In my May 22nd post here on the Big Picture titled “Are Markets in a Crash?”, I argued at the time that credit spreads, which dramatically widened in a matter of days, behaved as if we were in the midst of a Crash. This was occurring during the “mini-correction” of May which I began stating in my writings was likely as early as April 6th “Bad jobs numbers, a correction and risk-off”. As time moved forward, things got more interesting. Various intermarket trends by the very end of May behaved as if a Lehman-like event had already occurred “Making the Bullish Case for Stocks”, with various price ratios hitting levels not seen since late 2008.

Because I focus my attention on market behavior based on intermarket analysis rather than absolute price movements, it seems entirely possible that a “melt-up” could occur again given that behaviorally markets did act like a massive decline in absolute terms already took place. Scared money in bonds is likely to get scared that it is wrong about the end of the world trade, with yields in the U.S. far below the Fed’s stated inflation target of 2%, and in the face of stocks which are in better shape than most governments, have growth, and have better income potential than bonds. I addressed this in a recent BNN interview last week, and maintain that reflation is the environment we are re-entering as the negative narrative reverses and global growth expectations return.

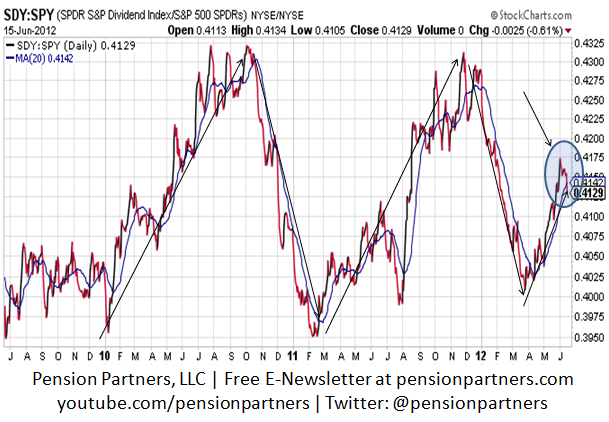

What confirms this is a price ratio chart I have shown quite a few times here. Take a look below at the price ratio of the S&P 500 Dividends Index (SDY) relative to the S&P 500 itself (SPY). As a reminder, a rising price ratio means the numerator/SDY is outperforming (up more/down less) the denominator/SPY.

Now, think this through. When dividend stocks outperform, it is indicative of bearish sentiment since dividend-heavy stocks tend to be 1) less cyclical, and 2) more defensive when entering into a highly volatile period. A rising ratio also coincides with sentiment that favors income over capital appreciation, which occurs when in a period of deflation expectations or reflation respectively. Notice how the two peaks coincided with post-Crash periods (Flash Crash of 2010 and Summer Crash of 2011), after which the ratio declined and a meaningful rally in risk assets began. Notice in 2012 that the ratio began rallying in mid-March, foreshadowing the May drop as money began getting afraid of the future again.

Notice on the far right that the ratio appears to be at a turning point, which would favor capital appreciation, and such, a rising stock market environment. If a downtrend now emerges because of Greece’s elections now being over, combined with optimism that Eurozone leaders won’t let Spain go because of escalation of commitment, another melt-up in equities could arise similar to the Fall Melt-Up of last year. The catalyst for this is no catalyst – it is the removal of the Lehman event fear, as the Spring Switch out of bonds and into stocks gets flipped just in time. We could be in for a “Great Re-Allocation” as stocks become the new bonds in terms of investor preference as animal spirits return to a resilient stock market as I discussed on Bloomberg Radio:

Click to listen:

Bloomberg Radio.

Should be an interesting Summer…

~~~`

Michael A. Gayed, CFA is Chief Investment Strategist at Pension Partners, where he structures portfolios. Prior to this role, Michael served as a Portfolio Manager for a large international investment group, trading long/short investment ideas in an effort to capture excess returns. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies. Michael earned his B.S. from New York University, and is a CFA Charterholder.

What's been said:

Discussions found on the web: