Here is a twist: We used to discuss how the Fed loved their core (ex food & energy) inflation measures. I termed that Inflation Ex-Inflation, and if you look around TBP, you will see lots of mentions of that measure.

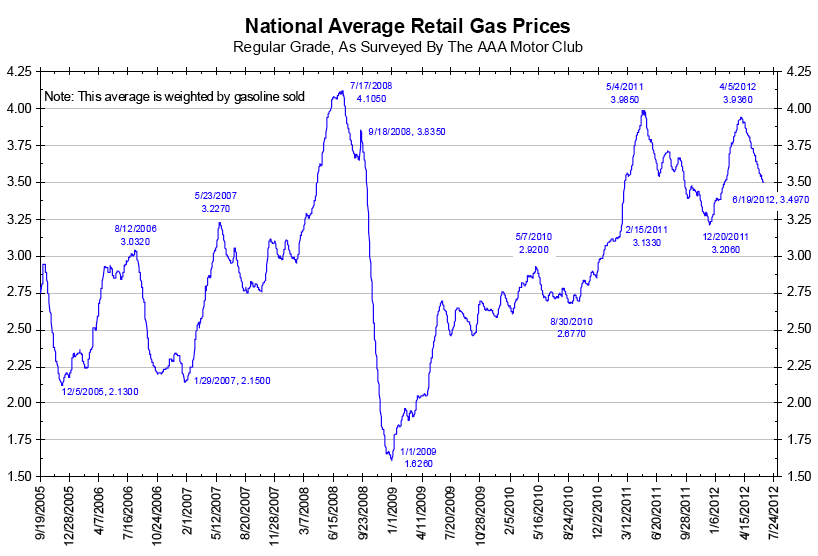

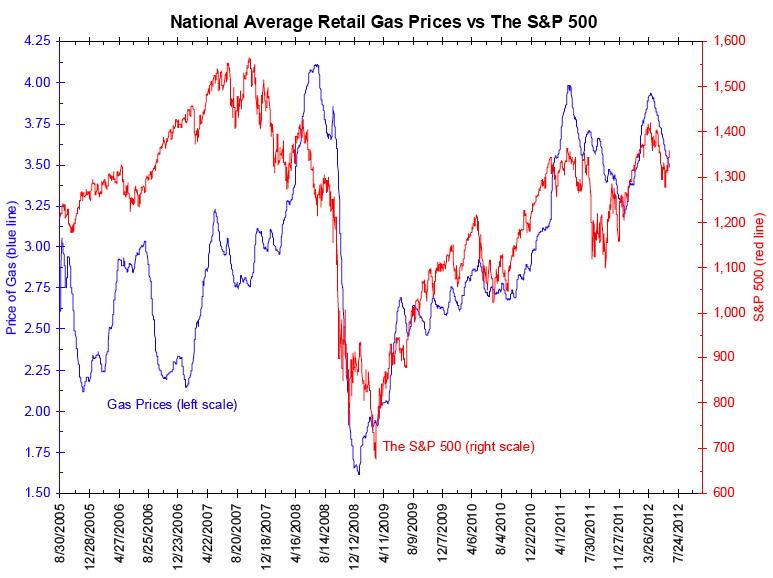

Take a closer look at Energy, one of the biggest non-housing components. As noted this morning, Commodities have entered a Bear Market. Gas & Oil are not contributing much inflationary pressures. If anything, Energy costs now are acting as a drag on Inflation.

Call it Inflation Ex-Deflation (Do you want to guess what that means for the Fed’s love of the Core Inflation (ex food & energy)?

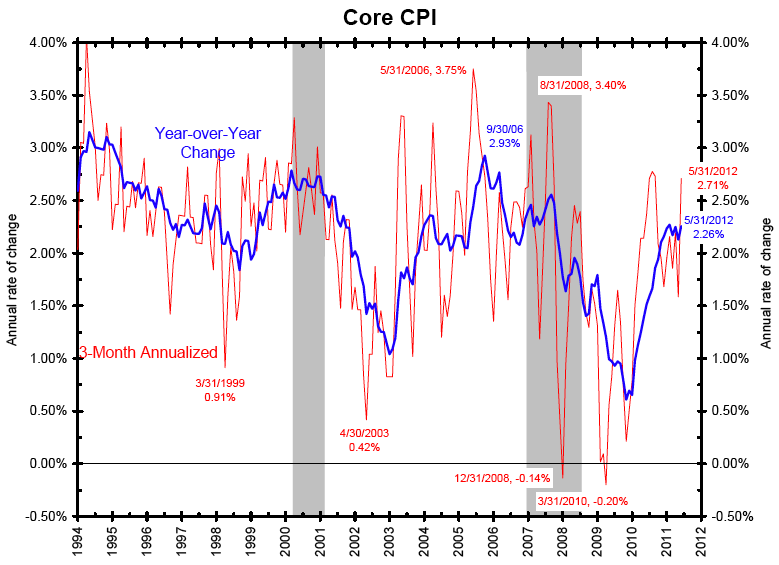

Consider the Federal Reserve inflation target of 2.0%. Jim Bianco notes that inflation is moderate at 1.73%. However, if you take a closer look at the chart below of core CPI — you will see a 2.3% on a year-over-year basis (blue line) and a heady 2.71% on a three-month annualized basis (red line).

Sum it up and it means inflation less energy is largely running above the Federal Reserve’s target.

>

Energy Now A Drag On Inflation

Source: Bianco Research

More charts after the jump

What's been said:

Discussions found on the web: