The danger when reviewing daily (or even weekly) trading is to assume a causal relationship between the headlines and the market action. My experience is they are hardly correlated, and indeed, are often at odds.

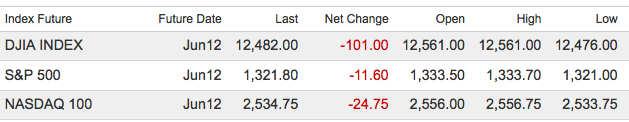

I bring this up following yesterday’s low volume bounce, with this morning’s Futures down appreciably. Take a quick look at this short list of headlines:

-China Has No Plans for Large-Scale Stimulus to Counter Economy’s Slowdown

-RIMM Hires Invertment Bankers to Explore Options

-Spanish Recession Seen Deepening Amid Crisis Contagion

-Germany’s Inflation Weakened in May as Energy Prices Retreated

-Facebook shares drop 20%; Worse IPO in decade

-Bank Indonesia to Sell Dollar Term Deposits to Stabilize Rupiah

-Italian bonds fall after auction of 5- and 10-yr bonds fetch higher borrowing costs

-Euro-area confidence declines to 90.6 in May vs forecasts of 91.9, lowest in 2 ½ years.

Are they actually what is driving equity prices and bond yields?

Consider: Nothing in that list is particularly new. All are subject to change. And the overall trend within each headline was true weeks and months ago.

Blackberry sales have fallen? Will China stimulate or not? Are we just learning whether Spain’s recession is bad or worse? Facebook is overvalued? And how far will Italy’s bond prices fall? These are all events already in play for a long time.

Cable news channels have 24 hours a day to fill, newspapers have lots of pages, and the capacity for the intertubes is (literally) infinite.

Investors need to understand the difference between what are truly new and unexpected developments that mover markets and noise.

Most of the headlines you see, including the list above, are noise. That is why my reads tend to include thoughts from people who provide insight into more than simply old data warmed over . . .

What's been said:

Discussions found on the web: