click for larger graphic

Source: The Pain in Spain

>

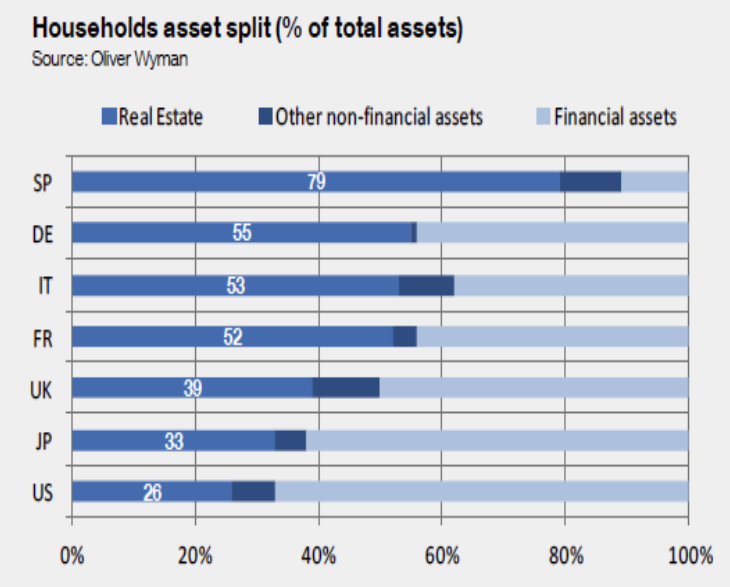

Real Estate comprised 79% of Spanish household assets, according to Jon Carmel at Carmel Asset Management (he credits the chart above to Oliver Wymann). That is 50% more than many other European countries, double the UK and triple the US.

I would expect mean reversion to be rather discomforting.

With all eyes on Greece, Carmel sees Spain as “worse than the market anticipates.” He points out these 5 bullet points as to why Spain’s RE market has much further to fall:

1. Spain’s national debt is 50% greater than the headline numbers

Spain’s debt-to-GDP balloons from 60% to 90% of GDP with regional and other debts2. Spain’s housing prices will fall by an additional 35%

Spain built one house for every additional person added to the population during the

past two decades; the fall will decrease GDP by ~2% each of the next two years3. Spain has “zombie” banks with massive loans to developers and to homeowners

Banks have not begun to realize losses and are vastly undercapitalized4. Spain’s economy has not stabilized and will continue to deteriorate

Spain has the highest unemployment in the developed world, one of the highest overall

debt loads, and the most uncompetitive labor market in Europe5. The EU will not have the firepower or political will to bail out Spain

Rescue fund headline numbers are misleading and count capital that is not yet

committed

Fascinating stuff . . .

What's been said:

Discussions found on the web: