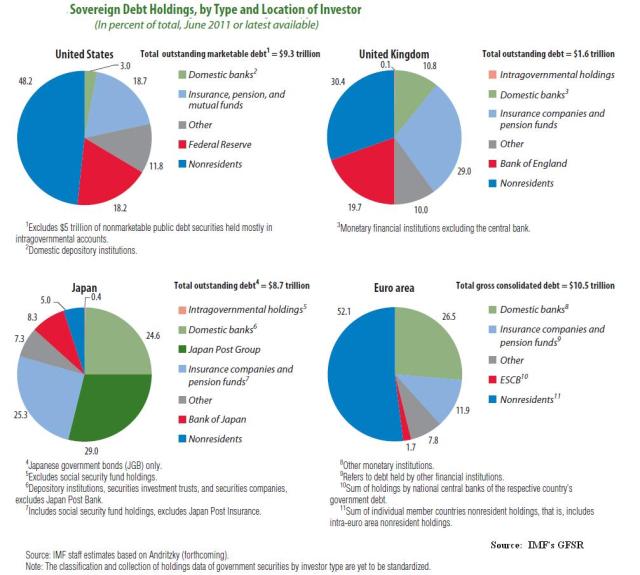

The International Monetary Fund (IMF) is out with an update of their Global Financial Stability Report, which includes the following graphic of sovereign debt holders of the big three issuers and the Euro area. The IMF notes,

…In the United States, foreign investors have dominated the market for U.S. Treasuries in view of its large size and depth and its high perceived degree of safety. However, post crisis monetary stabilization efforts increased the prominence of the Federal Reserve as a holder of government debt.

In Europe and Japan, domestic banks have played an important role as sovereign debt investors, in each case accounting for about 25 percent of outstanding sovereign debt (Figure 3.6). In the United Kingdom, insurance companies and pension funds have been traditional holders of government securities, although the Bank of England and foreign investors assumed a more prominent role after the global financial crisis.

Click on graphic to enlarge and for better resolution.

What's been said:

Discussions found on the web: