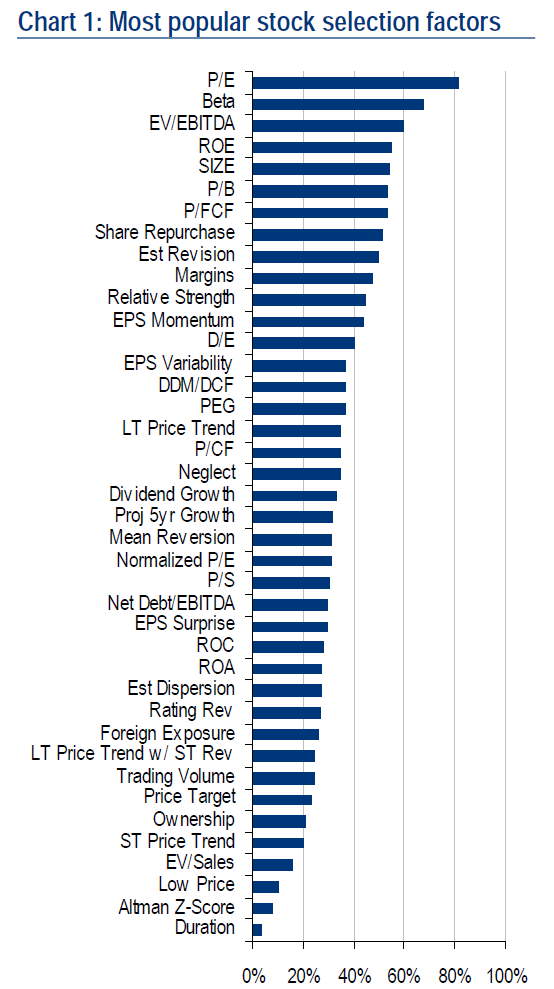

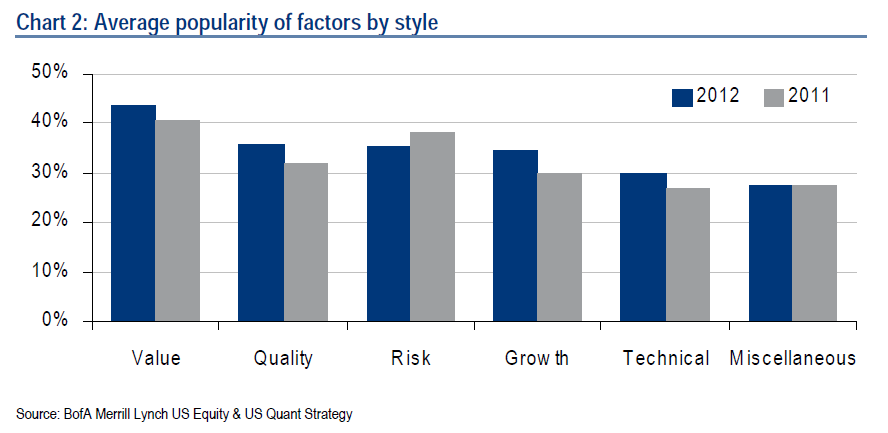

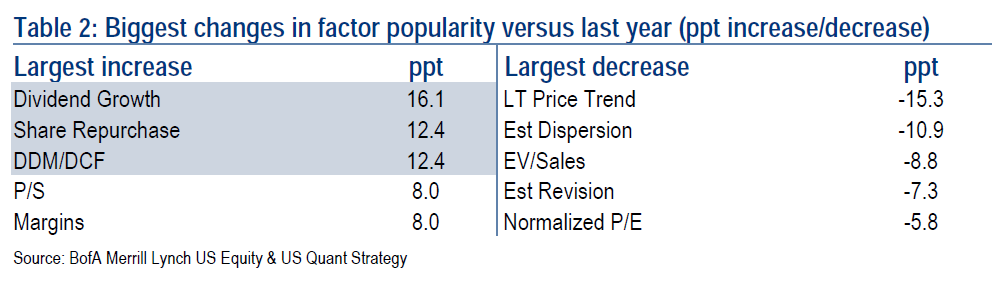

Every year since 1989, Merrill Lynch surveys a few 100 institutional investors using a broad variety of quantitative, valuation, process and modeling questions. Their responses get summarized in a 39 chart, 27 page report.

You can get a sense of the depth and breadth of the report in just a few charts — but overall, the results are quite thought provoking.

A few examples:

˜˜˜

˜˜˜

˜˜˜

Whether you manage money using quantitative or macro methods, I suggest you gives this report a read.

Source:

Annual Institutional Factor Survey #21

Results are in: investors are going back to basics

Savita Subramanian et al

Merrill Lynch Quantitative Strategy 16 May 2012

What's been said:

Discussions found on the web: