>;

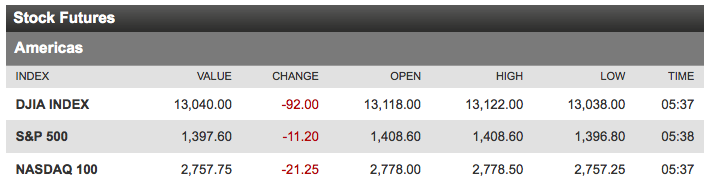

In Q1, it seemed there was no downward pressure whatsoever. Did we muster many triple digit negative closes? I recall one day that was a near 2% loss, and other than that, almost no days that were a 1% loss.

While Fed liquidity is a major force for support, this rally remains almost universally hated. Since the March lows, the biggest issue has been under-invested managers. Last year, the hedge fund community shit the bed, missed the rallies, and suffered outflows. They remain under-invested and were plowing into equities in Q1.

I get bearish when markets are loved, not hated like this one. Until then, I have to remain constructive, and give the benefit of the doubt to the Trend.

Market internals will reveal if this is the start of a serious correction, or merely an overdue digestion of recent gains.

More later.

What's been said:

Discussions found on the web: