A Tool for Monitoring Financial Stability

To promote stability in a dynamic financial system, supervisors must monitor the system for risks at all times. The Cleveland Fed has developed an index of financial stress, the CFSI, which is designed to track distress in the financial system as it is building. The CFSI will help financial system supervisors monitor and understand the state of financial markets on a real-time basis, and take appropriate regulatory or supervisory action as necessary.

The financial crisis of 2008 resulted in a sharpened focus on financial stability. Once merely a theoretical notion or, at best, a practical concept applied to emerging economies, financial stability has become a focal point of central banks around the globe. In particular, central banks in developed economies, including the United States, have made maintaining financial stability a priority nearly equal to that of monetary policy. Ben Bernanke, Chairman of the Federal Reserve Board of Governors, recently asserted that “The crisis has forcefully reminded us that the responsibility of central banks to protect financial stability is at least as important as the responsibility to use monetary policy effectively in the pursuit of macroeconomic objectives.”1

In order to promote stability in a dynamic financial system, policymakers must continually monitor the system to identify risks that threaten financial stability, both at present and in the future. An important first step is the development of tools that can monitor the condition of broad financial sectors. Ideally, the tools would also provide insight into the factors that are adversely affecting these markets.

The Federal Reserve Bank of Cleveland has developed such a tool: the Cleveland Financial Stress Index (CFSI). The CFSI incorporates information from a number of financial markets to provide a measure of financial system stress on a continuous basis. Financial system supervisors and macroeconomic policymakers can use the CFSI to monitor the condition of the financial system and to identify periods of excessive stress that may lead to financial instability.2

Construction of the CFSI

While there is debate over the appropriate definition of systemic stress, banking supervisors are likely to see it as the risk of the correlated default of financial institutions. A correlated default could impair the availability of capital and liquidity in the financial system, which could have subsequent negative effects on the real economy. To promote financial stability, supervisors must have the ability to monitor systemic risk in the financial system and be able to assess its level at a given point in time.

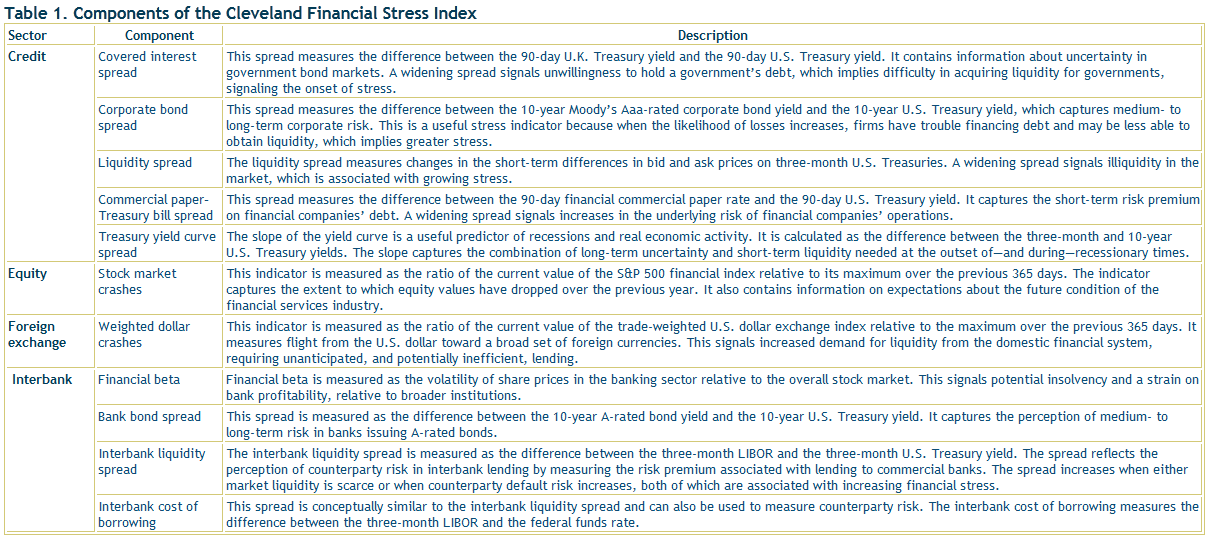

Like other indexes that measure aggregate movements in financial markets, the CFSI takes components that quantify individual aspects of the system and combines them into a single value. Specifically, the CFSI is constructed using daily data from 11 components reflecting four financial sectors: credit markets, equity markets, foreign exchange markets, and interbank markets (table 1). The overall financial system is complex and comprises many individual markets of varying size and significance. These four sectors were selected because they encompass major U.S. markets, and looking at them provides considerable coverage of the system. Stress in any of these four could carry over to others, affecting the system at large.

Click to enlarge:

Most of the CFSI components are spreads. Spreads show the gap in the yields, prices, or rates of different financial instruments, and they contain information about the market-perceived risk associated with those instruments. For example, the corporate bond spread is defined as the difference between the corporate bond yield and the Treasury yield. A widening corporate bond spread reflects the relative difficulty that firms have financing debt and obtaining liquidity, which indicates that the perceived risk of lending to corporate institutions in the medium to long term is increasing. Spreads also contain information relating to overall financial stress; a widening corporate bond spread, for example, could in part reflect broader financial stress.

Two of the remaining CFSI components are ratios, and one is a measure of stock market volatility. These components contain information about the stability of financial market conditions (in the stock market, foreign exchange markets, and banking sector).

The combined information about these sectors is more important for the detection of systemic risk than the information from any individual market. Numerous factors can affect spreads in individual markets over time, and many of them are not related to systemic stress. Further, when spreads change because of nonsystemic, stress-related events in one market, the change is not necessarily correlated with the movement of spreads in other markets. In contrast, systemic stress-related events are more likely to affect spreads in multiple markets. Observing conditions in a number of markets allows for the potential identification of a common factor, that is, financial stress.

The CFSI is designed to track stress in the U.S. financial system on a continuous basis. This allows banking supervisors and analysts to monitor stressful episodes as they are building. Such early detection is very important because when stress occurs in multiple markets, it is quickly amplified. The CFSI does a good job of capturing past episodes of economically significant stress (figure 1).

The Long-Term Capital Management (LTCM) crisis could be seen as the CFSI neared a value of 2.00 in the fall of 1998,3 a level not seen again until the beginning of the subprime crisis. The CFSI began picking up an increasingly stressful period beginning in late 2007, well before the full extent of the financial crisis was observed. The index topped out between the Bear Stearns collapse in early 2008 and the failure of Lehman Brothers in September of the same year.

The CFSI tracks analogous financial stress indexes reasonably well, suggesting that it is a practical measure of financial stress (figure 2). The differences observed across indexes—the amount and timing of stress, for example—exist because each index emphasizes different aspects of the financial markets. One advantage of the CFSI is that it is available on a daily basis, and the additional information is responsible for some of the divergence from other indexes as well.4

Using the Index as a Supervisory Tool

Constructing the CFSI is only the first step in being able to monitor systemic stress. Learning how to interpret the index and using it in practice are next.

Care must be taken to interpret the index because it is a continuous measure. At what point along the CFSI continuum is a policy response required? One way to approach the interpretation is to identify specific values or thresholds that would trigger supervisory responses. These thresholds must be reasonably sensitive to detect trouble before it gets out of hand. If supervisors make them too broad, their monitoring of systemic stress will be inefficient. If supervisors make them too narrow, they might fail to recognize and act on systemic stress in a timely fashion.

Michael Bordo, Michael Dueker, and David Wheelock (2000) showed in their research that a continuous index can be used to identify the severity of distress. They suggest a five-category differentiation: “severe distress,” “moderate distress,” “normal,” moderate expansion,” and “euphoria.”5 We employ a similar approach to distinguish the different categories of distress severity, offering minimum thresholds for potential supervisory responses.6 These thresholds yield four distinct stress classifications for the CFSI, which we refer to as stress grade levels (table 2). These grades differentiate “below-normal stress period,” “normal stress period,” “moderate stress period,” and “significant stress period.”

Figure 3 shows the CFSI since 1991 and overlays CFSI grades. The CFSI climbed into the “significant stress period” grade in late 2007 and remained there through the middle of 2009. While the CFSI has not moved back into this “significant stress period,” it rose throughout 2011, fell in 2012, and currently remains in the “moderate stress period” grade.

In addition to providing the level and grade of systemic stress at any given time, the CFSI allows for an explicit analysis of the components that are contributing to financial stress. Because of the aggregation method used to calculate the index, stress can be attributed to equity, foreign exchange, credit, or interbank markets, or any combination of these. This, along with the financial market stress classifications, allows supervisors to develop various options for supervisory responses to financial stress, such as additional reporting requirements, more frequent and targeted monitoring, greater emphasis on stress testing, higher capital requirements, or higher liquidity requirements The same can also be said of policymakers who have a responsibility for ensuring financial stability (see “SAFE” in the Recommended Readings for related research).

Monitoring stress is an important responsibility of financial system supervisors. The Cleveland Financial Stress Index is one tool that can help them do that. The contemporaneous nature of the index, combined with the ability to trace the origins of elevated stress, will allow financial system supervisors to monitor and better understand the state of financial markets on a real-time basis, and to take appropriate regulatory or supervisory action as necessary. With further research, we will be able to use the Cleveland Financial Stress Index to forecast—and potentially to mitigate—systemic stress.

Source: Federal Reserve Bank of Cleveland

Footnotes

- “The Effects of the Great Recession on Central Bank Doctrine and Practice.” Ben S. Bernanke (2011). Federal Reserve Bank of Boston, 56th Economic Conference.[Back]

- For a detailed description of the index’s construction, see Oet, Eiben, Bianco, Gramlich, and Ong (2011).[Back]

- Units of the CFSI are expressed as standardized differences from the mean (z-scores).[Back]

- For a detailed analysis of comparison of presently available alternatives, see Oet, Eiben, Bianco, Gramlich, and Ong (2011).[Back]

- Bordo, Dueker, and Wheelock (2000, p.27) assign Zt larger than 1.5 standard deviations (SD) above the subperiod mean to the “severe distress” category; Zt larger than 0.75 SD above the subperiod mean to the “moderate distress” category; Zt falling between ±0.75 SD of the mean to the “normal” category; Zt between −0.75 and −1.5 SD of the mean to the “moderate expansion” category; and Zt below −1.5 SD of the mean to the “euphoria” category.[Back]

- For the details of this approach and how we estimate the financial stress thresholds, see Oet, Eiben, Bianco, Gramlich, and Ong (2011).[Back]

What's been said:

Discussions found on the web: