>

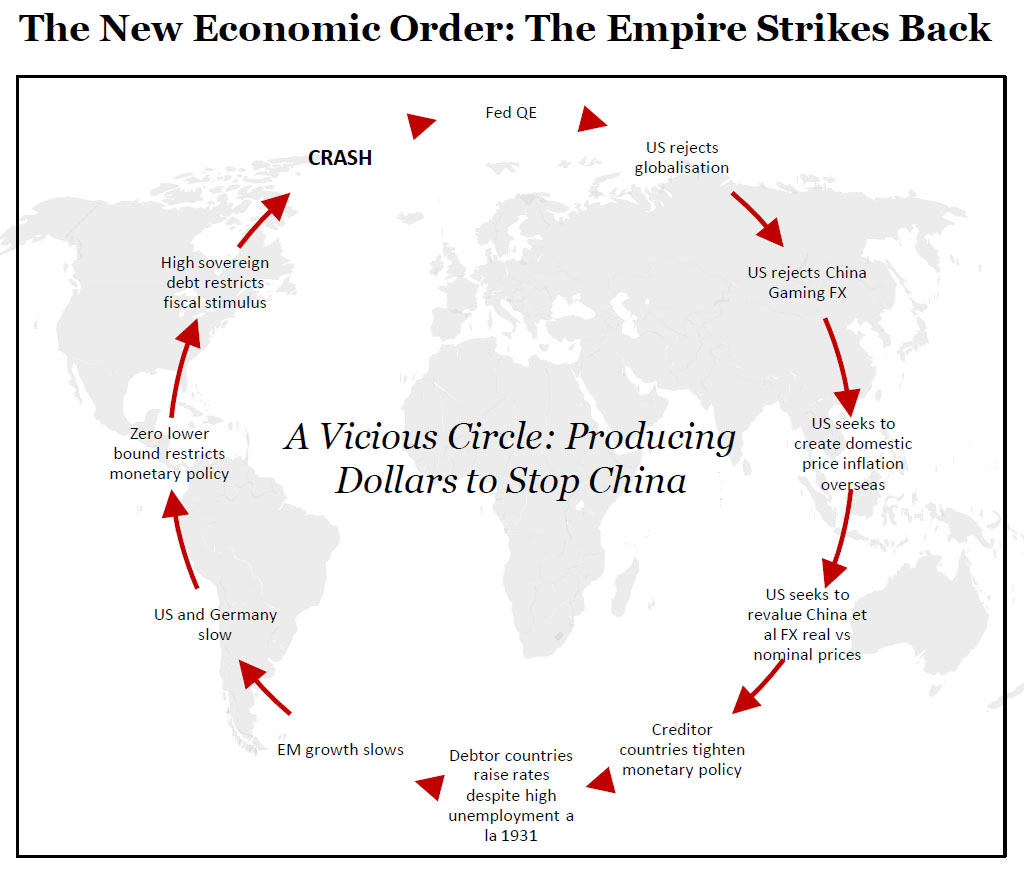

Over the weekend, Josh Brown directed me to this monthly commentary from the Eclectica fund, which had the very interesting chart, above. (Full Eclectica Fund April 2012 commentary is here).

The issue with the graphic above is that we have no real comparative history by which to judge this. It seems to be a modern question of first impression. As such, I have zero ability to evaluate whether it is a brilliantly insightful or a cranky critique of QE.

It certainly is a plausible explanatory of what the Fed’s QE is doing; I cannot tell if its a fair or accurate analysis of Fed / Government motivations for the dollar printing regime.

It is, at this moment in time, and unproven thesis.

That seems to be the biggest problem with most of the critiques of FOMC action. They are just that — unproven theories of cases of first impression. We are living in unprecedented times, and that means we have little in the way of frame of reference by which to evaluate these things.

All asset managers have a tendency to write towards their holdings. My guess would be that the holdings in the Eclectica fund are a reflection of the expectations of what is described above as coming to pass. This is where they expect the puck to be, and they are skating towards that.

We all do this to some degree. Our world view affects our holdings, and then those very same holdings begin slowly to affect our world view.

How are your portfolio holdings impacting the way you see the world?

What's been said:

Discussions found on the web: