The consolidation in equity markets is continuing. Yesterday, we noted that the US equity markets were in the process of digesting the rapid gains made since the beginning of the year (Look Out Below, Thursday Edition).

The consolidation in equity markets is continuing. Yesterday, we noted that the US equity markets were in the process of digesting the rapid gains made since the beginning of the year (Look Out Below, Thursday Edition).

Since we are “Miserably Long,” I spend lots of time thinking about what could go wrong. Yesterday, we discussed how mom and pop are still not buying equity mutual funds. The day before, we trotted out SocGen’s chart showing markets are not cheap, by way of Earnings Yield (Why Using P/E Ratios Can Be Misleading). GMO’s James Montier peak profit comments were widely circulated — he discussed how earnings are more likely to mean revert downwards than keep exploding upwards — and that 9eventually) has to mean lower equity prices (I’ll post his chart later).

Despite all this, the comment that seemed to resonate from yesterday’s morning missive was “And yet curiously, the market cannot even muster a triple digit down day. Odd.”

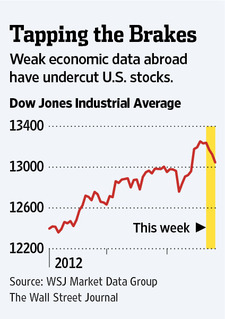

We had every opportunity to see that major whackage yesterday — bad European economic news, weak German PMI data, more slowing in China, European markets down substantially, sell offs in Copper and Crude.

And? We could not even muster a down 1% day.

Contemporaneous to the rally has been a surge of Bearish commentary. It is intellectually appealing, and I am empathetic to their arguments — but they have been on the wrong side of the trend for a long time. Even this week, those arguments have been money losers. At the same time, the Bull camp seems to be in a mad competition as to who can make the most absurdly foolish statement possible. The winner of the silliest bull commentary so far is Goldman Sachs, but there are many other contenders. And despite the intellectual vapidity of much of the Bull arguments these days, the Market has been on their side — at least so far.

The lesson appears to be Momentum + Fed liquidity trumps intellectual appeal + abstract theory.

As to my own positioning: The hot start to the year and my aforementioned Miserably Long posture has me looking for an excuse to lighten up, take some risk off the table, cash in some profits. But I need more than a gut instinct or a guess — I need to see some solid deterioration in market internals or in economic data as opposed to a guess or a gut feel.

The bottom line: The strength of this market — or at least, the Fed’s liquidity beneath it — deserves the benefit of the doubt. Until we see proof that something more untoward is a foot, I consider the current softness little more than back and filling, digesting excess gains from the start of the new year. The recent breakout points across major indices remain key levels to watch.

~~~

Previously:

Predicting Market Tops vs Observing Conditions (March 19, 2012).

Why Using P/E Ratios Can Be Misleading (March 21st, 2012)

The Public Is Still Not Buying Equity Mutual Funds (March 22nd, 2012)

Source:

Chart via WSJ

What's been said:

Discussions found on the web: