˜˜˜

The Wall Street Journal – John Hilsenrath and Matt Phillips: Fed Holds Fire on Stimulus

The Fed is in no hurry to launch new measures to boost economic growth, minutes from the central bank’s most recent meeting showed, disappointing investors eager for more stimulus. Among the hints dropped in minutes of the Fed’s March 13 policy gathering, Federal Reserve staff concluded that the U.S. economy is a little more susceptible to inflation than previously thought. That and other signals suggested that another round of bond buying by the Fed to push down long-term interest rates isn’t imminent. The minutes are written without specific staff forecasts or naming any officials. Still, they were written in a way that made clear Fed staff hadn’t made dramatic revisions to their forecast. The minutes showed that Fed officials themselves are very much divided over slack. One Fed official argued at the meeting that the economy was “much closer” to using up its idle resources than previously thought. “A few” officials thought the economy had emerged from recession with less potential to grow without causing inflation.Other officials said there was still “substantial slack,” particularly in the job market. The U.S. unemployment rate is 8.3%, which is 2.5 percentage points above its average since the 1940s.

The Financial Times – Why the Fed has taken QE3 off the agenda

The minutes of the Federal Open Market Committee meeting on March 13 have surprised the markets. The committee seems to have shifted in a markedly more hawkish direction than was reflected in the statement issued after the meeting, and the bar to quantitative easing 3 now seems to be rather high. Perhaps we should have expected this, given the fact that speeches by chairman Ben Bernanke and Bill Dudley since the meeting had given no hint of any further easing. But the breadth of the committee’s shift away from easing was certainly not expected. It is easy to find hawkish phrases in the minutes. The US Federal Reserve staff has not only upgraded its real gross domestic product projections, and increased its inflation forecasts, but has also reduced its estimate of the output gap. Only “a couple” of FOMC members saw any case for further easing, and then only if growth falters or inflation falls below target. There was even some discussion of changing the guidance on keeping short rates “exceptionally low” up to the end of 2014, a move which would really shock markets. In an important speech last month, Mr Bernanke again concluded firmly that cyclical unemployment is far too high. But, significantly, he did not suggest that there was still a “very strong case” for “additional tools” to support the economy. He is probably biding his time, waiting for clearer evidence from the labour market that more action is needed. There are three areas of uncertainty in the labour market which the Fed will be watching carefully.

CNBC.com – Fed Appears Less Keen On Further Easing: Minutes

Federal Reserve policymakers appear less keen to launch a fresh round of monetary stimulus as the U.S. economy improves, according to minutes for the central bank’s March meeting. The Fed policymakers noted recent signs of slightly stronger growth but remained cautious about a broad pick up in U.S. economic activity, focusing heavily on a still elevated jobless rate. However, the minutes suggest the appetite for another dose of quantitative easing, so-called QE3, has waned significantly.The March meeting minutes noted “a couple” of members thought additional stimulus might be needed if the economy loses momentum or inflation remains too low for too long.That contrasted with a much broader characterization in January, when the minutes cited a few members as seeing a possible need for additional easing before long, and others thinking stimulus might be required if economic conditions worsened.Still, the Fed remained sober about U.S. economic prospects.Members “generally agreed that the economic outlook, while a bit stronger overall, was broadly similar to that at the time of their January meeting,” the minutes said.

Bloomberg.com – Fed Signals No Need for More Easing Unless Growth Falters

The Federal Reserve is holding off on increasing monetary accommodation unless the U.S. economic expansion falters or prices rise at a rate slower than its 2 percent target. “A couple of members indicated that the initiation of additional stimulus could become necessary if the economy lost momentum or if inflation seemed likely to remain below” 2 percent, according to minutes of their March 13 meeting released today in Washington. That contrasts with the assessment at the FOMC’s January meeting in which some Fed officials saw current conditions warranting additional action “before long.” The March minutes show decreased urgency to add stimulus with no sentiment expressed for additional easing without a deterioration in economic conditions. The central bank also affirmed its plan, first announced in January, to hold interest rates near zero through late 2014 as the economy’s improvement may not be sufficient to lower the outlook for coming years.

Comment

Yesterday the Federal Reserve released the minutes from the March 13, 2012 meeting. On page 7 of the linked PDF they said:

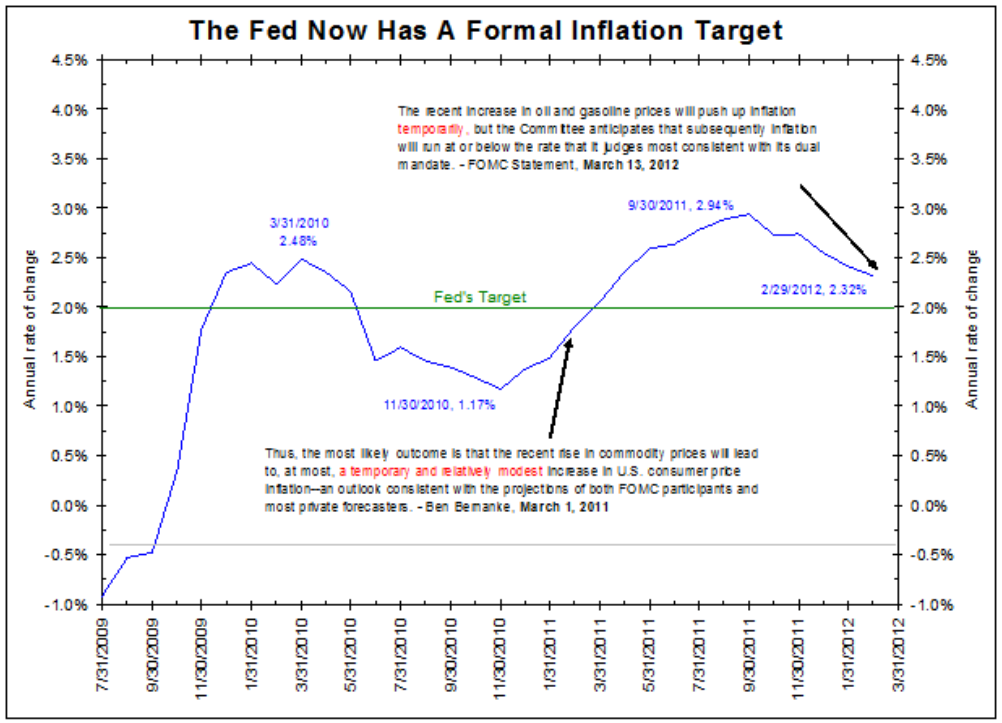

With longer-run inflation expectations still well anchored, most participants anticipated that after the temporary effect of the rise in oil and gasoline prices had run its course, inflation would be at or below the 2 percent rate that they judge most consistent with the Committee’s dual mandate. Indeed, a few participants were concerned that, with the persistence of considerable resource slack, inflation might be below the mandate-consistent rate for some time. Other participants, however, were worried that inflation pressures could increase as the expansion continued; these participants argued that, particularly in light of the recent rise in oil and gasoline prices, maintaining the current highly accommodative stance of monetary policy over the medium run could erode the stability of inflation expectations and risk higher inflation.

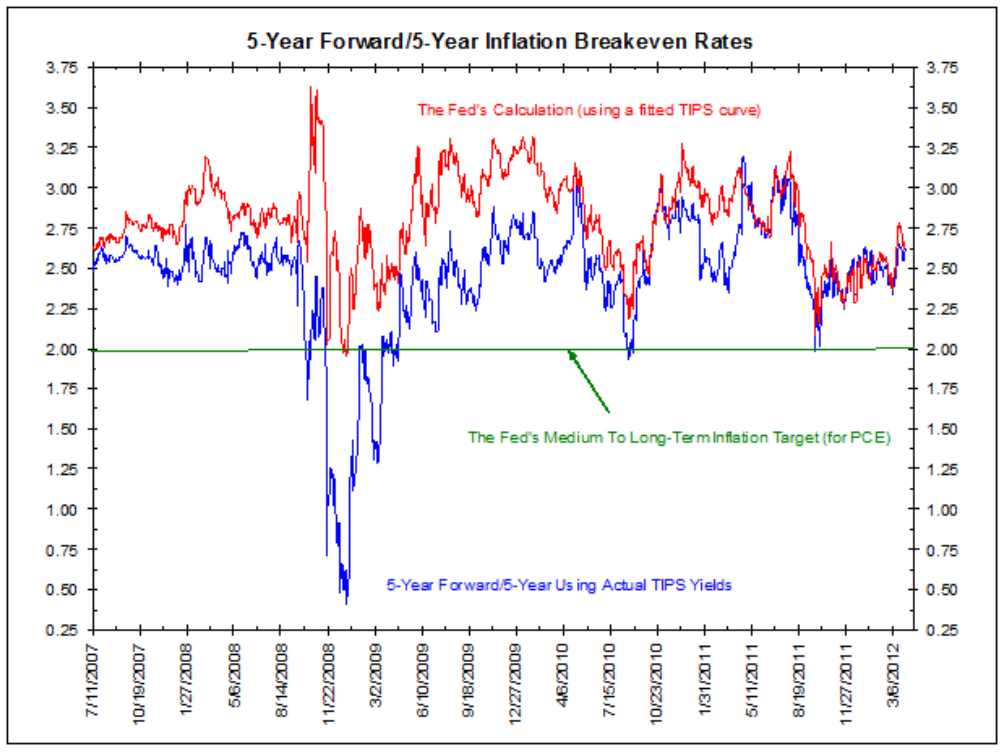

So the Federal Reserve repeated what they said back in January. They believe that year-over-year PCE will decline in the next few years and come in below their 2% target. The Federal Reserve is basically telling us to ignore the actual data and forward projections by the markets (detailed yesterday) and go with the FOMC forecast.

This would be fine if the Federal Reserve provided good forecasts in the past, but given their recent track record on GDP, unemployment, inflation and on housing, we are wary.

Project Syndicate – Martin Feldstein: Fed Policy and Inflation Risk

During the past four years, the United States Federal Reserve has added enormous liquidity to the US commercial banking system, and thus to the American economy. Many observers worry that this liquidity will lead in the future to a rapid increase in the volume of bank credit, causing a brisk rise in the money supply – and of the subsequent rate of inflation. That risk is real, but it is not inevitable, because the relationship between the reserves held at the Fed and the subsequent stock of money and credit is no longer what it used to be. The explosion of reserves has not fueled inflation yet, and the large volume of reserves could in principle be reversed later. But reversing that liquidity may be politically difficult, as well as technically challenging. Anyone concerned about inflation has to focus on the volume of reserves being created by the Fed. Traditionally, the volume of bank deposits that constitute the broad money supply has increased in proportion to the amount of reserves that the commercial banks had available. Increases in the stock of money have generally led, over multiyear periods, to increases in the price level. Therefore, faster growth of reserves led to faster growth of the money supply – and on to a higher rate of inflation. The Fed in effect controlled – or sometimes failed to control – inflation by limiting the rate of growth of reserves. The Fed began an aggressive policy of quantitative easing in the summer of 2008 at the height of the economic and financial crisis. The total volume of reserves had remained virtually unchanged during the previous decade, varying between $40 billion and $50 billion. It then doubled between August and September of 2008, and exploded to more than $800 billion a year later. By June of 2011, the volume of reserves stood at $1.6 trillion, and has since remained at that level.

Source: Bianco Research