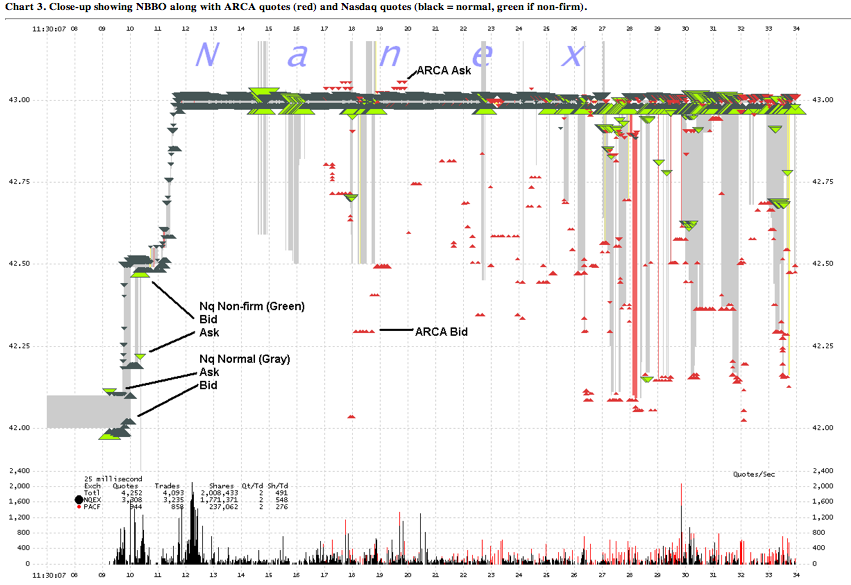

Click to enlarge:

Source: Nanex

As Facebook’s IPO opened, real-time data feed (and HFT critic) Nanex Research noticed a strange anomaly: A Crossed market. This occurs whenever the Bid price is higher than the Offer (the spread is inverted).

What might be the source of this? Take a wild guess:

This also brings another example of the dangers of placing a blind, mindless emphasis on speed above everything else. Algos reacting to prices created by other algos reacting to prices created by still other algos. Somewhere along the way, it has to start with a price based on economic reality. But the algos at the bottom of the intelligence chain can’t waste precious milliseconds for that. They are built to simply react faster than the other guys algos. Why? Because the other guy figured out how to go faster! We don’t need this in our markets. We need more intelligence. The economic and psychological costs stemming from Facebook not getting the traditional opening day pop are impossible to measure. That it may have been caused by algos reacting to a stuck quote from one exchange is not, sadly, surprising anymore.

Ironically, the NASDAQ’s clients are no longer the investing public, but rather are HFTs. Whiole most people look at this as a black idea, I suspect the Nazz’ accountants think its much ad o about nothing . . .

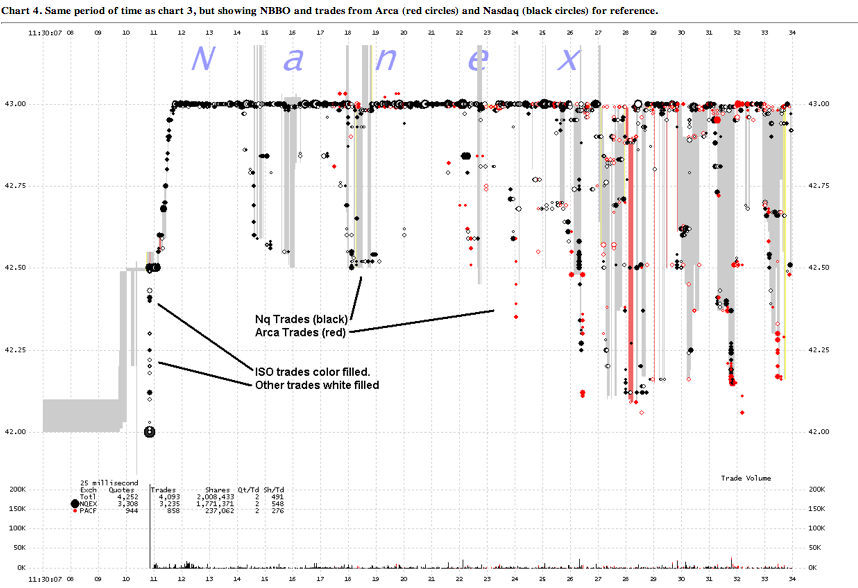

More charts after the jump

~~~

Source: Nanex

What's been said:

Discussions found on the web: