Followers of my various writings on sites such as MarketWatch, Minyanville, SeekingAlpha, and theStreet know that I have been wildly bullish on stocks for 2012, making the case that we could see a 2003/2009-like move as the reflation trade takes hold (see my segment on Bloomberg in late March). On April 6th, I argued that conditions were favoring a “mini-correction” for stocks and that if markets were resilient, it would further increase the chances of the “Spring Switch” out of bonds and into stocks taking place as a “Great Re-Allocation” takes place.

Stock markets began to severely break down post-European elections, sending international equities down on a year-to-date basis while stocks have held on to slight gains in the U.S. as deflation expectations suddenly returned. While I maintain that this has been the “mini-correction” I addressed in early April and which my company’s ATAC (Accelerated Time And Capital) models prepared for by positioning our own clients largely into bonds out of stocks, there is something which greatly concerns me.

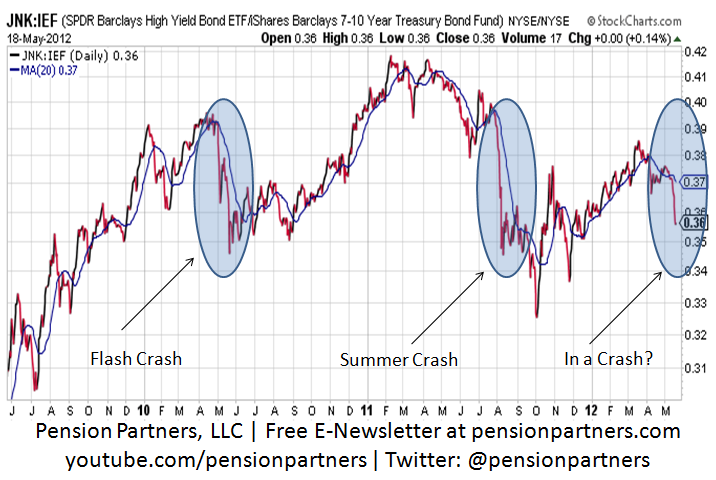

Treasury yields in the U.S. have dropped even deeper into panic mode with the 10 year yield near all-time record lows as the 30 year Treasury stays below the 3% level independent of the Fed’s stated inflation target of 2%. Last week a significant break in credit markets occurred, behaving eerily similar to the Flash Crash of May 6, 2010 and the Summer Crash of 2011.

Take a look below at the price ratios of Emerging Market Debt (EMB) and Junk Debt (JNK) ETFs both relative to 7-10 Year Treasuries (IEF). A rising ratio means credit spreads are narrowing, while a falling one means credit stress is returning as those spreads widen.

Notice the speed and magnitude under which Emerging Market Debt and Junk Debt collapsed relative to U.S. Treasuries in recent trading days. The move is very reminiscent of the 2010 and 2011 crashes. A credit spread shock tends to filter through to stocks with a lag. This should make sense given that equities have a lower priority on the capital structure scale than debt, so a break in debt likely must by definition result in a break in stocks. The concern is that should the breakdown not reverse shortly, a waterfall decline from oversold levels in stocks could occur as event risk gets quickly re-priced. I spoke about this on Bloomberg last Friday at http://www.bloomberg.com/video/93006859/.

The next few days are crucial. Should a V-formation occur in the above price ratio charts, things may turn out okay and a snap-back rally for stocks may be in order. Unless a move higher is confirmed though by healing in credit markets from the break last week, caution likely remains highly warranted. Either way, if it looks like a duck…

Source:

Michael A. Gayed

Chief Investment Strategist

Pension Partners, LLC

What's been said:

Discussions found on the web: