>

I am working on a longer piece as to why the may still be some downside in Home Prices, and why any Housing turnaround is not yet upon us, but in the meantime, let’s go to the Case Shiller data:

2012 Home Prices Off to a Rocky Start

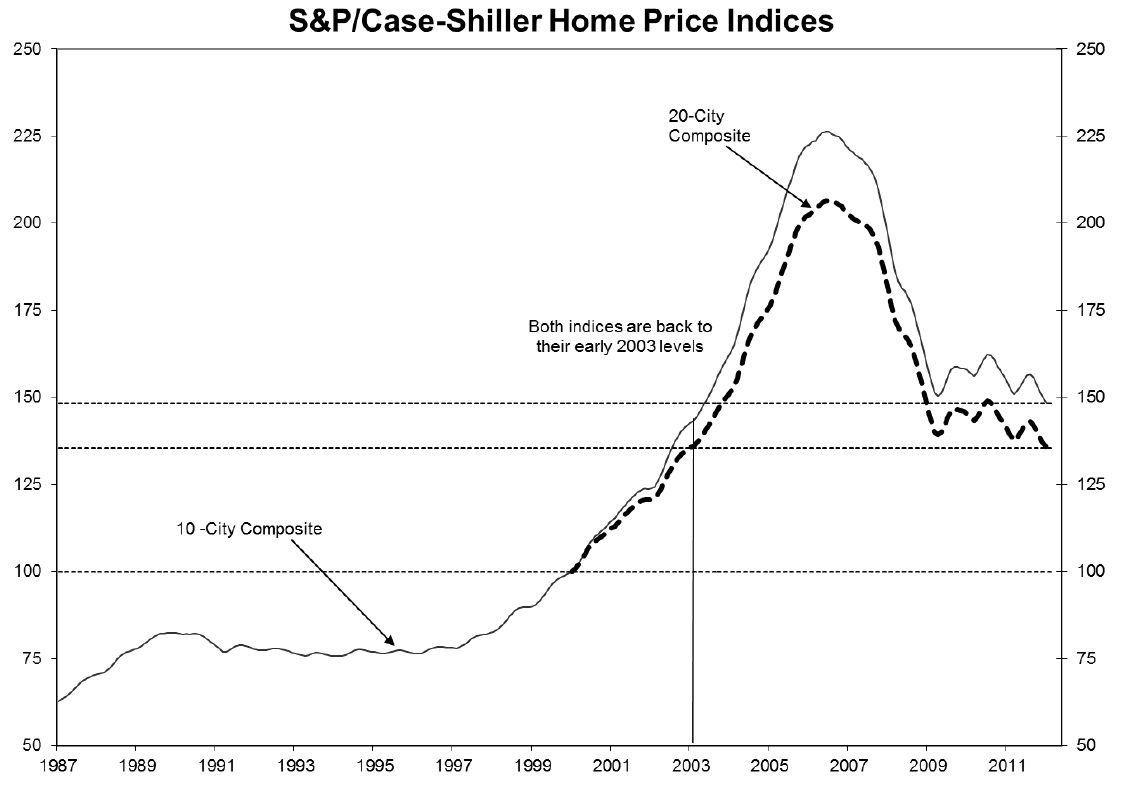

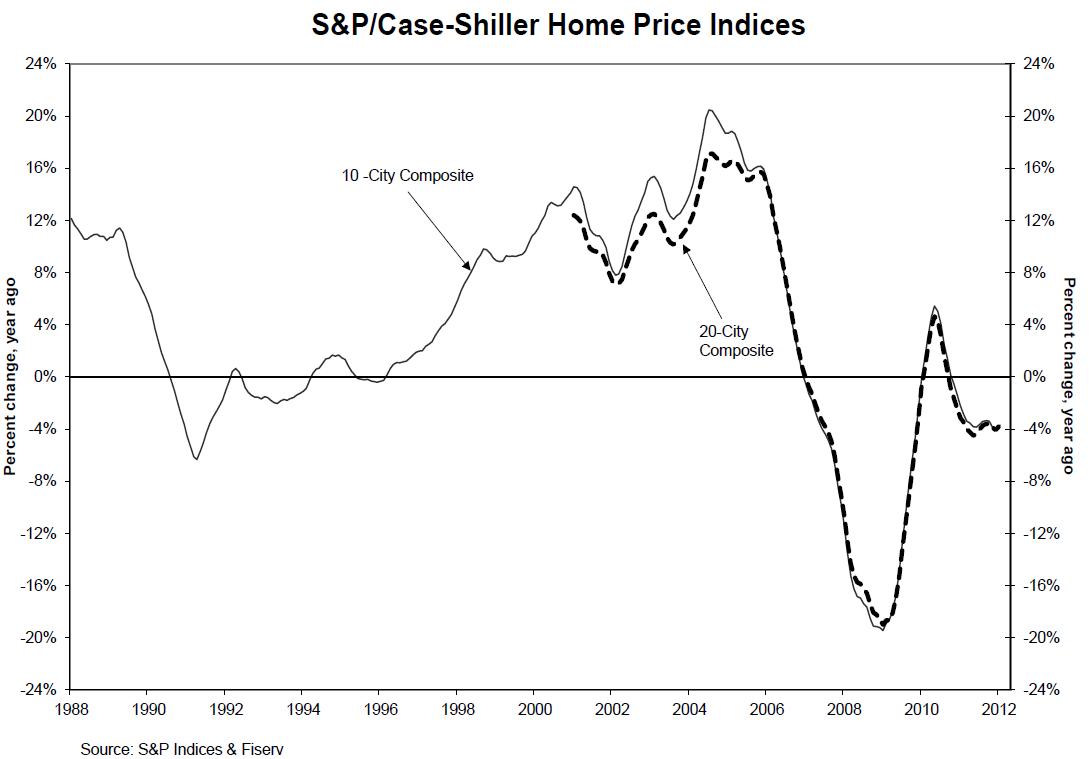

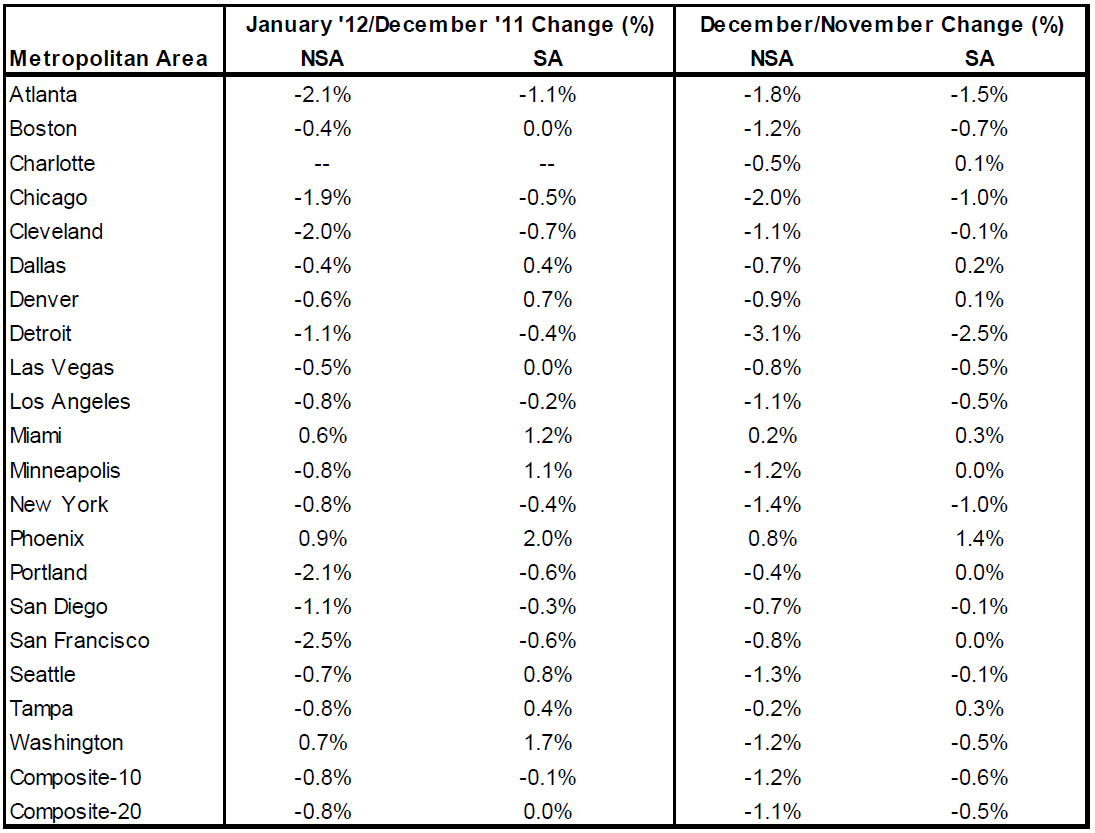

According to the S&P/Case-Shiller Home Price Indices data through January 2012, prices showed annual declines of 3.9% and 3.8% for the 10- and 20-City Composites, respectively. Both composites saw price declines of 0.8% in the month of January.

The 10- and 20-City Composites recorded marginal improvements in annual returns over December 2011 when they each posted -4.1%.

I am putting together a list of factors that will indicate when a bottom and turnaround are taking place. So far,w e simply are not there yet.

The nicest thing we can say is price decreases are decelerating, and some backlog of inventory is occurring. But this remains a Buyers — not Sellers market.

More charts after the jump

~~~

˜˜˜

Source:

S&P Indices

2012 Home Prices Off to a Rocky Start According to the S&P/Case-Shiller Home Price Indices

New York, March 27, 2012

What's been said:

Discussions found on the web: