Bloomberg Briefing, edited by Richard Yamarone, is fast becoming oe of my favorite Bloomberg publications for terminal subscribers.

They had an excellent set of charts along with a valid issue concerning rising gasoline prices recently. Here is a brief excerpt:

“The 7 percent rise in the price of gasoline combined with future wholesale prices pointing to another 4 percent rise pose additional downside risks to an already difficult outlook for the consumer.

The increase in gasoline prices comes at a time when consumer confidence, modest improvement in the labor market and easing inflation appear to have bolstered overall investor confidence. That confidence is one reason for the 24 percent increase in the Standard and Poor’s 500 index {SPX INDEX<GO>} since October. Household spending is on track to support a weak 1-to-1.5 percent expansion in the current quarter, even after a solid increase of 0.7 percent in retail sales, excluding the volatile autos, gasoline and building materials categories. An ill-timed increase in consumer gasoline prices carries with it the risk of pushing the economy back towards stall speed in the first half of 2012.

Rising gasoline prices tend to curb spending on discretionary service items like dining out, entertainment and consumer electronics, which given the weak pace of spending does not bode well for growth this quarter.

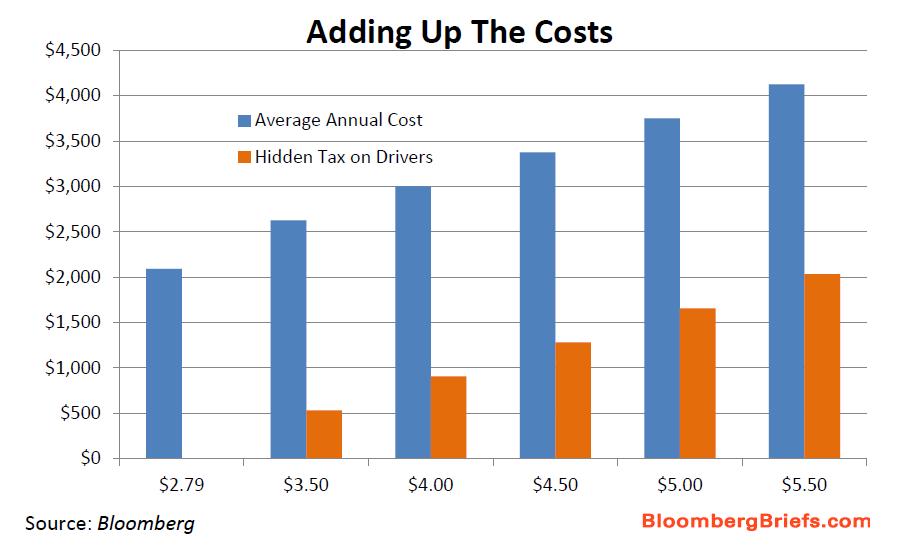

Yamarone does the back of the envelope calculation: If gas prices rise to $4 per gallon, it is $908 per year in additional energy costs (assuming they drive the same miles, a big if). At $4.50 per gallon (about $122/barrel) the cost would reach $1,283. That is about the amount of money the tax holiday is worth — about $1000 into the pockets of taxpayers.

>

Source:

Rising Gasoline Prices Point to Consumer Spending Risk

Bloomberg BRIEF, February 21, 2012

What's been said:

Discussions found on the web: