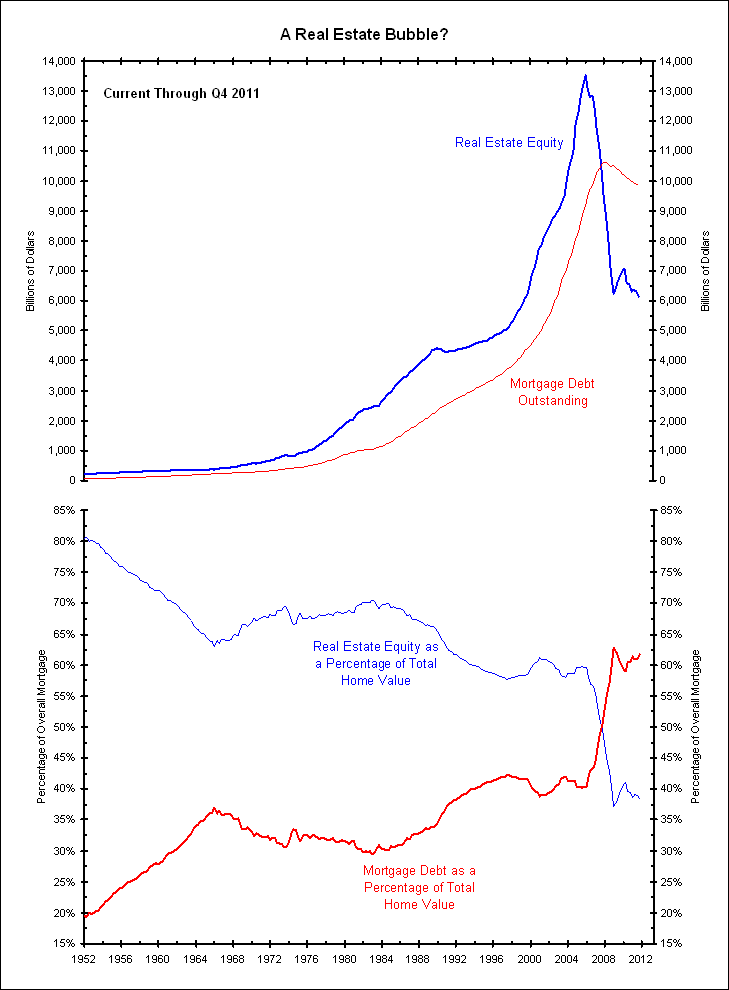

The chart below shows the total value of real estate equity, including homes without a mortgage, as well as total mortgage debt outstanding. As of Q4 2011, almost 62% of all homes’ values was mortgage debt while only 38% was actual equity. Prior to the housing bust these statistics were basically reversed.

Click to enlarge:

Core Logic offers similar statistics, but they only look at houses that actually have a mortgage. Within this universe, mortgage debt accounts for $8.8 trillion of the $12.5 trillion in total home value. This equates to a loan-to-value ratio of roughly 70%. Of these mortgaged homes, 22.8% had negative equity as of year-end 2011 while an additional 5% were considered near-negative equity. Core Logic defines near-negative equity as any home with less than 5% equity.

A 5% drop in home prices from current levels would likely push all the near-negative equity homes into the negative equity camp. In other words, a 5% decline in housing would mean at least 27% of homes would be underwater. A 10% decline, as predicted in the story above, would probably put one third of all mortgages underwater.

Source: Bianco Research

What's been said:

Discussions found on the web: