My reads to start the week:

• A to Z of bad banking (Independent) see also Big U.S. Banks Brace for Downgrades (WSJ)

• Ten of the largest S&P 500 companies generated 23% of Q1 sales from Europe (FactSet)

• The €249bn hole (FT Alphaville) see also In Europe, Banks Borrowing to Stay Ahead of the Tide (NYT)

• Subordination 101: A Walk Thru For Sovereign Bond Markets In A Post-Greek Default World (Zero Hedge)

• Shortage of homes for sale creates fierce competition (LA Times)

• Euro Breakup Precedent Seen When 15 State-Ruble Zone Fell Apart (Bloomberg) see also Is Global Finance a Ponzi Scheme? Ask a Russian Expert (Bloomberg)

• More Troubles for Chartists Ahead? (Price Action Lab Blog)

• Playing Until the Germans Lose Their Nerve (Spiegel.de) see also Europe Needs a German Marshall Plan (NYT)

• On the Introduction of the Startup Act 2.0 (Mike Bloomberg)

• Senate Dealmaker Baucus Turns to Rewrite of U.S. Tax Code (Bloomberg)

What are you reading?

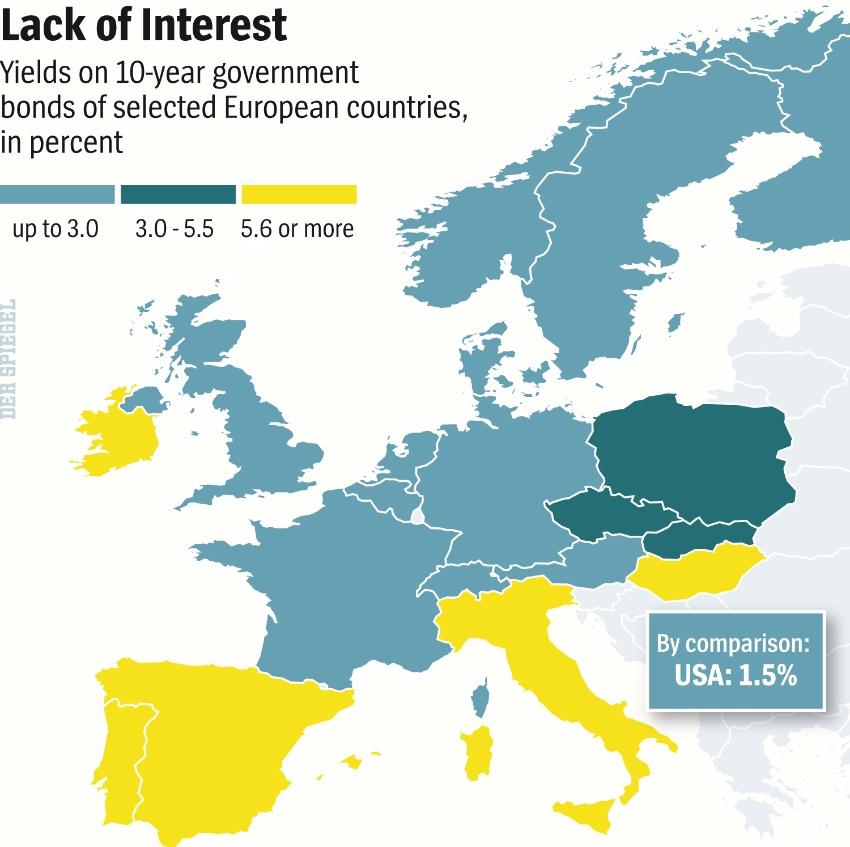

Big Investors Don’t Know Where to Put Their Cash

Source: Spiegel.de

What's been said:

Discussions found on the web: