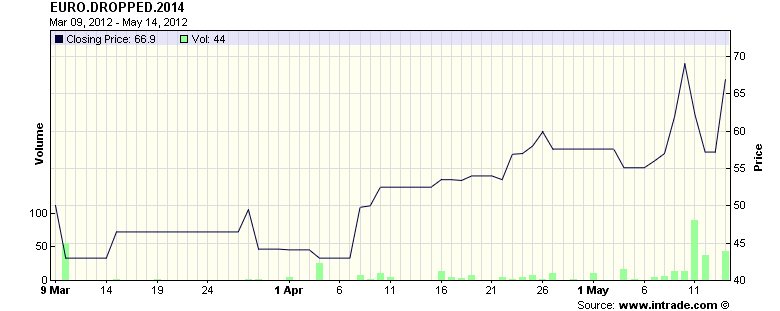

Click to enlarge:

The Financial Times – Fear grows of Greece leaving euro

Eurozone central bankers have talked publicly for the first time of managing a possible Greek exit from Europe’s monetary union as stalemate in Athens talks on a coalition government raises the prospect that Greece will renege on the terms of its international bailout. The comments by members of the European Central Bank’s governing council indicate that the risk of eurozone fragmentation is being taken increasingly seriously by the region’s policymakers. They mark a significant shift at the ECB, which has previously argued that European treaties do not allow for an exit and that a break-up would cause incalculable economic damage.

Bloomberg.com – Euro Officials Begin to Weigh Greek Exit as Euro Weakens

Greece’s possible exit from the euro moved to the center of Europe’s financial-crisis debate, rattling markets as authorities in Athens struggled to form a government. Meetings brokered by Greek President Karolos Papoulias were set to continue today after Syriza, the leading anti-bailout party, rejected a unity government following inconclusive elections May 6. That moved the country closer to a new vote, with at least five European central bankers broaching the once- taboo topic of its exit from the euro.

The Telegraph (UK) – Greece would face dire consequences from a euro exit – as its people know

Reinstating the drachma is not in the interests of the Greek electorate or the rest of the eurozone

Far from revealing that Greeks want to exit the euro, the election results send out a clear signal that the policy framework imposed since the crisis began has been wrong and needs to be rethought. The majority of the electorate supported parties that would prefer to keep Greece in Europe, while delivering a strong rebuke to the two traditional parties of government, New Democracy and Pasok, for having brought Greece to bankruptcy and then being associated with the “austerity memorandum” – the terms of the troika bailout packages. O pinion polls show that 70% of Greeks want to remain part of the eurozone. Only the parties of the extreme left and right want it to exit. Four-fifths voted for parties that would prefer to keep Greece in, although their views on the price to be paid to achieve that goal differ. It is not in the interests of either Greece or the rest of the eurozone to reinstate the drachma. An exit from the euro would lead to a run on the banks and the collapse of the Greek banking system. If Greece was shut out of international money markets, the temptation would be to meet the government deficit through printing money, leading to rapid inflation. People’s savings would be wiped out. And an effective devaluation might do little for Greece’s balance of payments anyway, except possibly through tourism. Poverty would become increasingly widespread.

Comment

The chart above shows the Intrade contract on whether or not a country will leave the euro before December 31, 2014. It has been above 50% for a month and is now approaching 70%. As the stories in this block point out, the market’s opinion is now coming around to the belief that a country will leave the euro in the next couple years.

However, as the highlighted part above states, 70% of the Greek population wants to remain part of the Eurozone and keep the euro.

The EU constitution has no provision for kicking a country out, just as the American constitution has no provisions for kicking out a state. Of course, they can invent reasons to throw Greece out. However, entry into the euro was supposed to last forever, not come and go at the pleasure of Germany and France.

Inventing rules to throw Greece out when they do not want to leave could cause more problems in the Eurozone than allowing them to stay. See the next block.

The Financial Times – Wolfgang Münchau: Default now or default later?

What would constitute an economically rational choice for Greece, given the economic and political situation? I see four options, each of which is fraught with uncertainty. The first would be the status quo: more austerity and economic reforms as outlined by the International Monetary Fund and the EU. One risk is that this would keep Greece in an eternal depression and a debt trap, where economic output fell faster than growth. Another is that, while on paper it might just work economically, it would almost certainly fail politically.

Reuters – Monti warns of tears in Italy’s social fabric

Italy’s social fabric is being torn by recession and tensions are growing among its citizens, Prime Minister Mario Monti said on Sunday. Speaking to a group of students in the central Italian town of Arezzo, Monti urged Italians to stick together and “not give up” in the face of a shrinking economy and rising unemployment. Monti’s technocrat government has imposed painful austerity measures since taking office last year, and in recent days ministers have responded to calls from politicians and the media to show more compassion for the plight of ordinary Italians. “The country is now marked by profound social tensions,” Monti said. “It’s inevitable that social unease is increasing, that job insecurity fuels a sense of suffering, that there are serious signs of tears in social cohesion.” A wave of highly publicized suicides in the last few weeks, especially among debt-stricken entrepreneurs, has highlighted the human cost of the crisis.

Source: Bianco Research

What's been said:

Discussions found on the web: