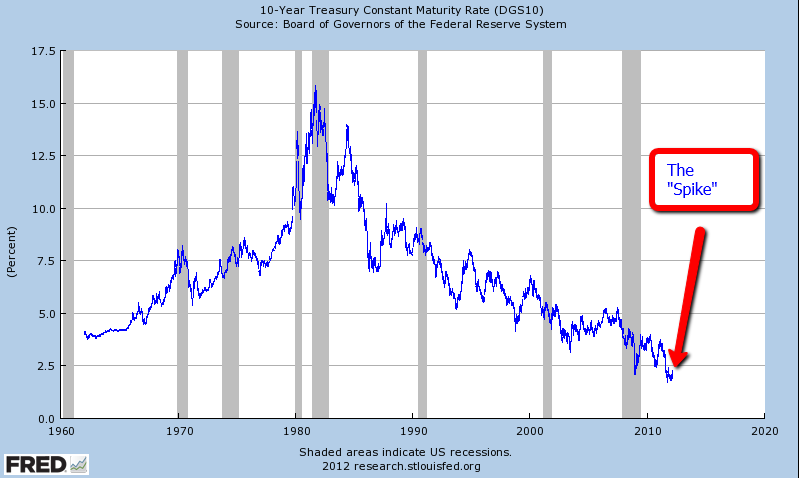

Ammo Trader mocks the overall chatter of the Spike in Interest rates with this Big Picture perspective seen below.

The key takeaway is that while the bounce in the 10 year yield from 1.99% to 2.4% is enormous, it does not by itself signal the end of the 30 year Bond Bull market. There have been repeated spikes in interest rates of larger yields that have failed to derail the bull. Still, percentage wise off of very low levels, I’d be lying if I failed to admit a 20% move was impressive.

The wild card remains the Fed. I have spoken to many fund managers, economists, traders and strategists who simply have no way to gauge their current impact and ZIRP end game.

>

click for larger chart

Source: Jerry Khachoyan

>

UPDATE: March 21, 2012 9:42am

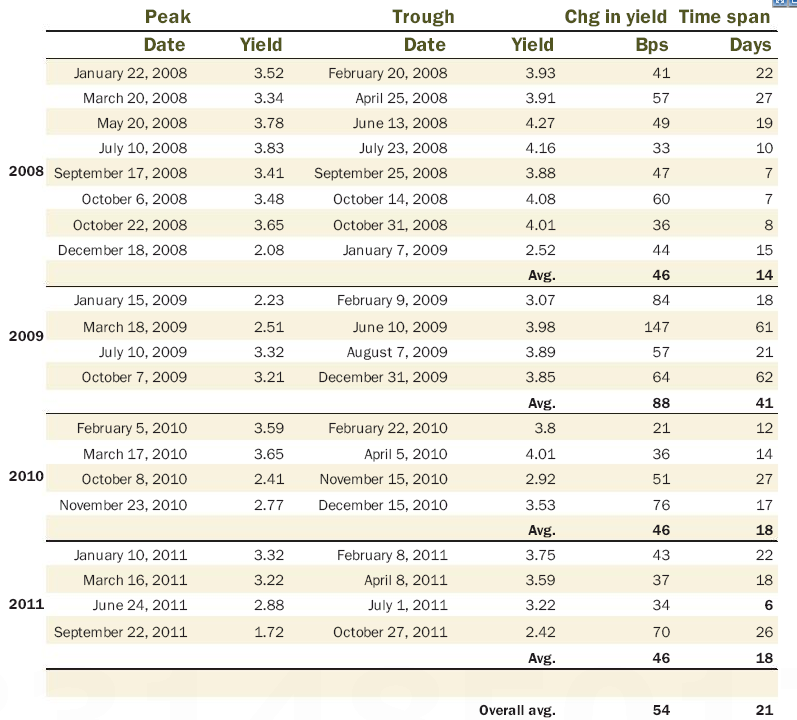

David Rosenberg sends along this chart of past interest spikes:

>

What's been said:

Discussions found on the web: