Real Time Economics (WSJ Blog) – Structural Unemployment Would Affect Both Sides of Fed Mandate

Over the past few months, Federal Reserve Chairman Ben Bernanke and other Fed officials have wondered how many of the millions who lost their jobs during the Great Recession are morphing into structural unemployed. The discussion has policy implications — and potential headaches. Structural unemployment is the result of permanent dislocations within labor markets, such as a mismatch between the skills a growing company needs and the experience job seekers have. Cyclical unemployment, on the other hand, results from not enough demand in the economy. The prospect of high structural unemployment will challenge the Fed to fulfill its dual mandates of supporting full employment and price stability. Monetary policy is designed to boost aggregate demand, but can do little to change structural forces. The threat to the Fed’s duty to promote full employment is obvious. “A pessimistic view is that a large share of the unemployment we are seeing, particularly the longer-term unemployment, is structural in nature,” Bernanke said in a speech in March. “If this view is correct, then high levels of long-term unemployment could persist for quite a while, even after the economy has more fully recovered.” Structural unemployment’s impact on inflation is more indirect, but also a concern. If many job seekers lack the skills required in current job openings, then businesses have a much smaller pool of workers to choose from. (Indeed, business surveys show companies cite the lack of skilled labor as an increasing problem.) Companies might have to raise starting salaries to attract appropriate workers and then recoup the extra cost by raising selling prices.

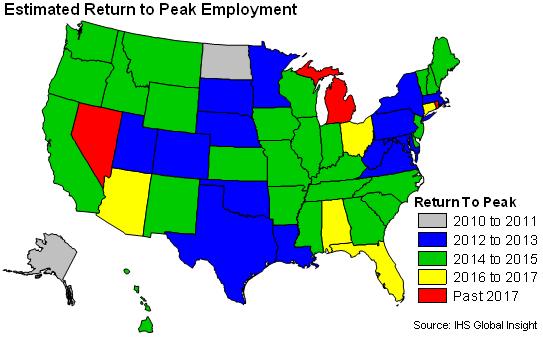

Real Time Economics (WSJ Blog) – Most States Still Years Away From Getting Back Lost Jobs

Most states are still more than two years away from returning to prerecession employment levels, according to a new analysis. Only four states — Alaska, North Dakota, Texas, and Louisiana — have created enough jobs since the recovery to get back to where they were prior to the recession, according to economist Steven Frable of IHS Global Insight. All four of those states have benefited from an energy boom, and Louisiana was starting at a low level of employment after taking a major hit from Hurricane Katrina. Two more states, New York and West Virginia, are expected to return to their prerecession peak later this year, and 10 more should reach the mark next year. But the majority of states still won’t get there until after 2014. Meanwhile, returning to peak employment levels doesn’t necessarily mean jobs markets are healed. In fact, getting back to where a state started doesn’t account for the jobs needed by new entrants to the labor force over the past four years.

Source: Bianco Research

What's been said:

Discussions found on the web: