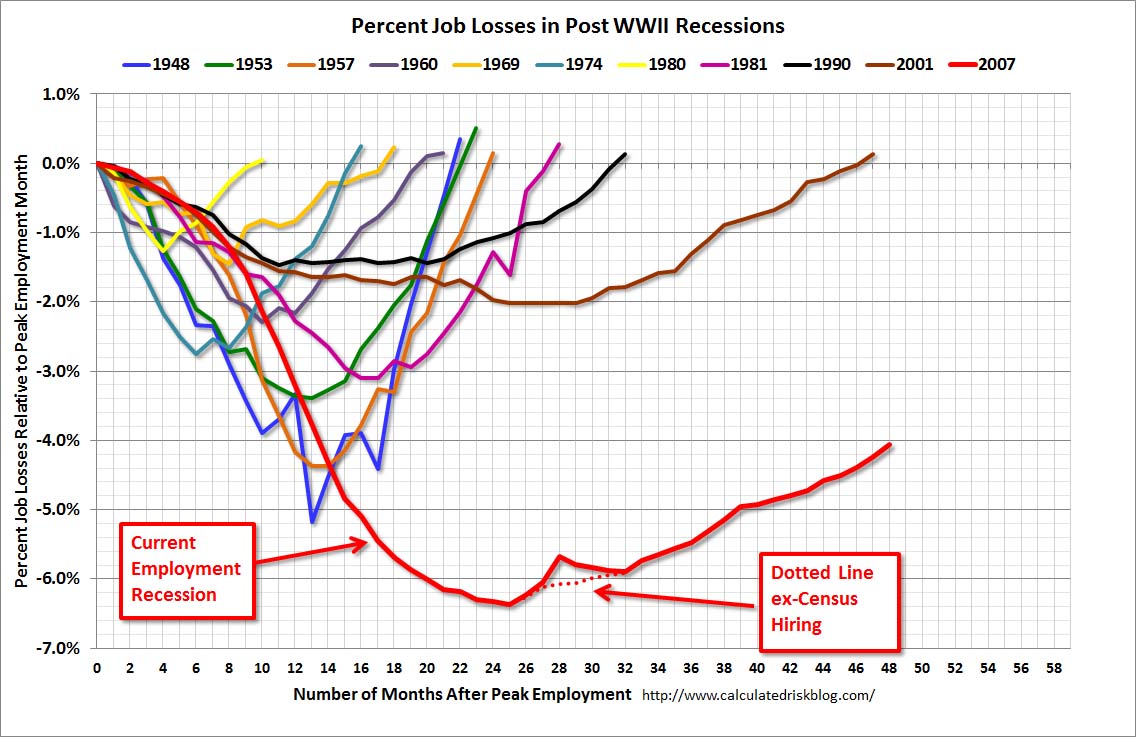

This crisis of American political economy in the form of excess mortgage debt is preventing a more powerful economic recovery. Three years after Ben Bernanke used the term “green shoots” to describe a recovering economy, job growth hasn’t really revived in any meaningful way. In fact, this is by far the worst recovery we’ve had since the end of World War II. The best way to measure this is not through traditional unemployment indices (which can be gamed), but by asking the question of how many Americans are working as a percentage of the population. In 2007, this was 63 out of 100. Today, it’s a full five percentage points lower. The ratio hasn’t been this bad since the early 1980s recession, and remember, we’re in a recovery. And the labor force participation rate is dropping, which is a long-term bigger crisis. [BR: Much of this is a function of demographics of the aging Baby Boomers; In terms of Job losses, the chart below is far more damning population ratio:

>

Calculated Risk

>

The housing market’s vicious deflationary cycle demands serious policy action to match the scale of the challenge. Dropping housing values lead to foreclosures, which damage housing values, and so on and so forth. According to Zillow, roughly half of homeowners with a mortgage are effectively underwater, which means they owe more on their mortgage than their house is worth. According to Zillow, 28.6 percent of all single-family homes with mortgages had negative equity in Q3 2011. And according to CoreLogic, “10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011.” (Correction hat tip Calculated Risk)

So far, the alphabet soup laden set of programs (HAMP, HARP, Hope for Homeowners) put forward by the Bush and then Obama administration have been failures. And this is because, as the Congressional Oversight Panel noted as far back as March of 2009, the single best predictor of default risk is how much equity homeowners have in a home. Many Americans, though considered homeowners, are essentially “renters with debt” (as housing analyst Josh Rosner put it). And Amherst Securities Laurie Goodman noted that with our current housing trajectory, we can expect up to 10 million more defaulted mortgages over the next decade. These foreclosures impacts housing values, reduce consumer purchases, and costs municipalities money.

The proposals on the table to solve this problem aren’t inspiring. The meager mortgage settlement deal cut via furious and dramatic negotiations is unlikely to be meaningful. This settlement is essentially a continuation of previous alphabet soup housing programs, because it would not force banks to fundamentally restructure the trillion dollar underwater mortgage problem. It will generate headlines, but it will fail to address the extent of the problem. State attorneys generals have accepted the settlement for a variety of reasons, one of the most frustrating being that they are substantially under-resourced and this deal moves cash their war. This is not how to make good policy. And the housing market will continue to suffer if our political leaders cannot acknowledge the depth of the problem.

Instead, we need some serious discussion from both the Republican candidates and the Obama administration about how to write down mortgage debt. Some proposals would reduce principal, while giving the banks an equity appreciation stake in the home. Others would deal with the problematic accounting standards which allow banks to overvalue second mortgages, and imply that one or more large banks needs to be restructured by the government. These are worth considering. We think it’s important, regardless of how policy-makers reduce the debt, to force the banking system to appropriately value mortgage debt.

Anything less would simply continue the deflation and uncertainty in the housing market.

Ultimately, we need to look at our banking and housing system and engage in a ruthless yet compassionate evaluation of whether it is working to solve our national needs. Serious thinkers in both parties recognize that it isn’t, and that we should find a way to write down this mortgage debt. Only then will we head down a pathway to a healthier banking system, and begin generating the roughly thirty million jobs that will bring America back to full employment. It’s time that the major presidential candidates, and President Obama himself, be honest with the American public, and openly recognize this as well.

What's been said:

Discussions found on the web: