Société Générale’s Albert Edwards discusses global housing prices and the ongoing economic recovery in light of coordinated central bank activity. I like the preface to his discussion:

• We have regularly explained that there are two types of market and economic commentator: those who will, if a trend persists long enough, embrace it and extrapolate the trend forward into the indefinite future. Therein lies the essence of great investment

disasters the market comes to believe a cyclical investment is actually a ‘growth’

investment and a whole array of assets end up massively overpriced going into a cyclical

melt-down. Then there is us.• Along with the Great Recession of 2007, in our working lifetime we have seen other examples of misguided extrapolative thinking that ended in the severe mis-pricing of assets ahead of a crash technology stocks at the end of the 1990s, the emerging Asia miracle in 1997 and Japan in 1989 are all examples where there were clear bubbles about to burst. In each case, any attempt to warn clients was met with a steaming dollop of derision.

The charts and tables are rather instructive:

>

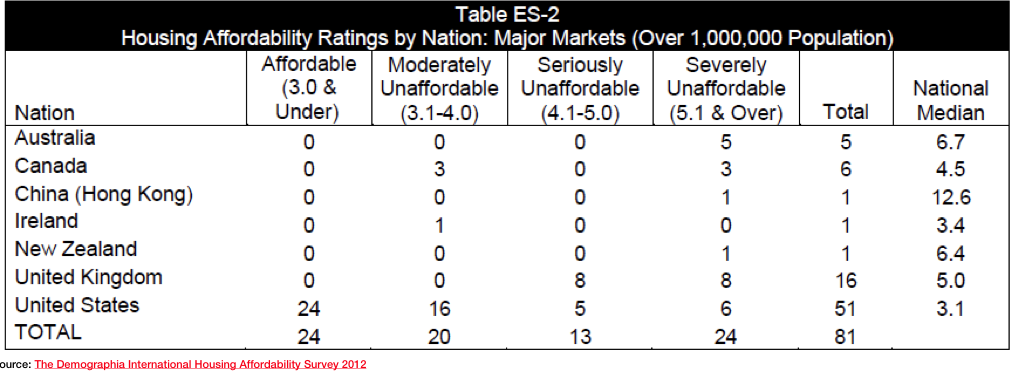

Housing Affordability Ratings by Nation

Source: The 2012 Demographia International Housing Affordability Survey

(See also the US National City affordability table after the jump)

>

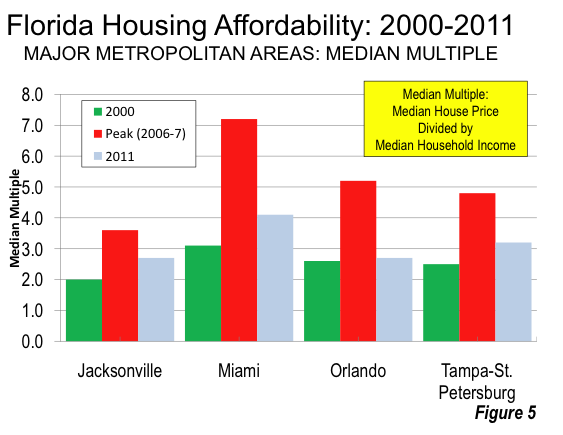

Note that in the US, Florida is often used as an example if where prices have fallen so greatly as to produce enormous bargains. The data suggests otherwise. Miami for example has still yet to revert to pre credit bubble levels:

>

Rumors of Affordability in Florida have Been greatly Exaggerated

Source: The 2012 Demographia International Housing Affordability Survey

>

Source:

The biggest bubble in recent history is heading for the mother of all hard landings

Albert Edwards

Société Générale, May 3 2012

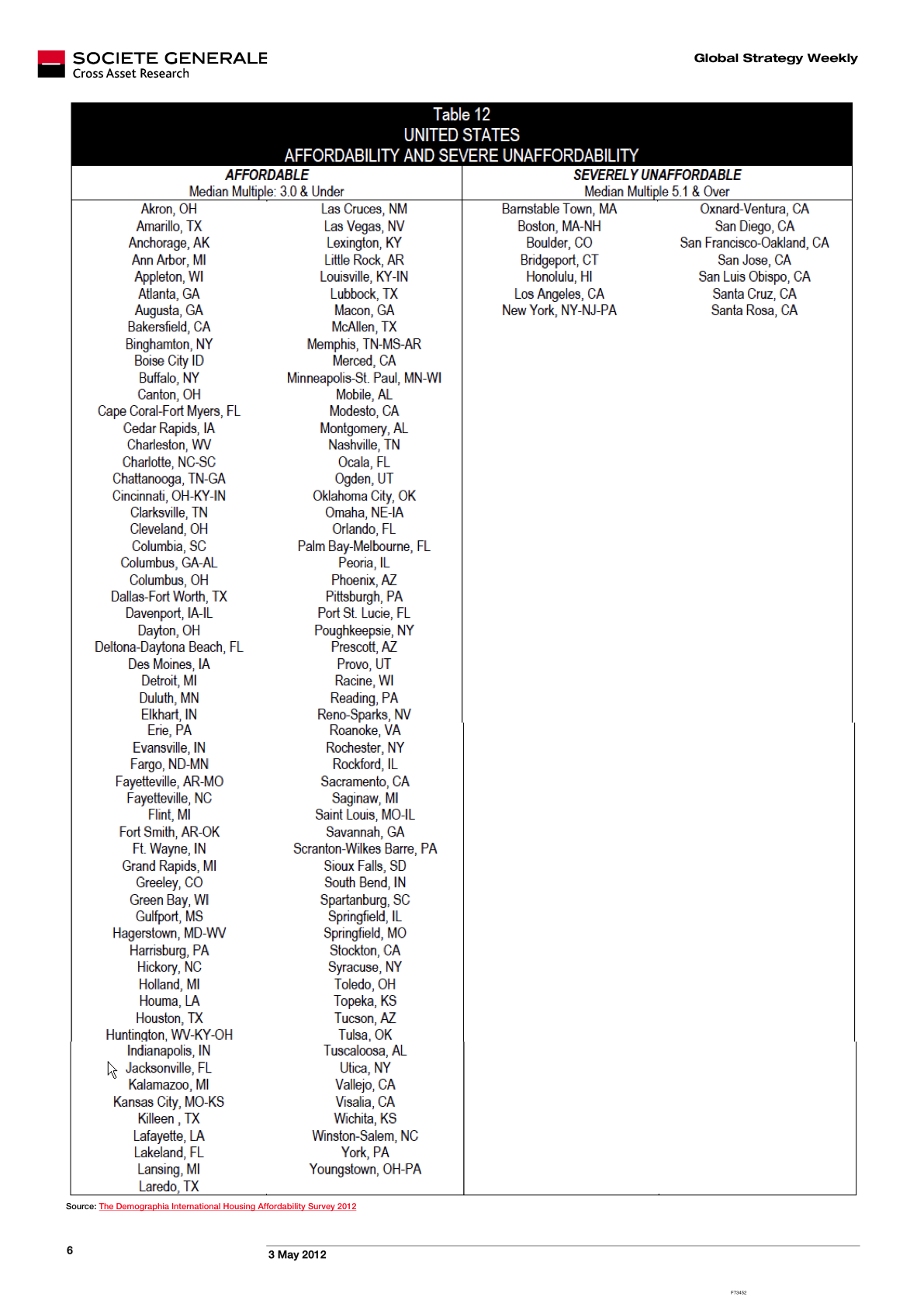

National US City affordability

Source: The 2012 Demographia International Housing Affordability Survey

What's been said:

Discussions found on the web: